Bitcoin

Bitcoin Puell multiple nears key level – What this means for investors

Is Bitcoin on the verge of pullback or will it extend its upside? Here’s a look at some data that may help provide insights into possible scenarios.

- Bitcoin could be on the verge of another rally according to its Puell Multiple.

- Bullish optimism and extreme greed may point to possible reversal.

The bullish Bitcoin [BTC] momentum that we observed in October and the first half of November appears to be fading out. But what is next for the king of the cryptocurrencies as 2024 approaches its conclusion?

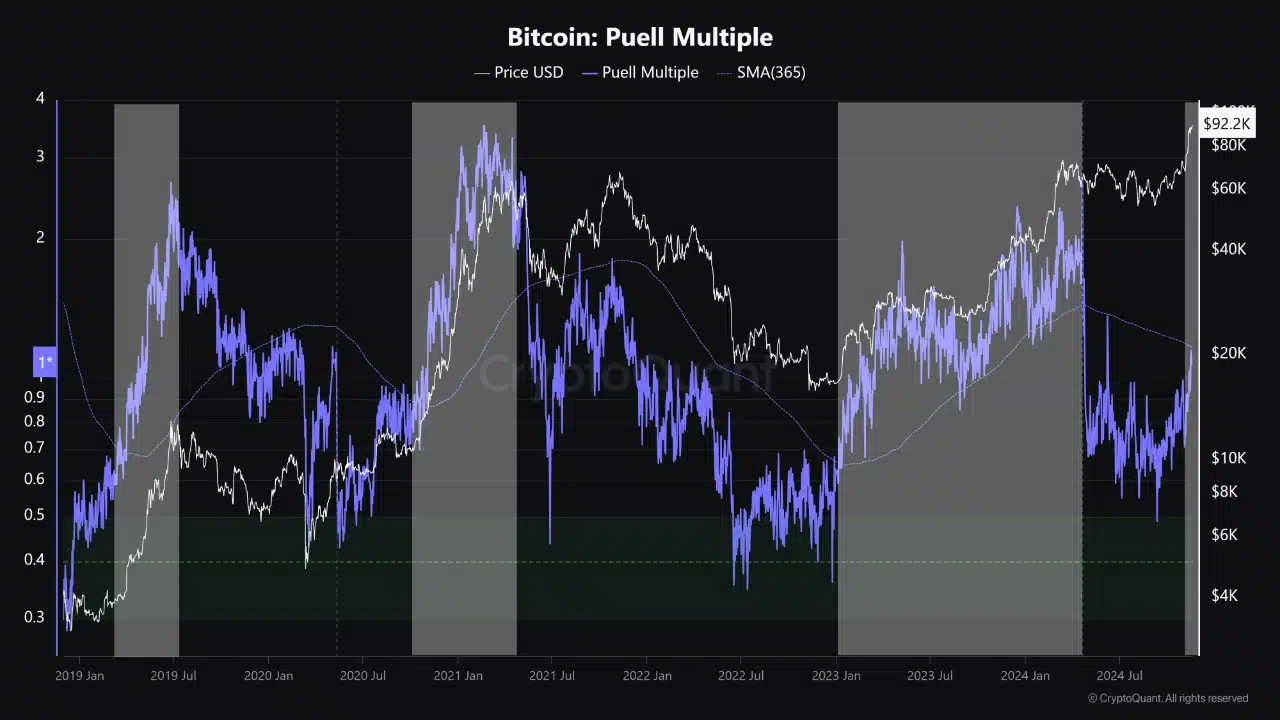

A recent CryptoQuant analysis reveals some insights in regards to Bitcoin’s next potential move based on the Puell Multiple. The latter evaluates mining revenues relative to market movements.

According to the analysis, the Puell Multiple recently pushed closer to its 365-day moving average.

If the Puell Multiple crosses the moving average, it could signal the start of another major bull run. This analysis was based on similar observations in the past when the same indicators interacted.

Should Bitcoin holders expect more upside?

The CryptoQuant analysis suggests that Bitcoin may regain the momentum in the coming days or weeks. However, it is just one indicator and the market dynamics may still shift in the coming days.

For example, miner revenue has historically been a reliable indicator for demonstrating market sentiment.

Miner reserves tend to soar when miners anticipate higher BTC prices so they can HODL and sell higher. The latest miner reserve data indicates that reserves dipped to 2024 lows on 18th November.

The miner reserves may indicate a lack of strong incentive to HODL. However, it is worth noting that Bitcoin has been hovering near its ATH which may encourage miners to sell some of their coins.

The risk of an unexpected selloff

Another potential reason why miner reserves were close to their bottom could be that there are expectations of a sizable pullback after the recent rally. In other words, there is growing uncertainty about BTC’s next move.

Bitcoin fear and greed index was at 90 or in extreme greed which is the highest level it has been in months. Major pullbacks have historically taken place in extreme greed scenarios hence the concern that it could pull off a decent retracement in an unexpected manner.

On the other hand, optimism remains high especially in light of the changing global liquidity conditions as interest rates drop. Also, the recent U.S elections provided optimism for the crypto market as the country ushers in a pro-crypto administration.

Read Bitcoin (BTC) Price Prediction 2024-25

These factors indicate that the rally may not be close to a cycle peak. Whales are still accumulating which signals that they could be preparing for another major move.

Inflows into large holder accounts peaked soared to more than 516,000 BTC in the last 24 hours. Outflows from whale addresses were lower at just over $471,000.