Global News

Bitcoin-related funds mark 99% crypto outflows last week

GBTC outflows have been the primary bearish catalyst for Bitcoin in recent weeks.

- Funds tied to Bitcoin attracted 99% of the total outflows last week.

- There was a significant reduction in the daily outflows from GBTC in recent days.

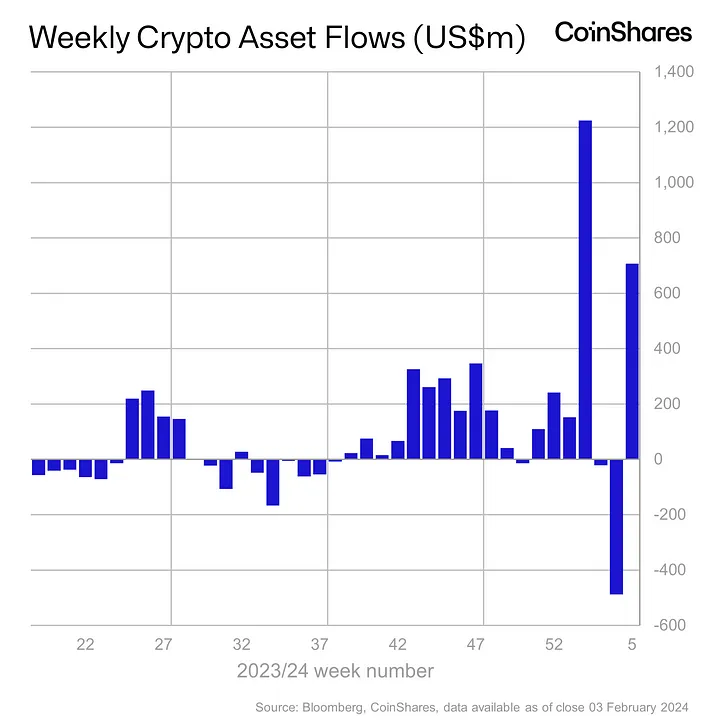

Institutional crypto products attracted net inflows for the first time in three weeks, according to the latest report by crypto asset management firm CoinShares.

Investors poured $708 million into the cryptocurrency market last week, a sharp reversal from the $500 million in outflows seen during the week before.

An impressive turnaround

With the latest statistics, the total inflows since the beginning of 2024 surged to $1.57 billion, and the total assets under management (AuM) to $53 billion. The AuM rose by nearly 4% from the previous week.

As is well known, AUM is a measure of the flow of investor money in and out of a fund. Investors place high weightage on the AUM before proceeding with their investments into any fund.

Funds tied to Bitcoin [BTC] attracted 99% of the total outflows last week. On a year-to-date (YTD) basis, $1.5 billion worth of institutional capital has moved into the Bitcoin market.

The activity has heightened following the regulatory approval of spot Bitcoin ETFs in the U.S. last month.

Newly issued ETFs received over $1.7 billion in inflows last week, taking total inflows since launch to $7.7 billion.

This has been offset by outflows of $6 billion from the already-established Grayscale Bitcoin Trust (GBTC) which was transitioned into a spot ETF last month.

However, Coinshares noted a “significant reduction” in the daily outflows from GBTC in recent weeks. AMBCrypto examined data from SoSo Value and found merit in the claim.

As seen below, outflows dropped from $640 million on the 22nd of January to just $144 million as of the 2nd of February, marking a 77% decline.

Winners and losers

Apart from Bitcoin, Solana [SOL]-linked products also registered impressive inflows of $13 million last week. This was the second straight week of net capital infusion into Solana.

Ethereum [ETH], on the other hand, continued to struggle with over $6 million in outflows, marking the third consecutive week of capital exodus from the market.