Unexpected Fed rate cut of 0.50% helps Bitcoin surge to $62K

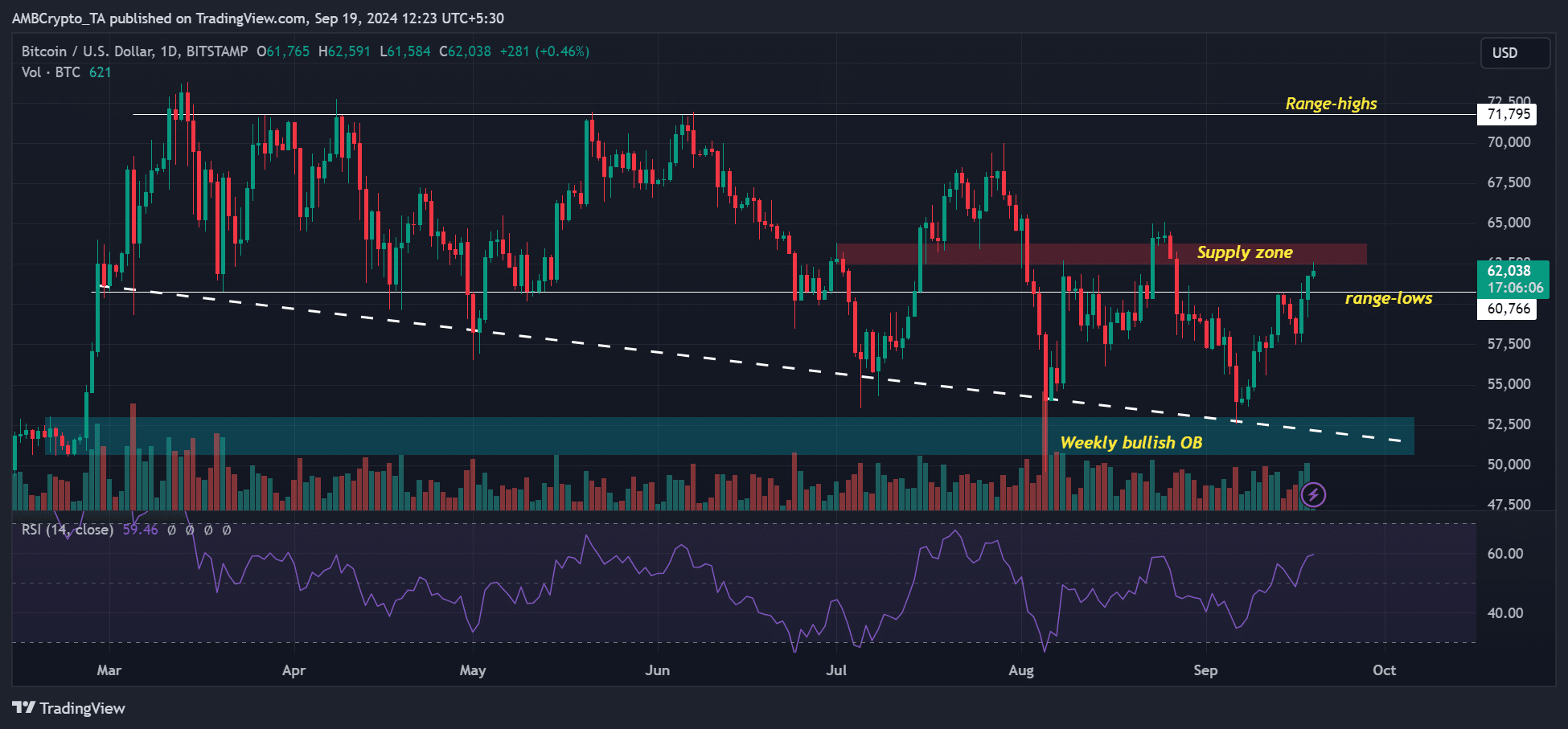

- BTC surged to $62K as the Fed’s easing cycle began.

- Analysts remained cautious after the Fed’s ‘aggressive’ 0.50% rate cut.

Bitcoin [BTC], the world’s largest cryptocurrency by market cap, surged to $62K on the 18th of September after a surprise 0.50% Fed rate cut.

BTC hit $62.5K, a two-week high that increased September’s recovery gains to nearly 18%.

However, the aggressive rate cut caught even economists polled by Bloomberg off guard. A recent Bloomberg poll showed that more economists leaned towards a 25 basis point (bps) cut, with only 9 out of 114 economists expecting a 50 bps cut.

Although the Fed Fund Futures accurately predicted the Fed’s 50 bps cut, the higher odds for aggressive cuts only changed earlier in the week.

What’s next for BTC?

Reacting to the 0.50% interest rate cut, Fed chair Jerome Powell argued it was meant to maintain low unemployment rates now that inflation has cooled off.

The policy shift effectively kicked off the beginning of the central bank easing cycle that could boost risk assets, especially BTC.

However, market pundits remained cautious as the aggressive cut signaled recession worries.

BitMEX founder Arthur Hayes noted that the 50 bps cut was a “nuclear catastrophe for financial markets,” signaling a deeper rot in the global financial system.

He added that assets might rally in the first or second day, followed by depressed prices afterward.

The same cautious outlook was echoed by 21Shares’ Crypto Research Strategist Matt Mena. However, Mena told AMBCrypto that the easing cycle was bullish for BTC in the long term. He said,

“In the short term, a 50 bps rate cut could signal to the market that the economy is slowing…However, over the long term, Bitcoin and other digital assets have historically thrived in low-interest-rate environments.”

Another cause of market concern for BTC was the strengthening of the Japanese Yen against the U.S. Dollar (USD), given the massive sell-off witnessed in early August after the carry trade unwinds.

With the upcoming BoJ (Bank of Japan) decision scheduled for the 20th of September, Hayes suggested tracking this front to gauge BTC’s price direction.

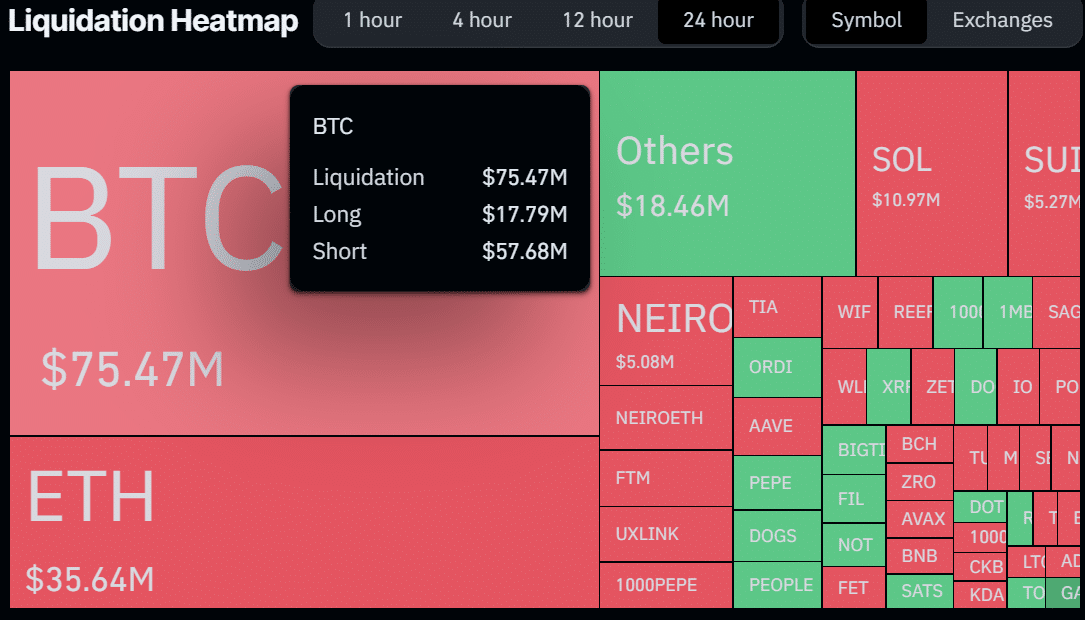

In the meantime, the upswing to $62K liquidated over $57 million worth of short positions out of $75.5 million, reinforcing a short-term bullish sentiment in the Futures market.