Bitcoin

Bitcoin predictions for November 2024 – A move to $84K is likely if…

Consolidation of the past six months gave the metrics, price action a chance to recuperate on the higher timeframes.

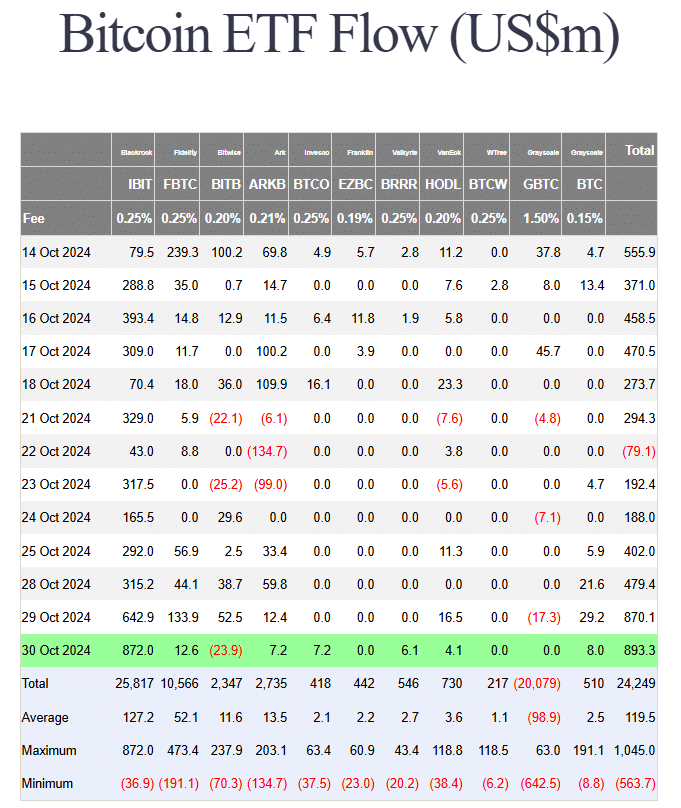

- Record-breaking ETF inflows underlined strong demand

- Price discovery beyond ATH could see Bitcoin approach $95k on the charts

On 15 October, Bitcoin [BTC] broke out of a descending channel that had lasted for almost seven months. Since then, it has gained by 7.7%, nearly retesting the all-time high at $73.7k on 29 October.

In fact, exchange-traded funds (ETFs) saw record inflows as well, signaling confidence in the asset. As BTC nears its all-time high, liquidations could induce volatility

.Hence, the question – Is BTC ready for another phase of price discovery, or should traders wait a bit longer to see new highs?

Bitcoin predictions for November remain strongly bullish

Using the rally from January to March, a set of Fibonacci levels were plotted. They showed that beyond $73.7k, the $82k and $95.5k levels would be the next targets.

However, these might not be the final targets.

During the BTC halving years, the fourth quarter has generally been bullish. This means that historically, Bitcoin

could complete a good chunk of this cycle’s gains in the next two months.Therefore, a breakout beyond $74k should not be faded. Instead, it would be a sign of strength and a move towards $95k could commence in November.

Clues from the liquidity pockets

BTC has already swept the cluster of liquidation levels at $72.6k, but didn’t fall further. More liquidity seemed to be present to the upside, extending to $80k. This made the Bitcoin predictions for November bullish too.

Ergo, it can be expected that the price would gravitate towards $80k, drawn by the liquidity to the north.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Finally, the Puell Multiple is a ratio of the daily Bitcoin mining revenue in USD (also known as daily coin issuance) to the 365-day average mining revenue.

At press time, the 30-day SMA of the metric was at 0.814, with the previous cycle top being at 2.98.

The consolidation of the past six months gave the metrics and the price action a chance to recuperate on the higher timeframes. Heightened demand, especially once the asset breaks its previous ATH and draws more eyes, could hasten gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion