Bitcoin realized price hits $43.6K: Will $150K be BTC’s next milestone?

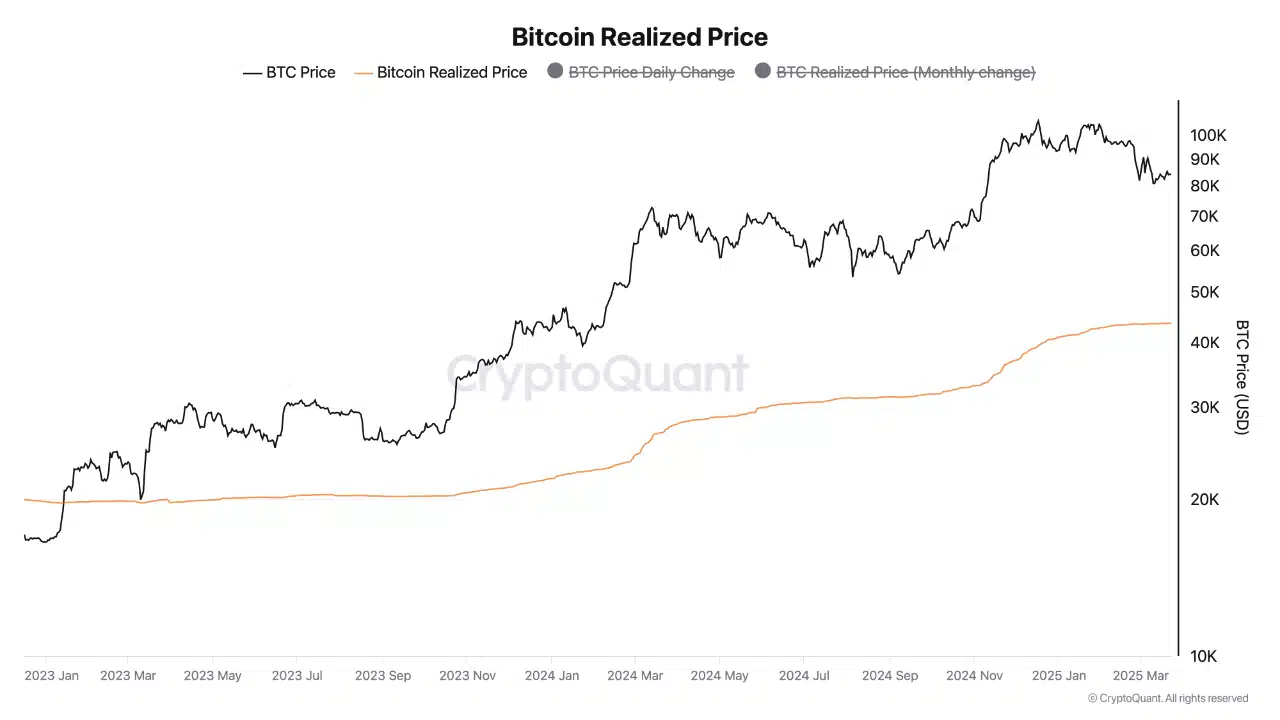

- Bitcoin’s realized price is rising steadily, signaling strong market confidence and continued accumulation.

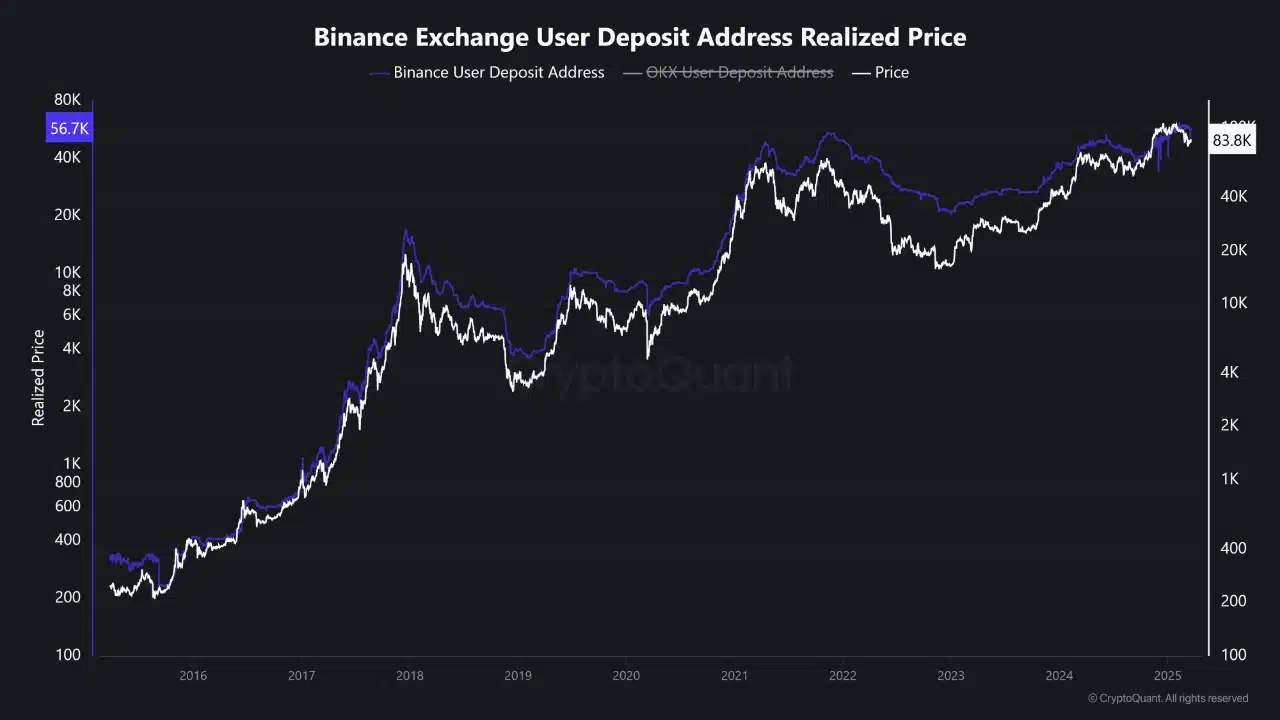

- Binance users’ realized price near $56K suggests ongoing profit and resilience, but risks of correction remain.

Bitcoin [BTC] continues to hover near the $84,000 mark, maintaining its dominance in a market that is both energetic and cautiously observant.

As traders eye new all-time highs, on-chain metrics provide deeper insights into market sentiment and structural strength — none more telling than the concept of realized price.

Realized price, which reflects the average acquisition cost of Bitcoin across all holders or specific user groups, has become a powerful tool for assessing profitability and potential inflection points.

Among the most notable data points: Binance users currently sit on realized price levels near $56,000, suggesting a large majority remain in profit.

Meanwhile, Bitcoin’s overall realized price has climbed to $43.6K, prompting speculation of a possible run toward $150,000…should historical patterns hold.

Will the trend continue, or are we approaching a saturation point?