Bitcoin reclaims $60K as miners ramp up OTC sales – What’s next?

- Bitcoin has reclaimed $60,000 amid a surge in OTC desk balances, indicating increased selling by miners.

- Analysts remain cautiously optimistic, despite mixed signals from network activity and large-scale transactions.

Bitcoin [BTC] has recently shown signs of recovery after several weeks of consolidation below the $60,000 mark.

The leading cryptocurrency has managed to climb back above this physiological level, reaching a 24-hour high of $61,830 and currently trading at $60,798, marking a 2% increase over the past day.

This upward movement has brought a sense of relief among traders who had been concerned about Bitcoin’s stagnant price action in recent weeks.

The resurgence in Bitcoin’s price coincides with a significant development in one of its key metrics, which could have important implications for the market.

Rising OTC desk: What this means for BTC

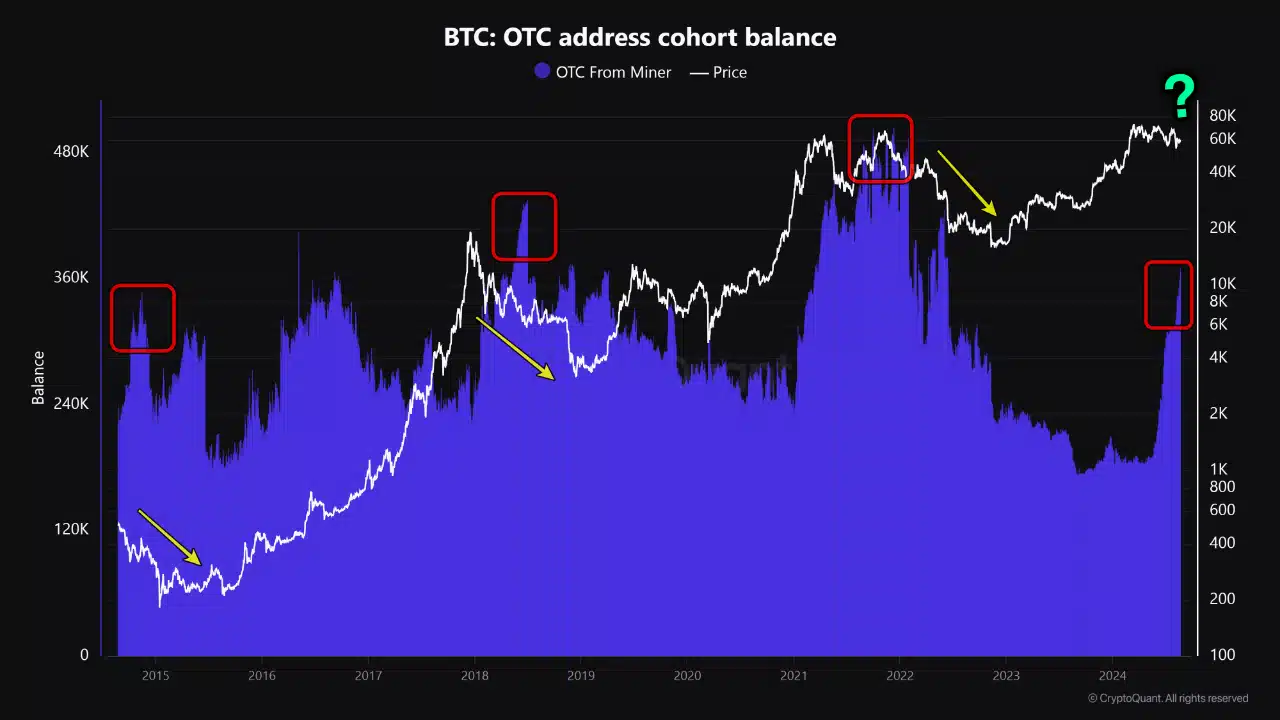

According to a recent report from CryptoQuant, the balance of Bitcoin held in Over-the-Counter (OTC) desks has surged to a two-year high.

Analyst ‘Ego Hash’ reported that these balances, which represent the amount of Bitcoin that miners sell directly to buyers through OTC deals, have increased by more than 70% over the past three months.

Specifically, OTC desk balances have risen from 215,000 BTC in June to 368,000 BTC in August, an increase of 153,000 BTC.

This level of OTC activity has not been seen since June 2022. The rise in OTC desk balances is often associated with increased selling pressure from miners, which historically correlates with subsequent declines in Bitcoin’s price.

Despite the potential bearish implications of the rising OTC desk balances, several analysts and experts in the cryptocurrency space remain optimistic about Bitcoin’s prospects.

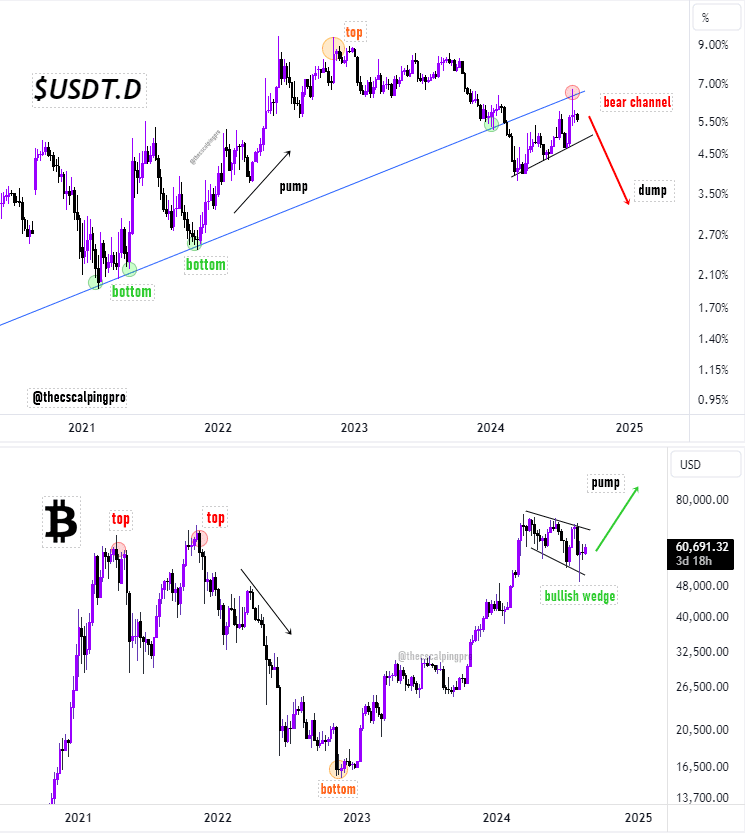

For instance, a prominent crypto analyst known as Mags earlier today shared a bullish outlook on X, suggesting that Bitcoin could be on the verge of a significant price increase.

Mags pointed to the inverse correlation between the dominance of Tether (USDT.D) and Bitcoin (BTC), noting that a recent breakdown in USDT.D’s trendline support could lead to a bullish continuation pattern for Bitcoin.

According to Mags, if this scenario plays out, Bitcoin could potentially surge to $72,000 or even higher in the near future.

Ready for the lift off?

However, beyond these bullish predictions, comes Bitcoin’s complex underlying fundamentals which if assessed can be used to gain a more comprehensive understanding of the market’s current state.

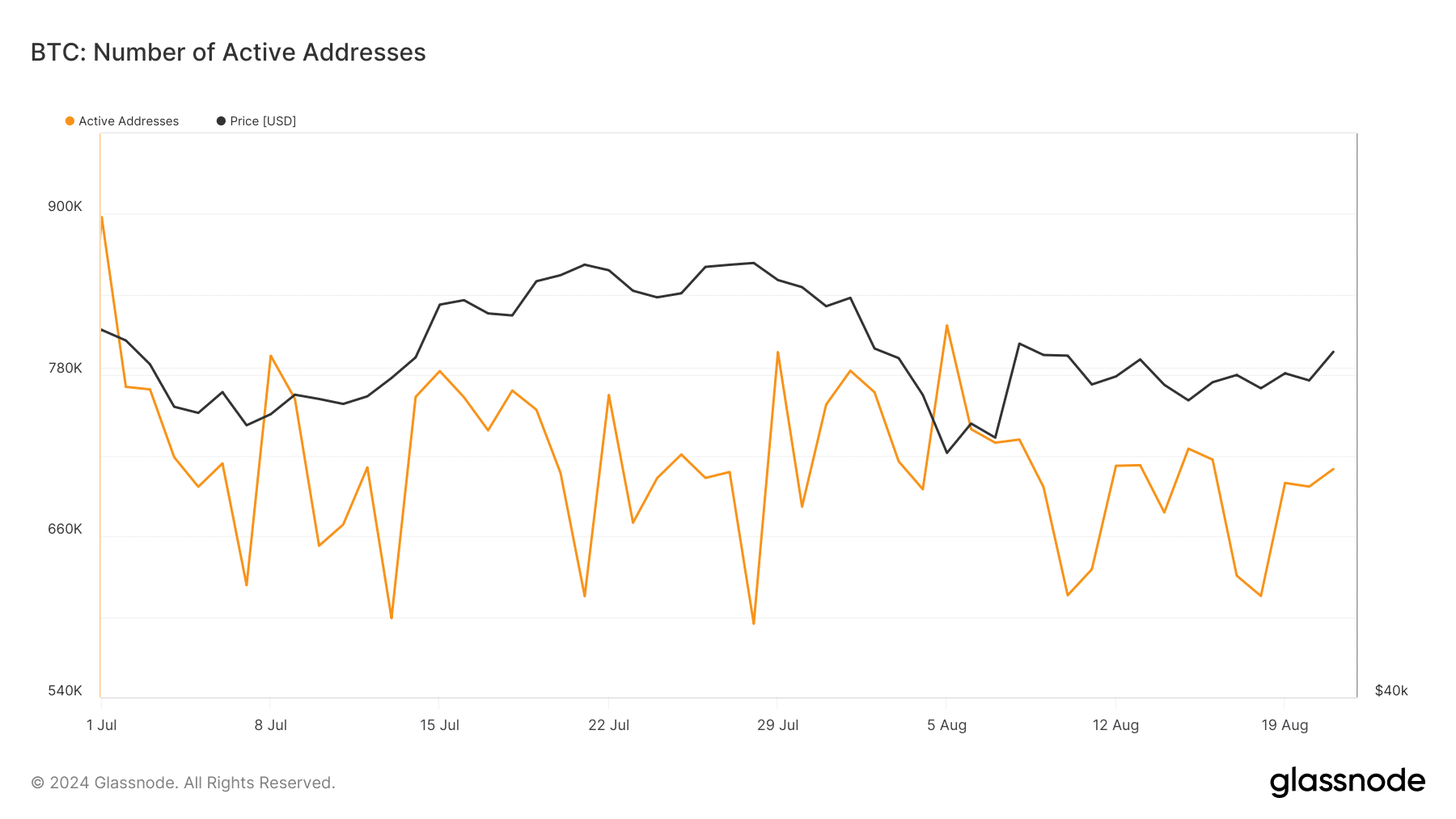

Data from Glassnode reveals that Bitcoin’s number of active addresses, a key indicator of network activity, experienced a significant decline over the past month.

The number of active addresses dropped from nearly 900,000 on July 1 to a low of 594,000 on July 24. Nevertheless, there has been a recent rebound, with active addresses rising to over 700,000 as of today.

This recovery in network activity suggests that user engagement with Bitcoin is beginning to pick up again after a period of decline.

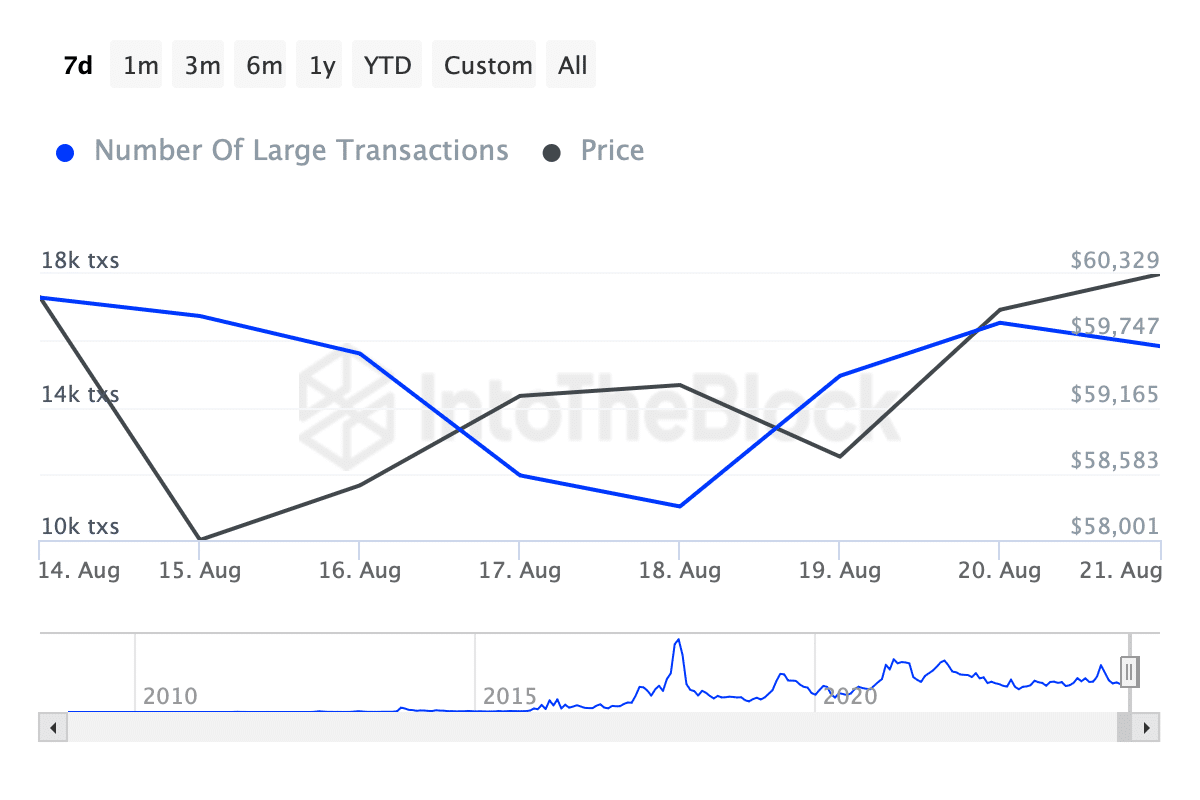

In addition to network activity, whale transactions—defined as Bitcoin transactions greater than $100,000—have also seen some fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to data from IntoTheBlock, the number of these large transactions has decreased slightly over the past week, dropping from over 17,000 to just below 16,000.

While this decline may indicate some caution among large investors, it is not necessarily a cause for concern, as the overall market sentiment remains cautiously optimistic.