Bitcoin

Bitcoin price prediction – Recession fears trigger FUD, but is it right time to buy?

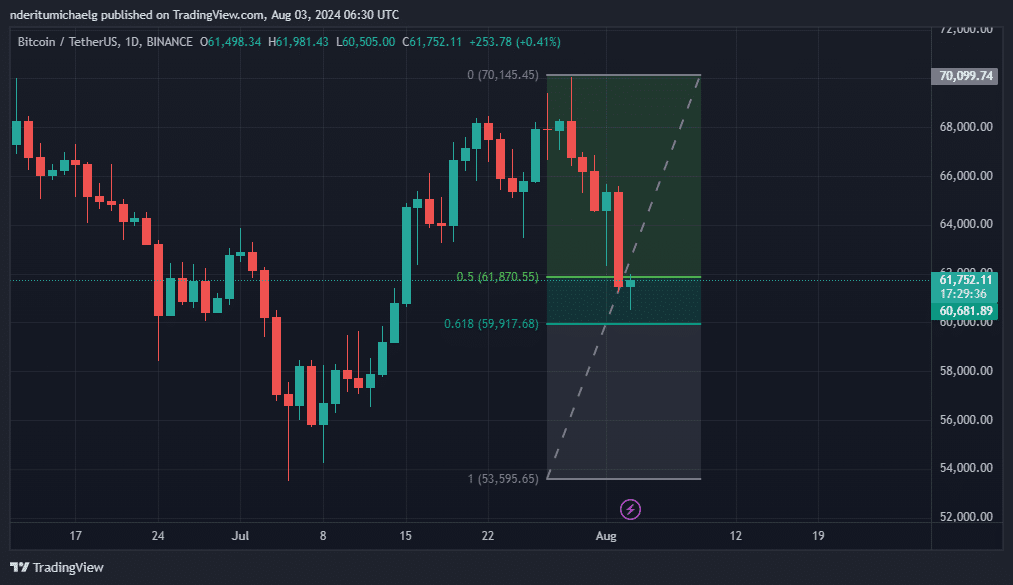

Bitcoin’s extended dip pushed the price into a potential buy zone.

- Bitcoin saw extra sell pressure on Friday as economic data hammered down on market sentiment

- BTC might regain some momentum as the price dips into a potential buy zone

Bitcoin bears dominated on Friday, sending the market crashing by almost 6%. The top cryptocurrency has been on a downtrend for a while now, with multiple economic reports affecting its performance over the last few weeks.

Bitcoin’s bearish outburst on Friday was in response to weak unemployment data. The numbers came in higher than anticipated, with the overall unemployment rate in the United States rising to 4.3%. Consequently, the news

triggered recession fears, leading to a bearish investor sentiment for BTC and the rest of the market.Is Bitcoin ready to push back up?

Bitcoin has so far dropped roughly 13% from its highest price on Monday, courtesy of this recent bearish extension. As a result, it entered an important potential buy zone, one that we highlighted previously.

Our analysis placed the next potential buy zone between $61,870 and $59,917. This was based on Fibonacci retracement from its July lows to its highest recent levels.

At the time of writing, BTC was valued at $61,727, indicating a surge in buying pressure at recent discounted levels. This was within the aforementioned Fibonacci retracement zone too.

This can also be interpreted as a signal that the sell pressure has slowed down. Hence, the question – Will it be enough to sustain a sizeable uptrend now?

Bitcoin whales on the move

BTC’s ownership stats revealed that whales have been actively moving funds in and out of their wallets. Whale inflows peaked at 99,000 BTC on 30 July. Inflows also showed positive growth from 391.8 BTC on 1 August to 13,490 BTC during yesterday’s session.

This may be a sign that whales accumulated a significant amount of Bitcoin across the board.

On the contrary, whale outflows peaked at 14,370 BTC on 30 July, before dropping to 340 BTC the next day. Outflows peaked at 10,330 BTC more recently on 2 August. The total amount of inflows in whale addresses were higher than outflows – Signaling that whales have been accumulating.

We also explored the amount of Bitcoin flowing in and out of exchanges to determine the level of buy or sell pressure.

The data revealed that Bitcoin’s aggregated exchange outflows peaked at 27,730 BTC during yesterday’s trading session.

In comparison, Bitcoin had 16,850 BTC in outflows during the same trading session. This means there was a net outflow of 10,880 BTC. This equates to over $671 million worth of buying pressure.

Ergo, the amount of BTC flowing out of exchanges during Friday’s trading session seemed to confirm that traders, including whales, have been accumulating. This could set the pace for some recovery into the new week, unless sell pressure intensifies.