Bitcoin at $70,000 – Should you follow these long-term holders and sell?

- Long-term holders began to move their BTC holdings.

- Short sellers got liquidated, while traders turned bullish.

Bitcoin’s [BTC] price has been hovering at the $70,000 mark for quite some time. Due to the stagnancy of BTC’s price, many addresses have been contemplating selling their holdings.

Long-term holders make moves

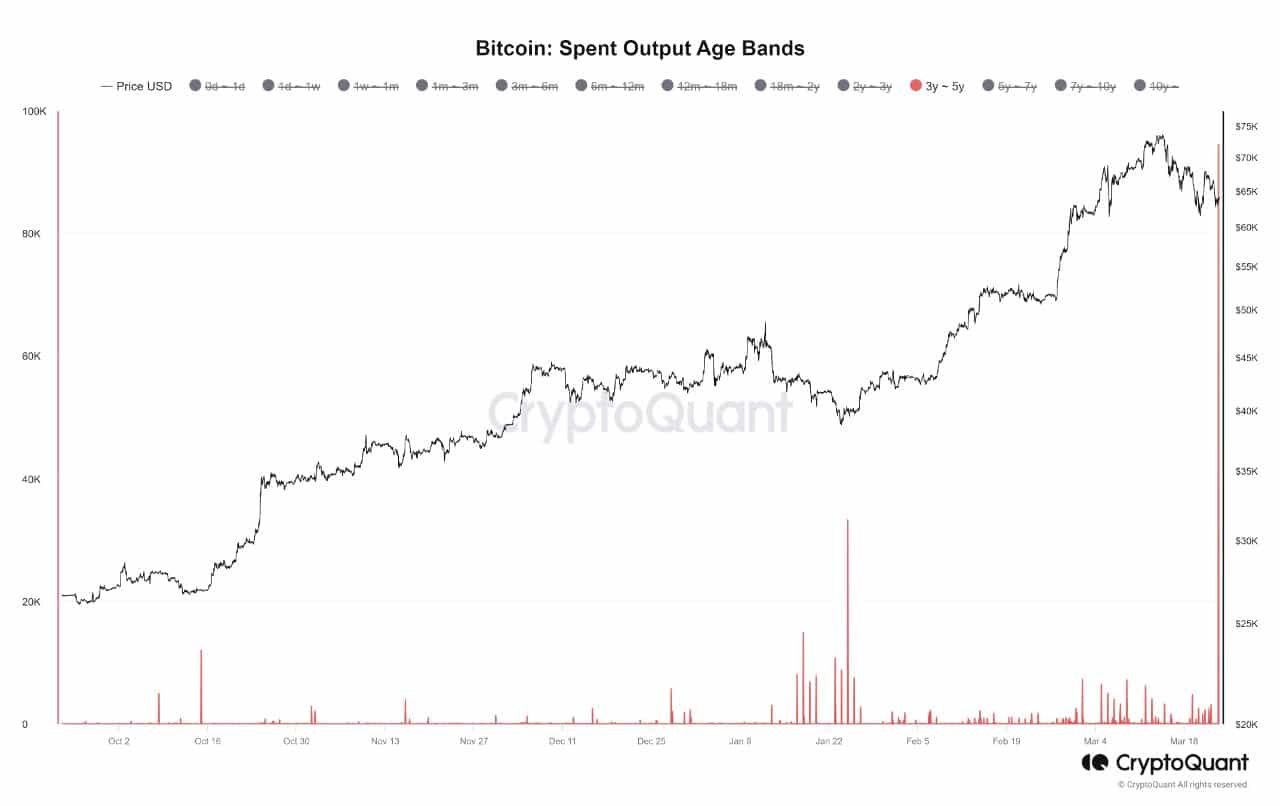

Recent data indicated a massive trend of significant movement among long-term holders (3 to 5 years), with approximately 90,000 Bitcoin transferred over the past few weeks. These transfers predominantly involve wallets likely owned by individual users, rather than exchanges or other intermediary platforms.

Long-term holders are increasingly liquidating their holdings, it may indicate a lack of confidence in the future price appreciation of BTC or a need for liquidity for other purposes.

Additionally, a large influx of BTC onto exchanges from long-term holders could exert downward pressure on prices due to increased selling pressure.

Furthermore, the Sharpe Ratio experienced a significant increase. For context, the Sharpe Ratio is a measure of risk-adjusted returns. It can potentially impact Bitcoin negatively if it indicates an excessively high level of risk relative to returns.

A rising Sharpe Ratio might suggest that the risk associated with holding Bitcoin has increased disproportionately compared to potential gains, which could deter investors seeking a more favorable risk-return profile.

This heightened perception of risk may lead to reduced investor confidence and a subsequent decrease in demand for Bitcoin, ultimately putting downward pressure on its price.

Liquidations on the rise

Despite this, traders continued to remain bullish around BTC. This was indicated by the rising number of long positions taken by traders.

One of the reasons for the growing number of long positions could be due to the recent losses faced by short sellers. AMBCrypto’s analysis of coinglass’ data indicated that 41.81 million short positions had been liquidated in the past 24 hours.

The rising amount of liquidations may deter short sellers from betting against BTC in the near future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

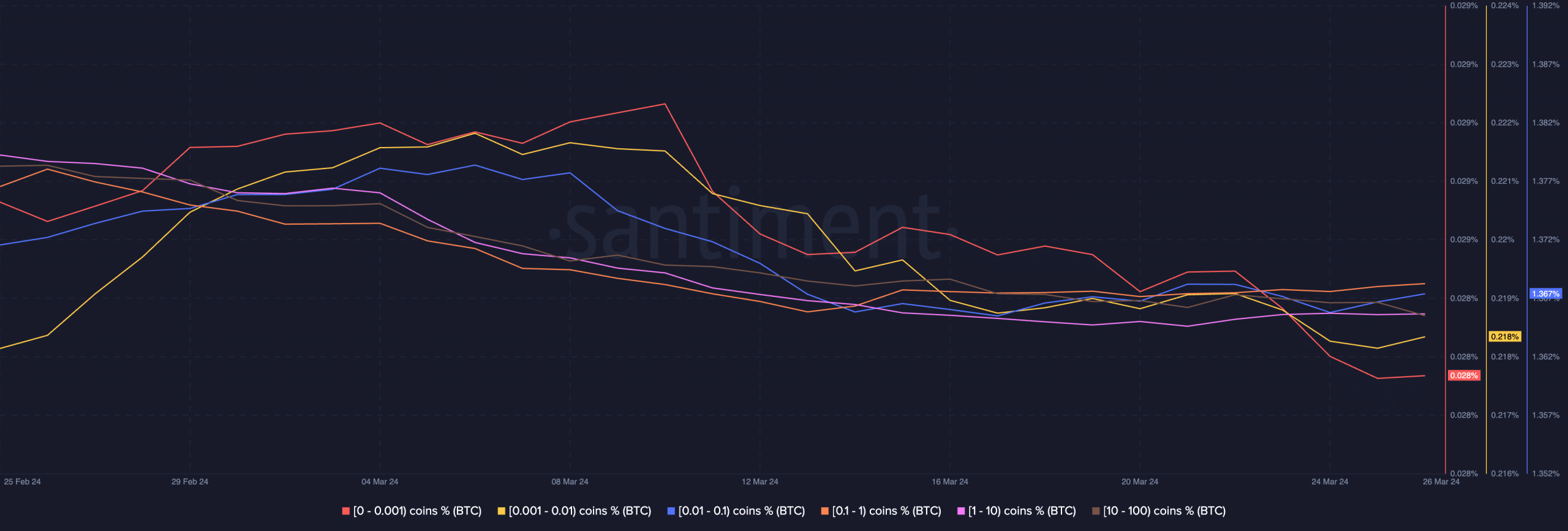

Even though traders were bullish on BTC, the overall interest showcased by retail investors had declined. Recent data showcased that the holdings of addresses that possess 0.001 to 1 BTC had fallen in the last few days.

At press time, BTC was trading at $70,732.95 and its price had grown by 0.59% in the last 24 hours. Moreover, the volume at which it was trading at had also grown by 27.05% during the same period.