Bitcoin

Bitcoin pushes above $61k once again – Here’s what’s different this time

Bitcoin may exit its current range as multiple signs signal that it is at a pivotal point.

- Why Bitcoin could be flashing signs of a volatility resurgence and a potential breakout.

- BTC whale activity on the rise as exchange flows are expected to surge in the coming days.

Bitcoin [BTC] has been trading within a narrow range underpinned by low volatility in the last 15 days.

It has demonstrated resistance near the $61,000 level during that time, resulting in pullbacks every time it pushed near or above that zone.

The king coin has once again managed to rally above the $61,000 price level in the last 24 hours. This time, though, there are some noteworthy observations which may hint at growing bullish momentum.

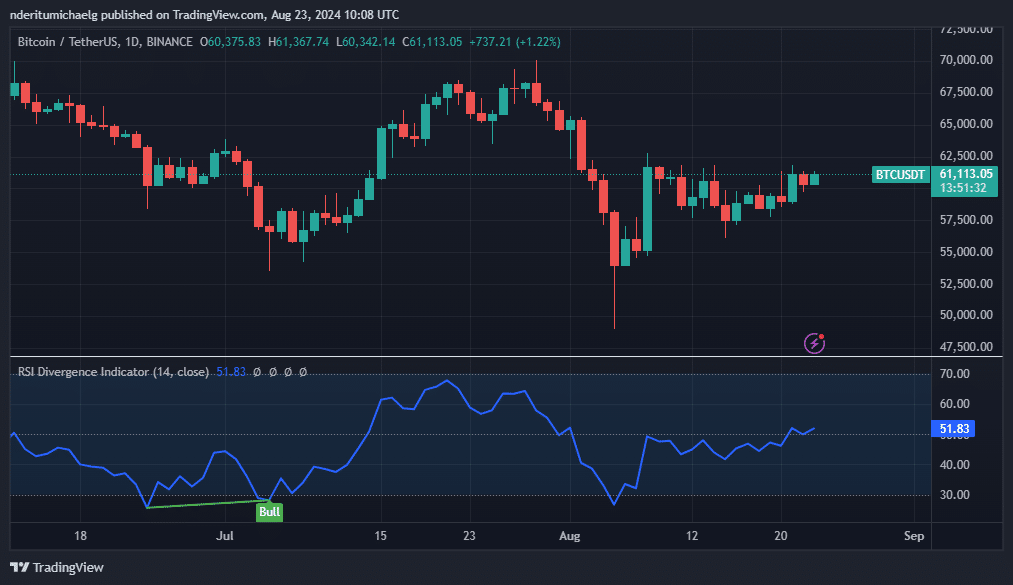

For starters, BTC’s RSI has been struggling to push above its 50% level ever since the crash that occurred earlier this month.

However, the recent mid-week bullish push propelled it above the RSI mid-level, and its upside in the last 24 hours demonstrated resilience above that level.

The RSI’s behavior indicates that Bitcoin is experiencing a gradual resurgence of bullish momentum, which may aid its price action in the short-term.

This could spill into the weekend, possibly allowing BTC to push outside the sideways range.

Bitcoin signs at pivotal moment

Bitcoin may benefit from a liquidity influx to fuel a robust upside. Coincidentally, The NASDAQ just formed a bearish divergence pattern, which means a resurgence of sell pressure could see liquidity flow from stocks to Bitcoin.

Meanwhile, Bitcoin whale activity has been on the rise. Addresses holding at least 10 BTC have been increasing in the last few days.

Growing whale activity suggested that Bitcoin was getting closer to exiting the current low volatility range. Bitcoin exchange flows

also revealed another important observation worth noting.Its exchange flows have been quite cyclical over the last few months, with peaks and troughs.

While the exchange flow peaks have been different for the most part, the bottom range has been relatively consistent. Exchange flows fell to the same low range in the last 24 hours.

Note that exchange outflows were slightly higher than inflows at press time.

The above chart signals that exchange flows are about to pivot to the upside. This means the market is about to experience higher exchange flows in the next few days.

As a consequence, Bitcoin price volatility may be in favor of an uptick in the next few days.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The observation that whale activity is making a comeback could signal a higher probability of Bitcoin bulls taking over in the coming week.

A stronger move is to be expected if the U.S. Federal Reserve announces interest rate cuts.