Bitcoin Ordinals and how it relates to recent miner interest: Decoding…

- Bitcoin’s hashrate reached a new all-time high on 26 February.

- Daily active users have increased over the past weeks and other metrics were bullish.

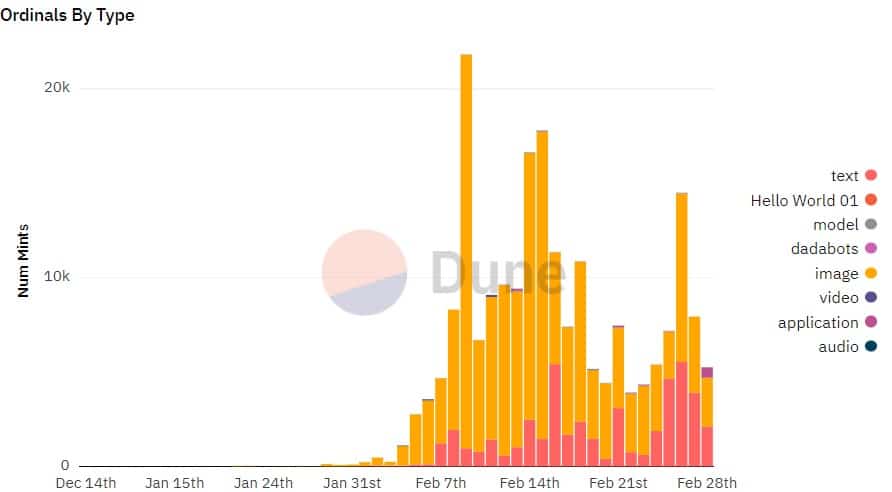

Bitcoin [BTC] Ordinals crossed the benchmark of successfully inscribing over 200,000 NFTs. This milestone was reached swiftly, as it has only been a couple of months since Ordinals’ launch. The total Ordinals inscribed at the time of writing was 207,269, with image-type ordinals accounting for the lion’s share, followed by text.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, it was interesting to note that the volume registered a decline after inscribing the highest number of Ordinals on 9 February.

Ordinals inviting new miners into the network

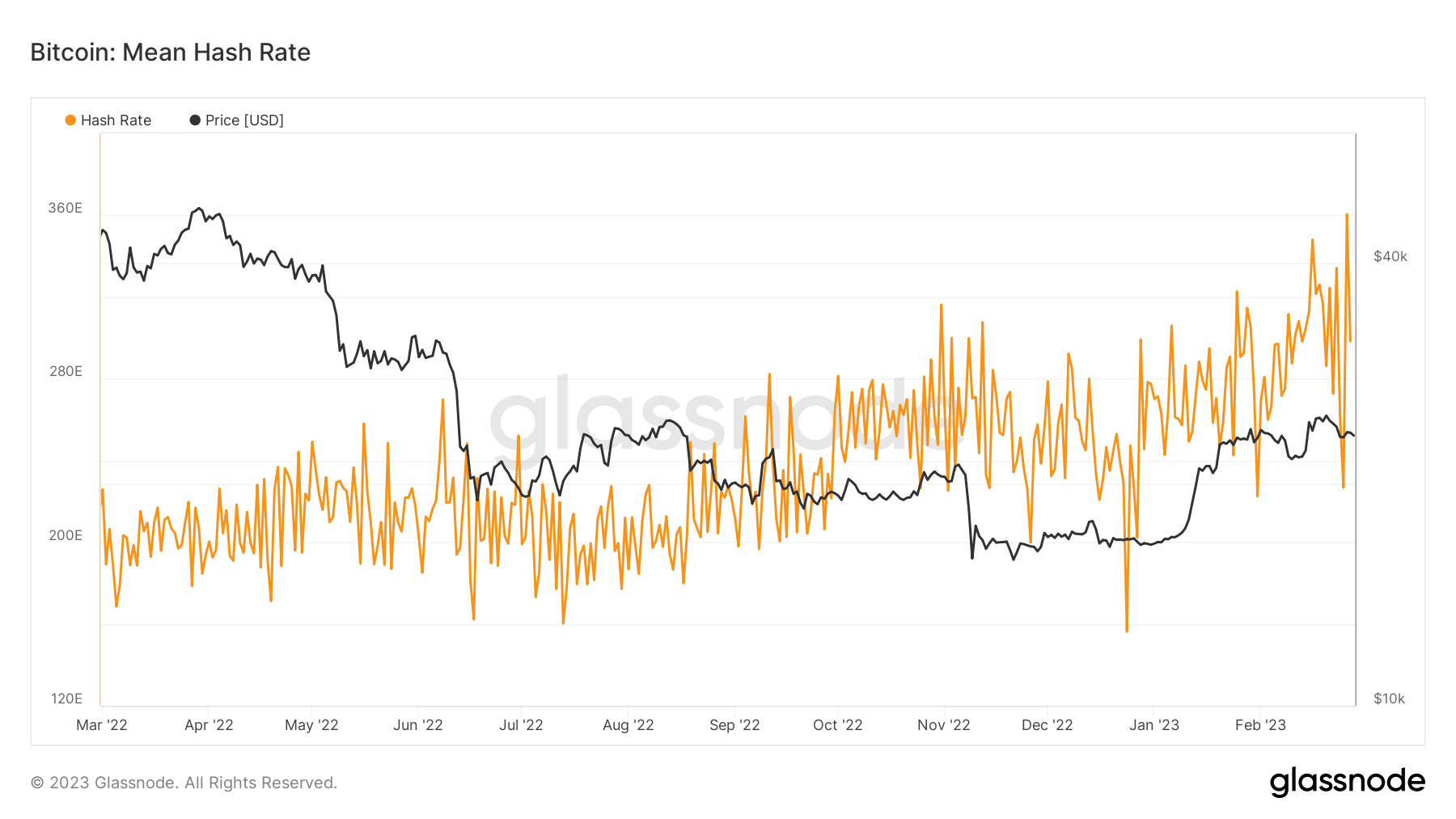

While more NFTs were being minted in the last few weeks, BTC’s mining industry witnessed growth as its hashrate reached a new all-time high on 26 February 2023. The surge in hashrate reflected an influx of new miners in the network, and Ordinals may have played a major role in fueling this hike.

A possible reason for miners’ interest in Ordinals can be the impact it had on BTC’s price. As BTC’s price increased, revenue generated by mining became more lucrative, resulting in an increase in the number of miners. When the hashrate reached a new ATH, it was clear that miners were bullish on BTC and, by extension, Ordinals.

BTC geared up on the metrics front

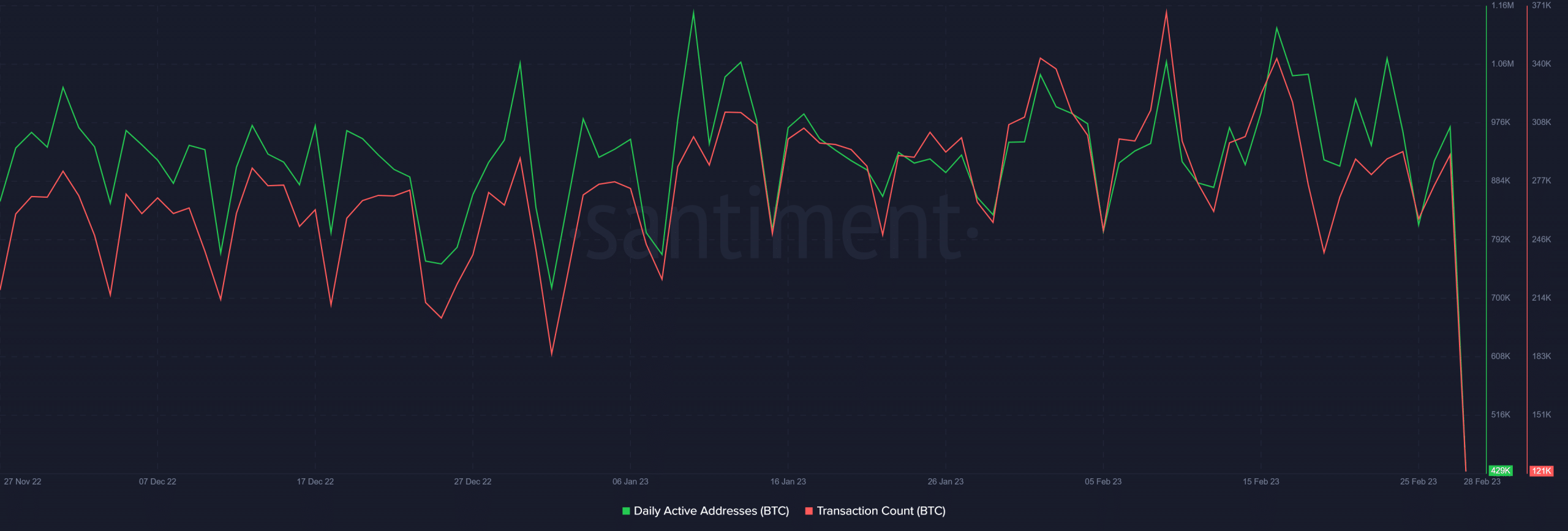

According to Glassnode, BTC’s Taproot utilization reached an all-time high a few days ago, thanks to Ordinals, which used the protocol for inscription. As Ordinals’ popularity skyrocketed, so did BTC Taproot utilization and adoption. Not only this, but Bitcoin NFTs also had an effect on the network’s usage, which was evident from Santiment’s data.

For example, BTC’s transaction count increased over the last few weeks. Furthermore, BTC’s daily active addresses followed a similar pattern and increased. Both of these uptrends can be attributed to the growing popularity of Ordinals.

Is your portfolio green? Check the Bitcoin Profit Calculator

Will Ordinals’ achievements be reflected on BTC’s chart?

As Ordinals’ popularity and inscription continue to increase, the chances of this development reflected in BTC’s chart can’t be understated. CryotoQuant’s data revealed quite a few key metrics that suggested that BTC could break its resistance near the $25,000 zone in the days to follow.

The derivatives market remained confident on BTC, as its taker buy sell ratio indicated that buying sentiment was dominant. BTC’s funding rate also looked optimistic, which increases the chances of a price uptrend. Moreover, BTC’s exchange reserve was declining, which is a positive signal as it indicates less selling pressure. At press time, BTC was trading at $23,371.22 with a market capitalization of more than $451 billion.