Bitcoin Protocol sees TVL growth as staking restrictions lift

- The Bitcoin Protocol reached nearly 24,000 BTC locked, totaling around $1.5 billion in value.

- Bitcoin ranks third in NFT sales volume, with nearly $15 million in sales over seven days.

The Bitcoin [BTC] Protocol, Babylon, has recently experienced a significant increase in its Total Value Locked (TVL). The surge follows the removal of certain staking restrictions.

Also, this change allowed more BTC to be staked, setting a new milestone for the network.

Furthermore, the expanded staking function marks another step in its evolution, featuring amongst networks with the highest NFT sales volume.

Bitcoin Protocol locks more BTC

According to recent data, the Bitcoin Protocol, Babylon, currently has nearly 24,000 BTC locked, equivalent to almost $1.5 billion at the current market price.

Furthermore, this milestone was reached after the protocol lifted its cap on new deposits on the 8th of August, allowing users to stake more BTC.

Thousands of BTC were staked within just over an hour, spanning around 10 Bitcoin blocks.

The only restriction was a 500 BTC limit per transaction, a change from the initial 1,000 BTC cap when the protocol launched earlier in August.

Additionally, the lifting of the staking cap spurred rapid growth in the TVL, showcasing the increasing interest in utilizing the Bitcoin Protocol for staking purposes.

Comparing the Bitcoin Protocol’s staked assets to Ethereum

As of now, approximately 24,000 BTC—around 0.122% of the circulating supply—is staked in the Bitcoin Protocol. Bitcoin has a market capitalization exceeding $1.2 trillion and a circulating supply of over 19.7 million BTC.

While this percentage is noteworthy considering the protocol’s relatively new staking function, it pales compared to Ethereum [ETH].

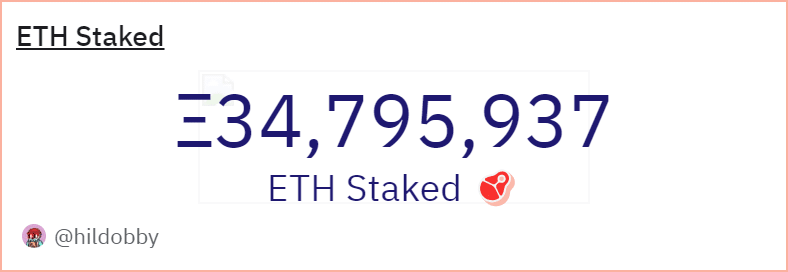

Data from Dune Analytics indicates that nearly 35 million ETH is currently staked, accounting for more than 28% of the total ETH supply.

Data showed that the Ethereum market cap is approximately $294 billion and a circulating supply of about 120.4 million ETH. With this, Ethereum’s staking participation far surpasses Bitcoin’s.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Growth in NFT sales volume

In addition to staking, the Bitcoin network has made strides in NFT. The network ranks amongst the top five networks in terms of NFT sales volume.

Furthermore, according to Crypto Slam, Bitcoin recorded nearly $15 million in NFT sales over the past seven days. This positions it as the third-highest network for NFT sales, trailing only Ethereum and Mythos.