Bitcoin

Bitcoin price prediction: Why a BTC rally might be delayed

Until the volume expands and prices can breach the $73.5k region, traders can anticipate the range formation.

- Bitcoin has a bullish structure after flipping $67k to support.

- The lack of volume might cut short an uptrend.

Bitcoin [BTC] has gained close to 3.6% from the lows of Friday the 31st of May. Back then, the king of crypto was trading just above the $67k support level and showed little bullish momentum.

This might have begun to change. However, the trading volume was unconvincing, and bulls needed to do much more to force a convincing breakout. Is the market ready for a rally, or will we see an extended consolidation?

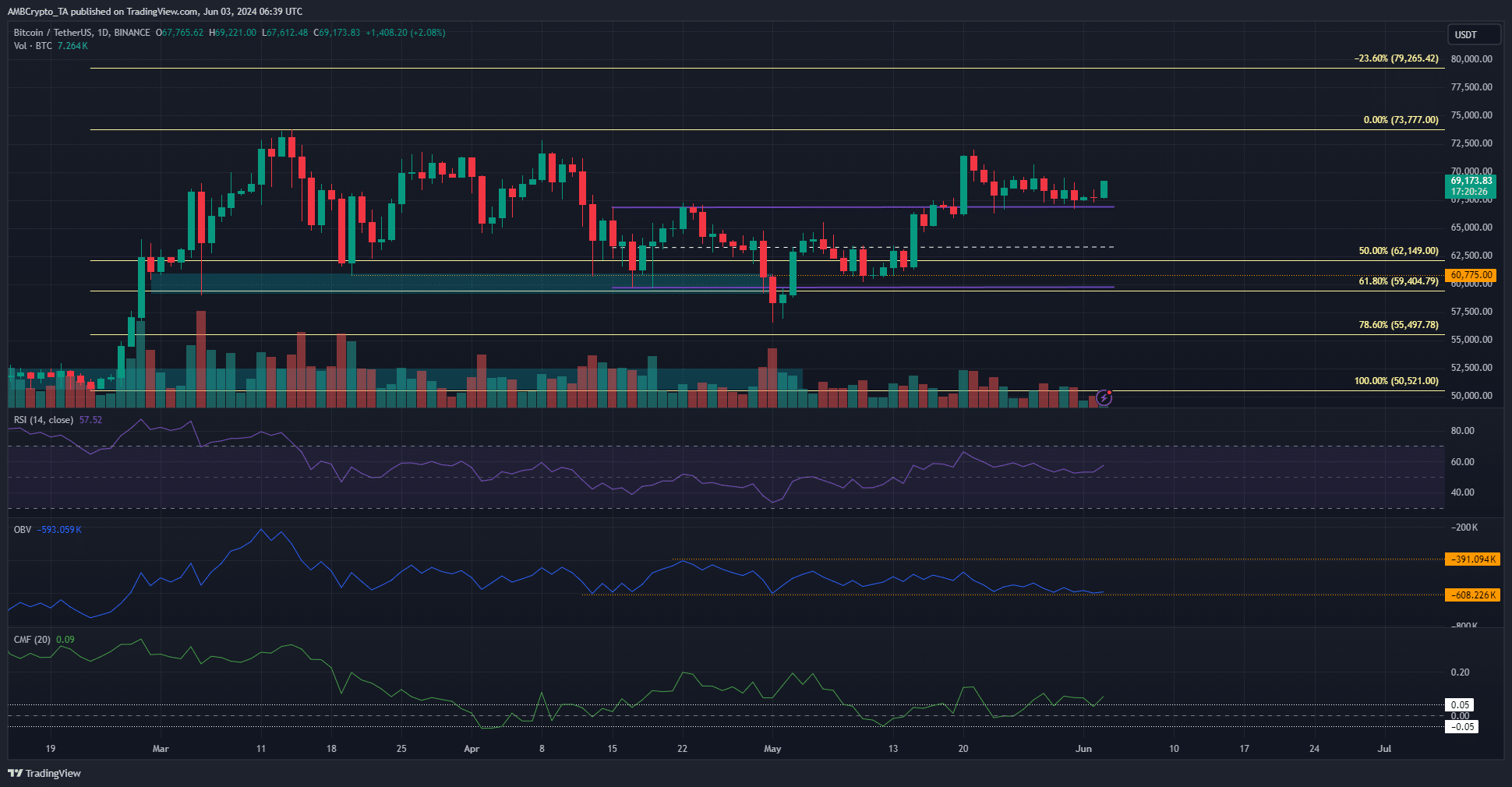

Resolving the conflicting volume indicators

The late February rally saw a retracement to $59k in mid-April. This level was only the 61.8% retracement level and since then BTC has recovered well. The RSI on the daily chart climbed above neutral 50 to signal a shift in momentum.

However, despite the price’s range breakout, the OBV was resolutely within a range. It was at the lows from April, which was a concerning development.

It indicated that the recent gains were likely to be wiped out quickly due to the lack of buying pressure.

Conversely, the CMF jumped above +0.05 to highlight significant capital inflows. The volume indicators opposed each other’s findings.

Overall, while the bullish bias was stronger, the lack of trading volume in the past two weeks weakened Bitcoin price prediction’s bullish arguments.

The liquidation cluster could pull BTC toward $75k

Source: Hyblock

The large cluster of liquidation levels at $73k-$75.2k is likely to act as a strong magnetic zone for Bitcoin prices. To the south the $65.6k region was also a region of interest.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The lack of trading volume meant the Bitcoin price prediction is consolidation around the $70k region for this week, or even longer.

Until the volume expands and prices can breach the $73.5k region, traders and investors can expect a range formation to take hold.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.