Bitcoin price crashes: Breaking down how Trump’s tariffs upset BTC

- Bitcoin price drops over 6% after Trump’s tariffs, with global markets bracing for further fallout.

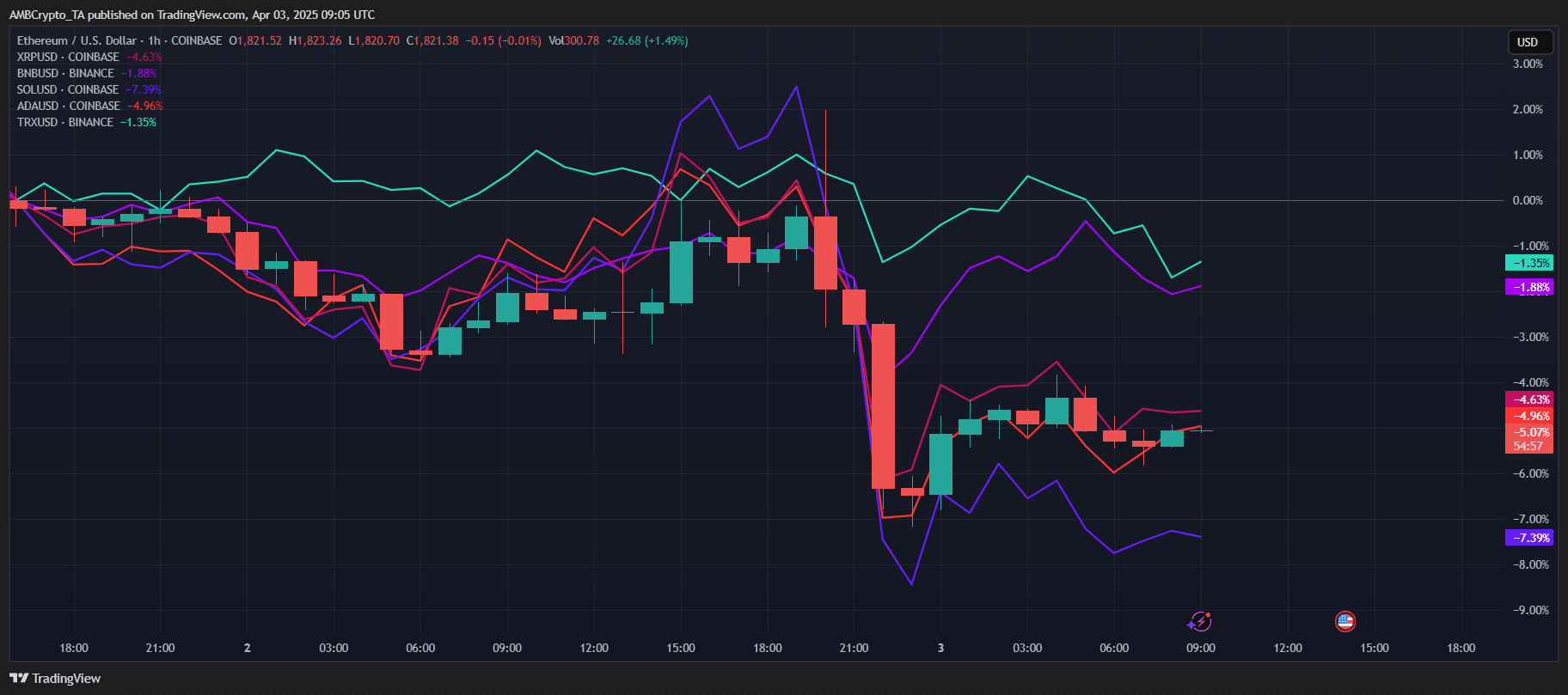

- Tariffs hit Bitcoin and altcoins hard, with market sentiment shifting toward a cautious, bearish outlook.

The market is reeling after U.S. President Donald Trump’s latest trade tariff bombshell.

Bitcoin [BTC], the flagship digital asset, felt the brunt of the impact, nosediving by over 6% in the wake of the announcement on the 2nd of April.

As Trump’s tariffs target 185 nations, the fallout has been swift — liquidations hit hard, and asset prices are in freefall.

With the global economy bracing for ripple effects, can Bitcoin ride out the storm, or is this the beginning of a deeper plunge?

Trump’s tariff storm

On Wednesday, U.S. President Donald Trump announced an aggressive set of tariffs, rocking the global financial markets.

A minimum 10% tariff would be imposed on all exports to the U.S., with additional duties targeting 60 countries with the largest trade imbalances with the superpower.

China was hit hardest, facing a steep 34% tariff, followed by India (26%), Japan (24%), and the European Union (20%).

In a televised address from the White House’s Rose Garden, Trump justified the move by claiming that the US is charging “approximately half of what they are and have been charging us.”

While initial reactions in the crypto market were positive, with a brief uptick following the announcement of the 10% universal tariff, the market soon turned south.

As the full scope of the tariffs became clearer, sentiment shifted, and prices across the board began to drop. Bitcoin, which had been trading near $87K, saw a dramatic dip to as low as $82K before staging a mild recovery.

Tariffs wreak havoc on Bitcoin price

Following the sharp drop triggered by Trump’s tariff announcement, Bitcoin attempted to stabilize near the $83,000 mark.

The latest hourly chart shows a mild recovery after the initial plunge, but momentum remains weak.

The OBV indicates declining buying interest, while the RSI hovers around 45, suggesting neutral to slightly bearish sentiment. With volume tapering off, Bitcoin’s ability to reclaim higher levels remains uncertain.

As the market digests the broader economic implications, cautious trading is likely to persist.