Bitcoin regains its correlation with the S&P 500 ahead of FOMC meet

- There is a distinct correlation between Bitcoin and the S&P 500

- Bitcoin miner reserves may be worth keeping an eye out for too

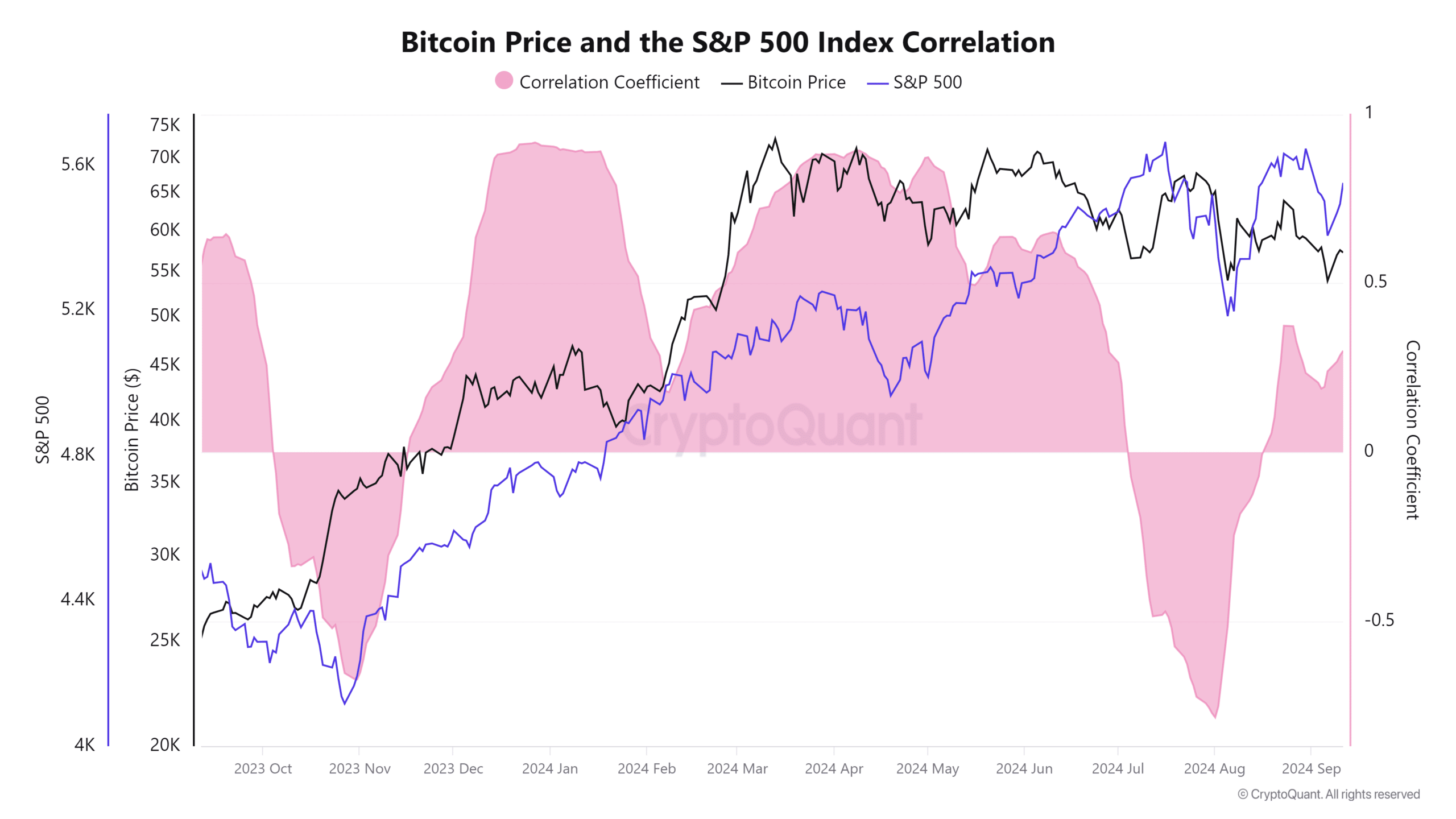

Bitcoin is often classified as a risk-on asset, which is a term reinforced by how people invest in it. The most notable characteristic of this classification is that Bitcoin has historically demonstrated correlation with the S&P 500.

The correlation between Bitcoin and the S&P 500 usually underscores investor diversification in the risk-on category. However, there are instances where Bitcoin has lost its correlation with the stock market. This was evident in June and July, phases which were characterized by differing factors such as Bitcoin’s involvement in politics.

According to latest data, however, Bitcoin is once again moving in tandem with the stock market. The correlation coefficient bounced from its lowest point in the beginning of August and turned positive in mid-August.

Rate cuts expectations are the common denominator for this correlation. The U.S Federal Reserve is slated to hold its next FOMC meeting in the next 4 days. Expectations have been overwhelmingly leaning towards a sizeable rate cut. Such an outcome would be favorable for the risk-on segment, one which encompasses both stocks and crypto.

Both Bitcoin and the stock market are expected to respond to the announcement. In fact, most analysts hold the consensus that a bullish outcome is highly likely if the Fed decides to embark on aggressive rate cuts. Here, it’s. worth noting that the correlation may be lost further down the line, especially if Bitcoin takes off aggressively.

All eyes on Bitcoin miner supply

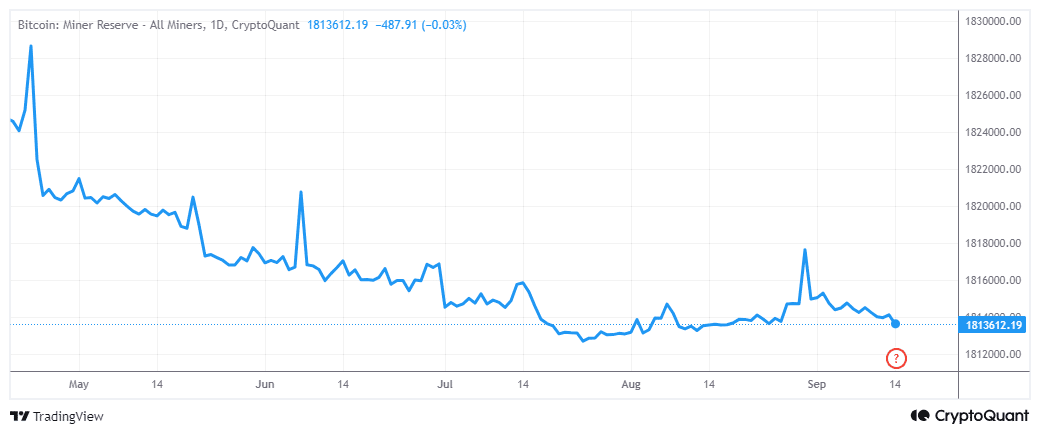

Speaking of bullish expectations, the market is currently looking for signs of a major rally. In fact, a recent Santiment post pointed out that mining wallet balances may offer a strong signal when the next major rally commences.

“Bitcoin and Ethereum mining wallets have seen declining supply held since the first half of 2024. With this latest mild rebound, look for a jump in their combined supplies as a strong signal the next bull run is approaching.”

Investors should thus keep a close eye on miner reserves based on this assessment. The miner reserves metric revealed that Bitcoin miner balances have been declining since April. It demonstrated some uptick in July, but it soon retraced in favor of outflows.

We can see based on the aforementioned analysis that miner flows were within their 2024 bottom range. This means there is a significant chance of a pivot from this level, especially now that Q4 is just around the corner.

A combination of rate cuts and the U.S elections may provide the right blend of catalysts to trigger another major market move. A shift in guard in Bitcoin miner reserves, especially in favor of a sharp uptick, may be seen as ample confirmation of when the next bull run kicks off.