Bitcoin: Why BTC won’t end its bull run anytime soon

- BTC has seen its highest short-term net realized profit/loss in months.

- BTC has fallen below the $52,000 price level.

Bitcoin’s [BTC] recent price movements have reached new levels in the past few days, prompting many holders to sell. Despite these sell-offs, certain metrics indicate that there has been a consistent inflow of capital.

Bitcoin realized profit/loss shows capital inflow

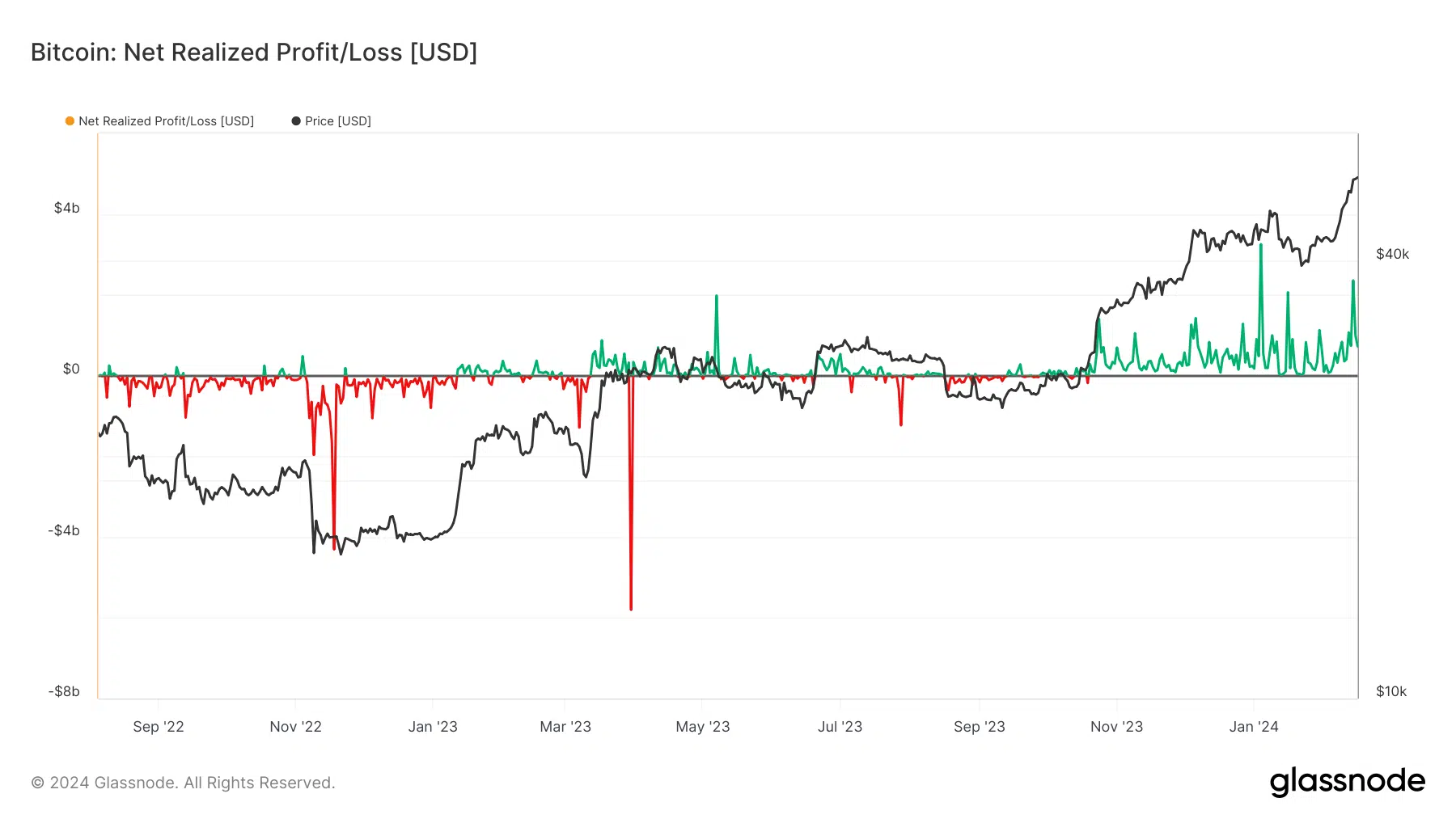

The recent shift in Bitcoin’s price range has influenced the short-term net realized profit/loss trajectory, reaching its highest point since 2021. According to the Glassnode chart, this specific category of holders recorded a net realized profit/loss of over $647 million.

Additionally, a broader analysis of the overall net realized profit/loss showed a positive figure, surpassing $722.8 million at the time of writing.

This suggests that profits are actively being realized on-chain. As the price continues its upward trend, it signals capital inflows, helping absorb the sell-side activity.

Bitcoin Open Interest confirms more capital inflow

Traders actively injecting more capital into Bitcoin was further supported by the Bitcoin Open Interest metric. An examination of the metric on CryptoQuant showed that BTC Open Interest was now over $13 billion.

Although it slightly decreased to approximately $13.3 billion at the time of writing, this still marked the highest level observed since April 2022.

Open Interest reflects the total number of open long and short BTC positions. The ongoing growth in Open Interest suggests an influx of more capital, potentially contributing to further upward momentum in the BTC price.

How BTC has trended

The Bitcoin daily timeframe chart showed its most significant uptrend in months, breaking through the $50,000 price range. The most recent notable increase was on 14th February, with an increase of over 4%, reaching approximately $51,890.

Subsequently, the uptrend has continued, gradually pushing the price into the $52,000 range. By the close of trade on 16th February, it settled around $52,181.

How much are 1,10,100 BTCs worth today

At the time of writing, a slight decrease of less than 1% brought the current trading price to around $51,866.

Additionally, this slight price decline has impacted the Relative Strength Index (RSI). Although the RSI remained above 80, indicating a strong bull trend and an overbought condition, a noticeable slight decline is observed.