Bitcoin

Bitcoin Open Interest reaches record levels: Could $80K be next?

While the price has been mildly affected, AMBCrypto explains how BTC may be on the cusp of another high.

- The coin’s open interest hit the highest point since March, suggesting that BTC could break past $73,750.

- Exchange withdrawal increased while the funding rate was positive, reinforcing the bullish bias.

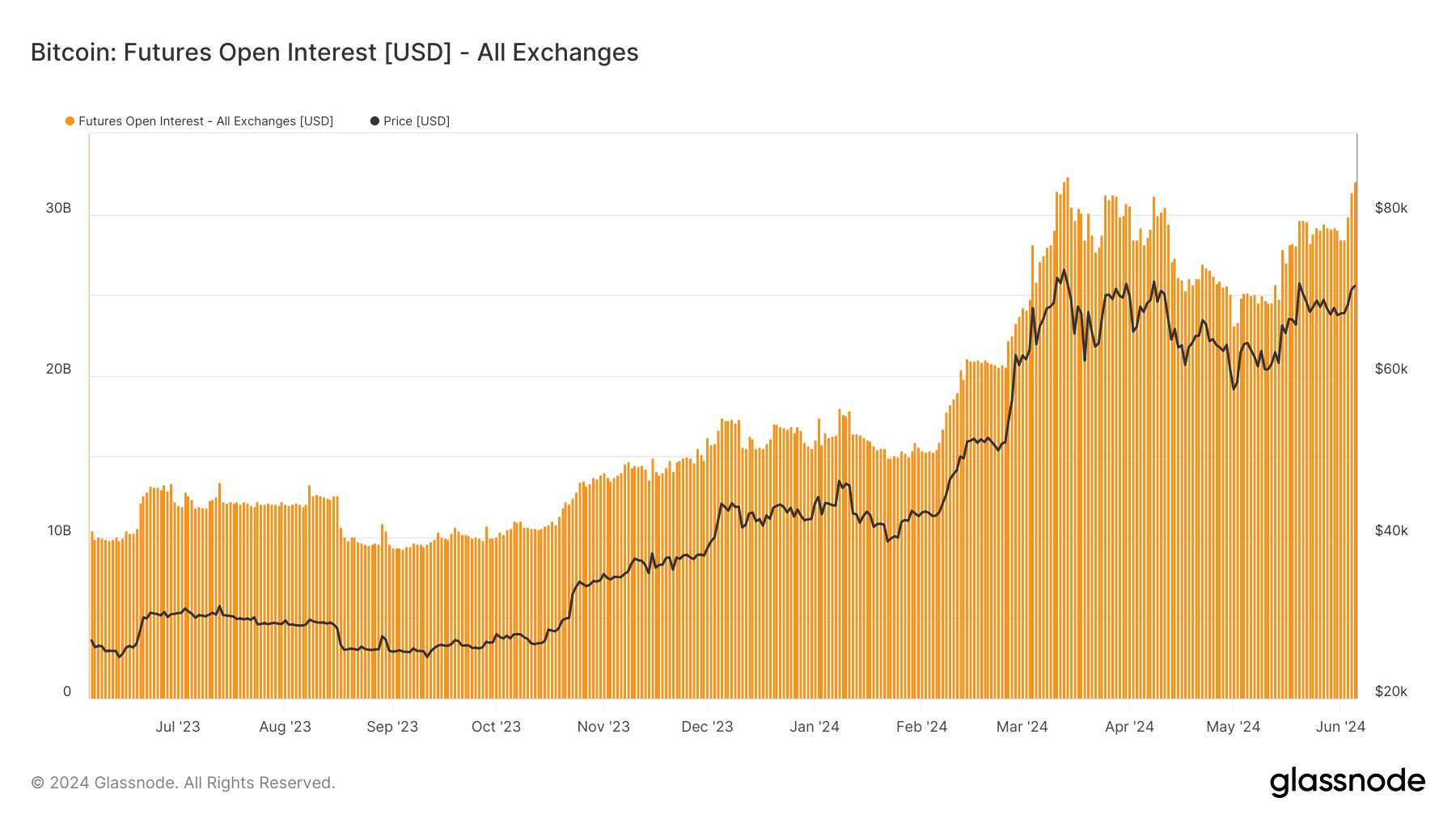

For the first time since it hit its all-time high of $73,570, Bitcoin [BTC] Open Interest has hit a new high. Specifically, the Open Interest was $37.66 billion, according to data from Glassnode.

Open Interest (OI) is the value of outstanding contracts in the derivatives market. If the OI decreases, it means traders are increasingly closing their positions, and this could lead to a price decrease.

However, an increase in OI like Bitcoin has done recently is a sign that new money is entering the market. If sustained, this could back BTC’s uptrend and lead to a higher price.

BTC aims higher, backed by exchange flow

As of this writing, BTC changed hands at $71,200. This represented a 3.89% jump in the last seven days. With increasing interest in the token, there is a high chance that it could surpass its all-time high and possibly reach $80,000.

Despite the bullish prediction, it is important to look at the spot trading activity on exchanges as this could also affect the price action.

One of the ways to do this is by looking at the supply on exchanges and the supply out of it. In addition, the balance held by some of the top exchanges could give an idea.

For instance, AMBCrypto found that Binance and Coinbase’s historical balance was down, indicating that users were withdrawing their BTC from the platforms. However, Kraken recorded a surge in BTC purchases on the 30th of May before the recent decline.

It seemed that many holders were buying more coins on exchanges and withdrawing them for the long term. If this continues to be the case, Bitcoin might evade selling pressure, and the price could hit an all-time high before the end of June.

Traders continue to bet on a rally

On the other hand, the prediction could be invalidated if supply on exchanges begins to rise. This is because an increase in the supply would mean that investors are willing to book profits. If this happens, BTC might lose hold of $70,000.

However, traders seem not to share the viewpoint of price decrease. This was based on the Funding Rate data obtained from Coinglass.

According to the derivatives information portal, Bitcoin’s Funding Rate was positive. If the reading of the metric is negative, it implies that shorts are paying longs a fee to keep their position open.

In this instance, the broader sentiment is bearish.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

However, the positive reading of the metric indicated that longs are dominant, and are expecting BTC’s price to increase. Should Bitcoin rise to $74,000 as it is being talked about, traders with long positions would be rewarded.

This could also give way to $80,000 provided bears fail to nuke the uptrend.