Bitcoin open interest takes a dive as ETH, SOL traders hold strong – What now?

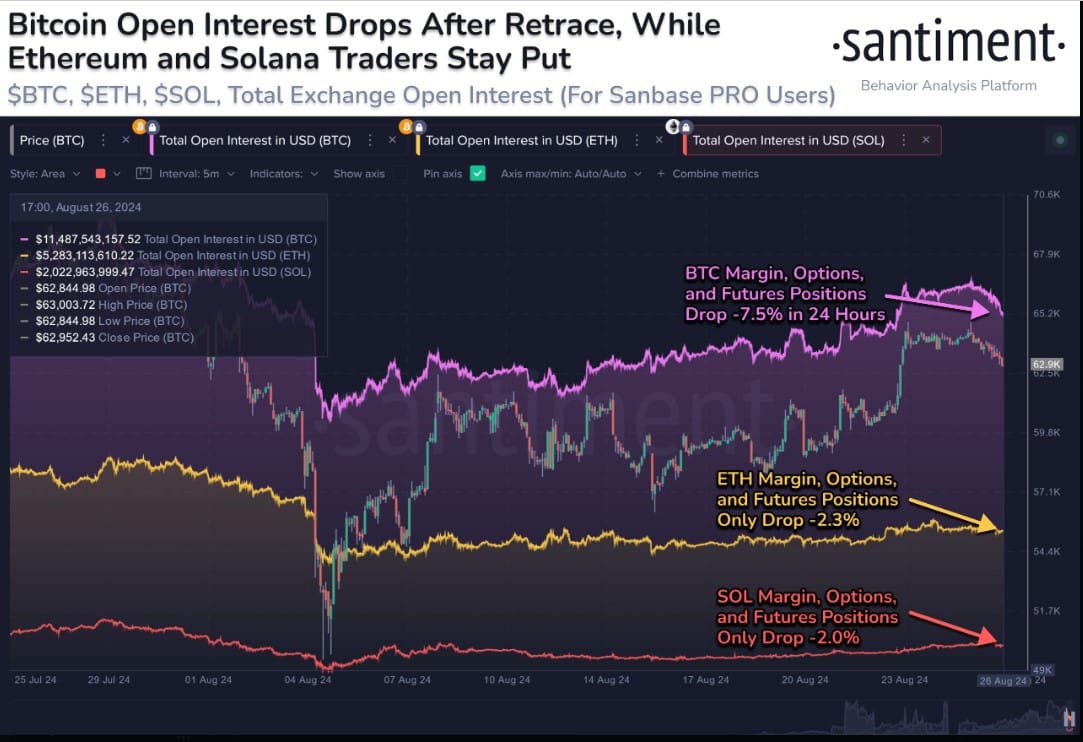

- BTC’s 2.2% price drop led to a 7.5% decrease in open interest.

- Ethereum and Solana show resilience with minimal open interest changes.

The cryptocurrency market witnessed a curious turn of events as the price of Bitcoin [BTC] dropped slightly. As per Coinglass data, BTC has diminished in value by 2.2% in the past 24 hours.

However, the total open interest on the exchanges has dropped by an astonishing 7.5%. This sharp contrast indicates how sensitive BTC investors are, even to a slight price change.

Altcoins display resilience amid Bitcoin’s volatility

As BTC witnessed the turbulence in its prices, alternative crypto coins appeared to retain most of their value.

The overall open interest for these altcoins did not change much, with ETH and SOL witnessing only slight drops of 2.3% and 2.0%, respectively.

Since the massive crash that occurred on August 5, the cryptocurrency market has been on a recovery. This rebound seems to have prompted some market participants to move in and possibly reconsider their positions.

The minimal changes in ETH and SOL open interest suggest that these altcoins are less sensitive to BTC price movement than usual.

The notable drop in Bitcoin’s open interest suggests that a shift in the capital may be taking place. This is further affirmed by some steady altcoin markets.

It is possible that big players in the market are shifting away from overexposed positions to Bitcoin while adding to their capital in altcoins.

This approach could be directed towards a quest of fulfilling higher returns by being exposed to a number of assets in efforts to minimize risk.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Shifts in market sentiments as August rebound potentially peaks

Based on BTC’s exceptionally large pullbacks in its open interest, it can be inferred that investors think that the August rebound is now close to exhaustion.

Further approaches in support of this conclusion can be drawn from the observation of recent data. Some participants in the market are trying to offload their assets toward the top of the existing cycle.

Source: Cryptoquant

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)