Bitcoin options: Could reduced risk hedges cause new price highs?

- Reduced risk hedging and increased on-chain activity suggested growing confidence in Bitcoin’s price potential.

- Bitcoin may be positioned for a breakout due to rising open interest and a lower NVT ratio.

Bitcoin [BTC] options market were showing a shift, with traders pulling back on risk hedging. This development suggested that a breakout could be on the horizon.

As on-chain metrics improve, Bitcoin’s current momentum raises the question: Are new price highs within reach?

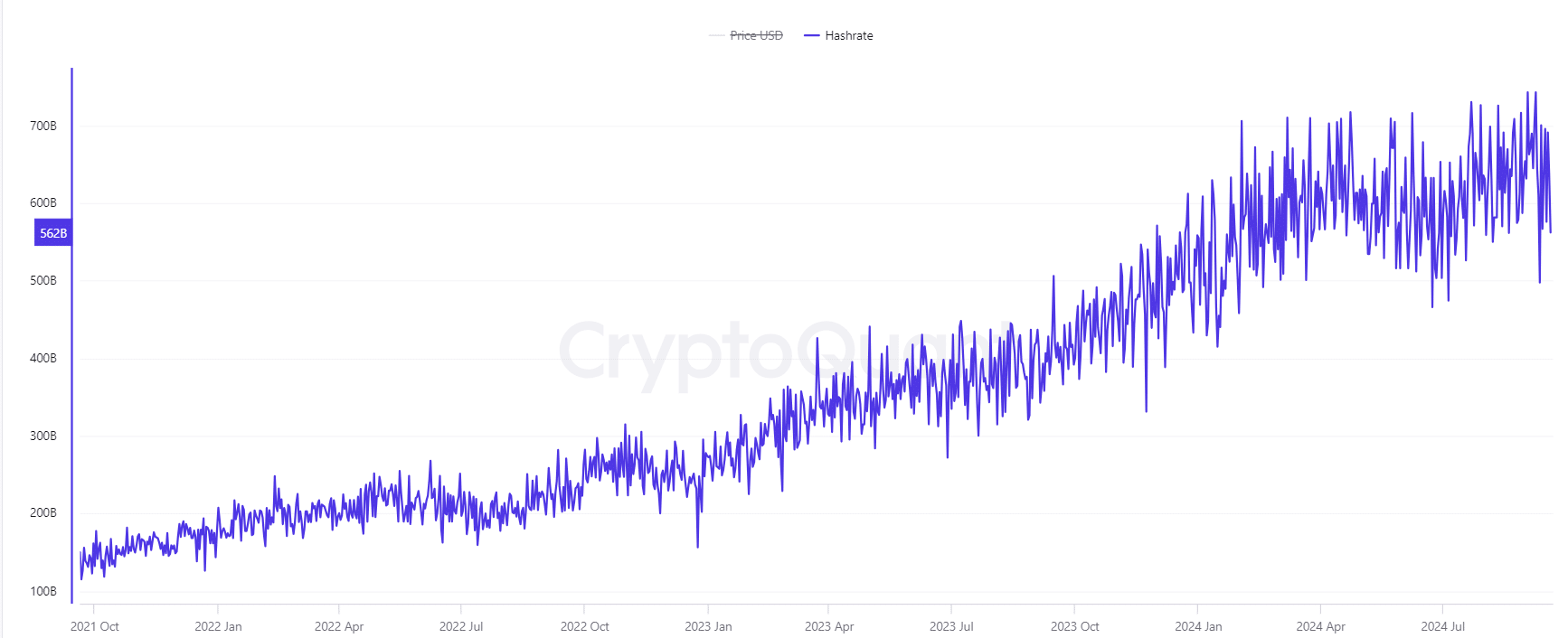

Is Bitcoin’s hash rate reflecting growing confidence?

At the time of writing time, the hash rate has risen to 562B, showing a 0.61% increase in the past 24 hours. This metric is critical because a higher hash rate often indicates that miners are confident in Bitcoin’s long-term outlook.

When miners invest more resources into securing the network, it typically correlates with stability or expectations of an upward price movement.

Do these metrics suggest rising demand?

On-chain activity remained strong. According to CryptoQuant data, the number of active addresses stands at 8.685 million, a 0.91% increase over the past day.

Similarly, the daily transaction count has grown by 1.29%, reaching 584,631K.

Both metrics highlight increased network activity, which often precedes notable price movements. Rising transaction volume indicates growing interest and engagement, potentially laying the groundwork for a price surge.

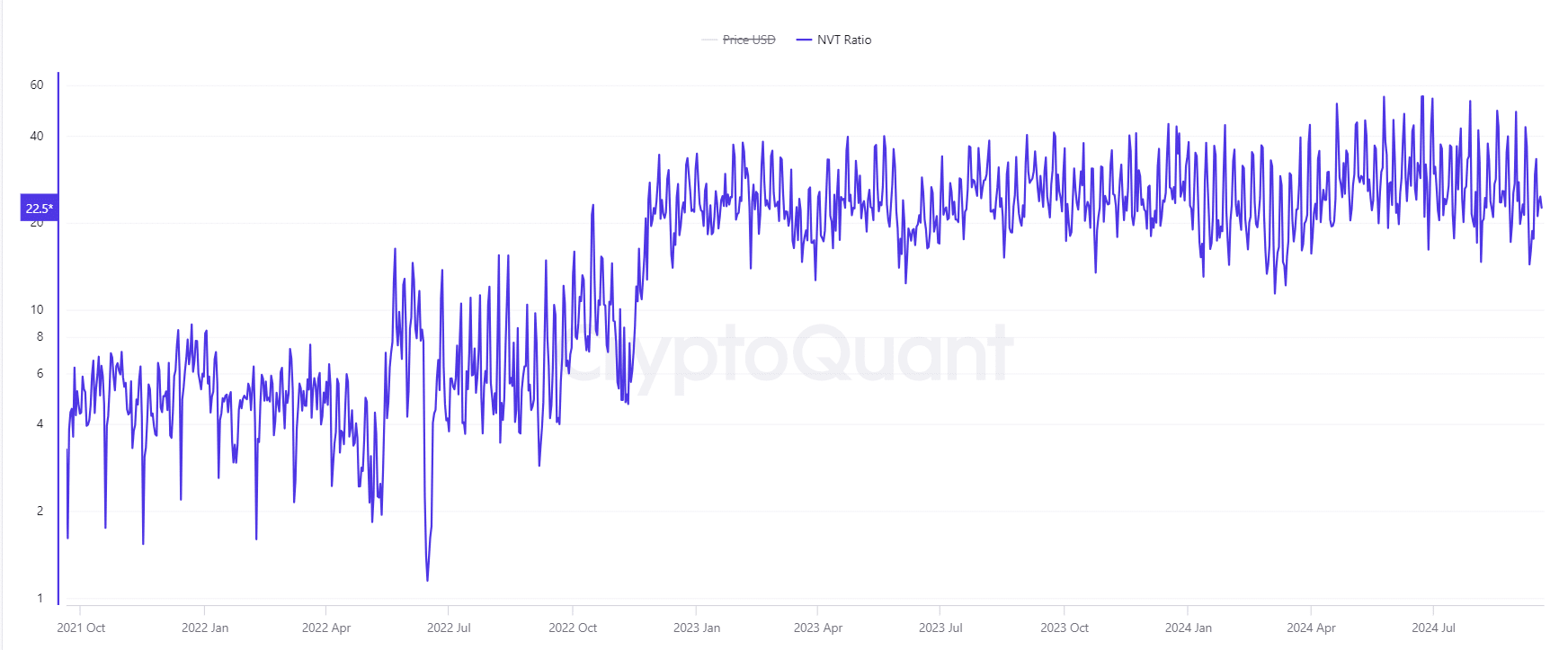

Is Bitcoin undervalued based on the NVT ratio?

Looking at the NVT ratio, which currently sits at 22.549 (an 8.36% decrease), Bitcoin might be undervalued.

The NVT ratio measures the relationship between market cap and transaction volume, and a lower ratio suggests the network is seeing more activity than the price reflects.

This imbalance can signal a strong potential for upward price movement, especially when paired with positive on-chain trends.

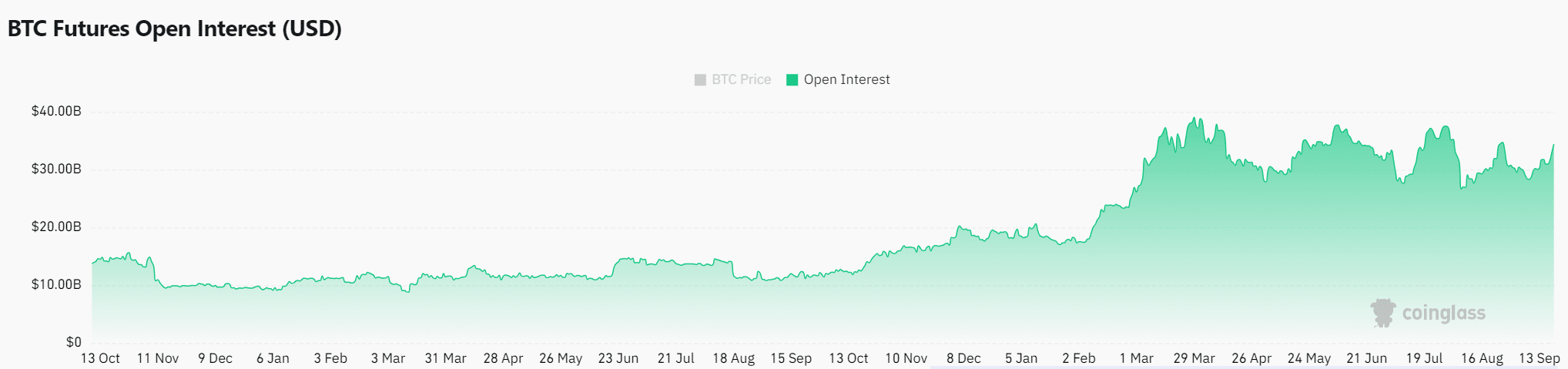

Could the surge in open interest trigger a price breakout?

Open interest in Bitcoin options has increased by 3.86%, reaching $35.38B. Furthermore, with Bitcoin trading at $63,402.45, up 1.34% over the last 24 hours at press time, the reduction in risk hedging is notable.

When traders reduce their protective puts, they often expect less volatility and a potential price breakout. This market behavior suggests growing optimism for Bitcoin’s price action.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Are new range highs likely?

With a rising hash rate, increasing on-chain activity, and a reduced NVT ratio, BTC appears positioned for an upward movement.

The surge in open interest, combined with reduced risk hedging, strongly indicates that new range highs may be just around the corner.