Bitcoin rises amidst Japanese yen crisis: ‘Nothing stops this train’

- Japan’s currency decline impacted Bitcoin and global finance dynamics.

- Interest in Bitcoin rises, spurred by investments and nation-state involvement.

The cryptocurrency landscape has seen its fair share of changes recently, but this time, there’s a particularly interesting development for Bitcoin [BTC].

In an unexpected turn, Japan’s currency is plummeting rapidly amidst reports of a new deal with the United States.

The deal aims to prevent Japan’s central bank from unloading U.S. treasuries to avoid a potential doom loop for both countries.

However, amidst these shifts, there is one question that becomes increasingly important to address-How will this arrangement impact liquidity absorbers such as Bitcoin?

Will Bitcoin be a savior?

Remarking on the same, Dante Cook, head of Swan Business, in a recent stream said,

“This spells disaster for Japan and the U.S. potentially.”

He added,

“As Japan is the largest holder of U.S. treasuries, only 4% of its forex reserves are in gold, the rest are almost exclusively in U.S. treasuries.”

Because of this imbalance, Cook argues that without intervention from the U.S. government through swap lines or backdoor liquidity, Japan may be forced to sell its reserves to support its currency.

He emphasizes that this potential sell-off could introduce uncertainty into the market, prompting a surge of liquidity into liquidity absorbers such as Bitcoin.

A shift in the Bitcoin trends

Additionally, with time and tide, seismic shifts have resulted in various positive impacts on the leading cryptocurrency. Cook added,

“I see this as just the beginning of another massive wall of liquidity entering the markets.”

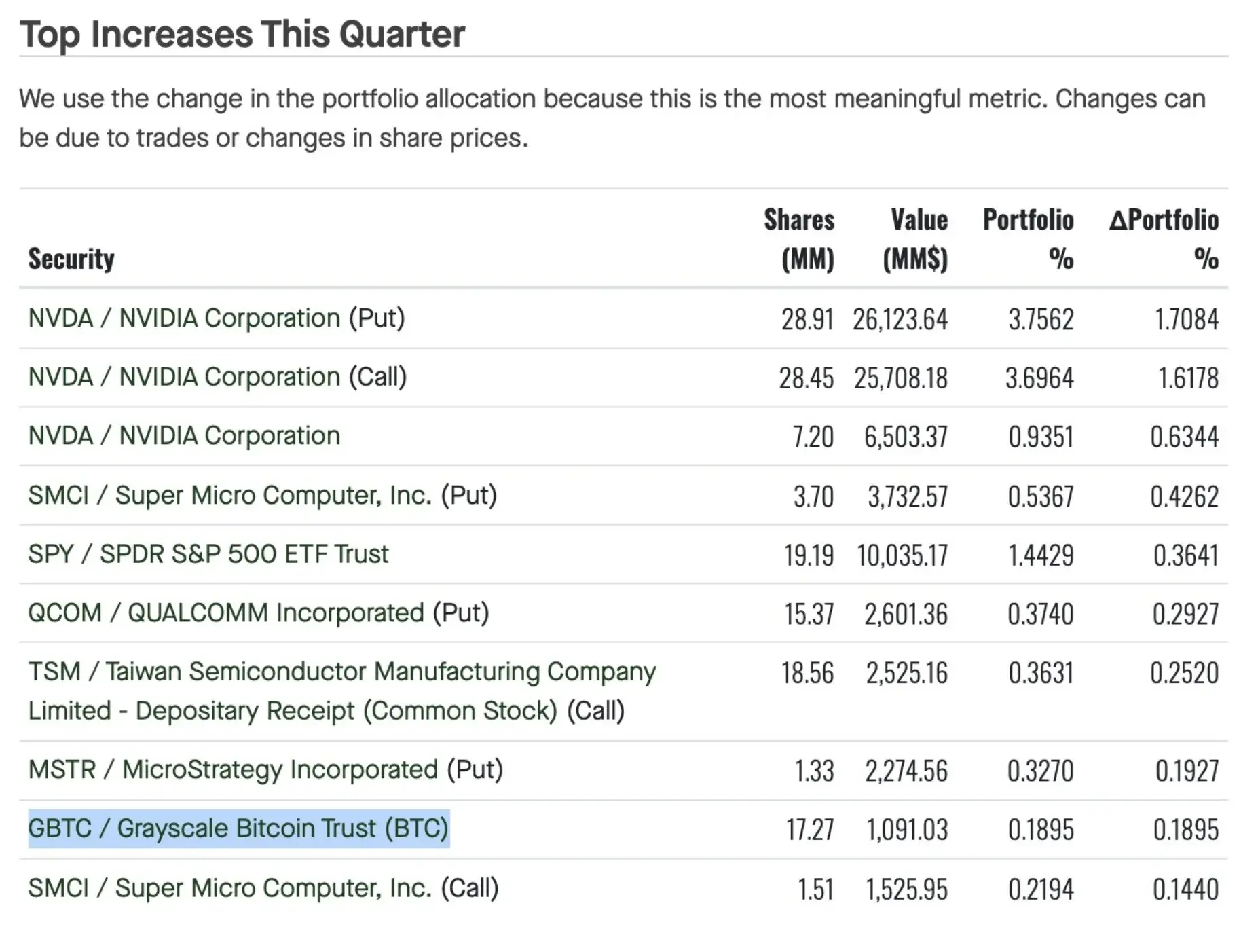

Supporting his argument, he highlighted a 13F-HR filing on the 7th of May, showing that Susquehanna International Group acquired over $1 billion worth of spot Bitcoin ETFs during Q1 of 2024.

Additionally, there are still various nation-states now recognizing Bitcoin’s potential and joining the fray. Cook continued,

“Argentina becomes the latest nation-state to get into Bitcoin mining as the game theory continues to play out before our eyes.”

Bitcoin’s bright future ahead

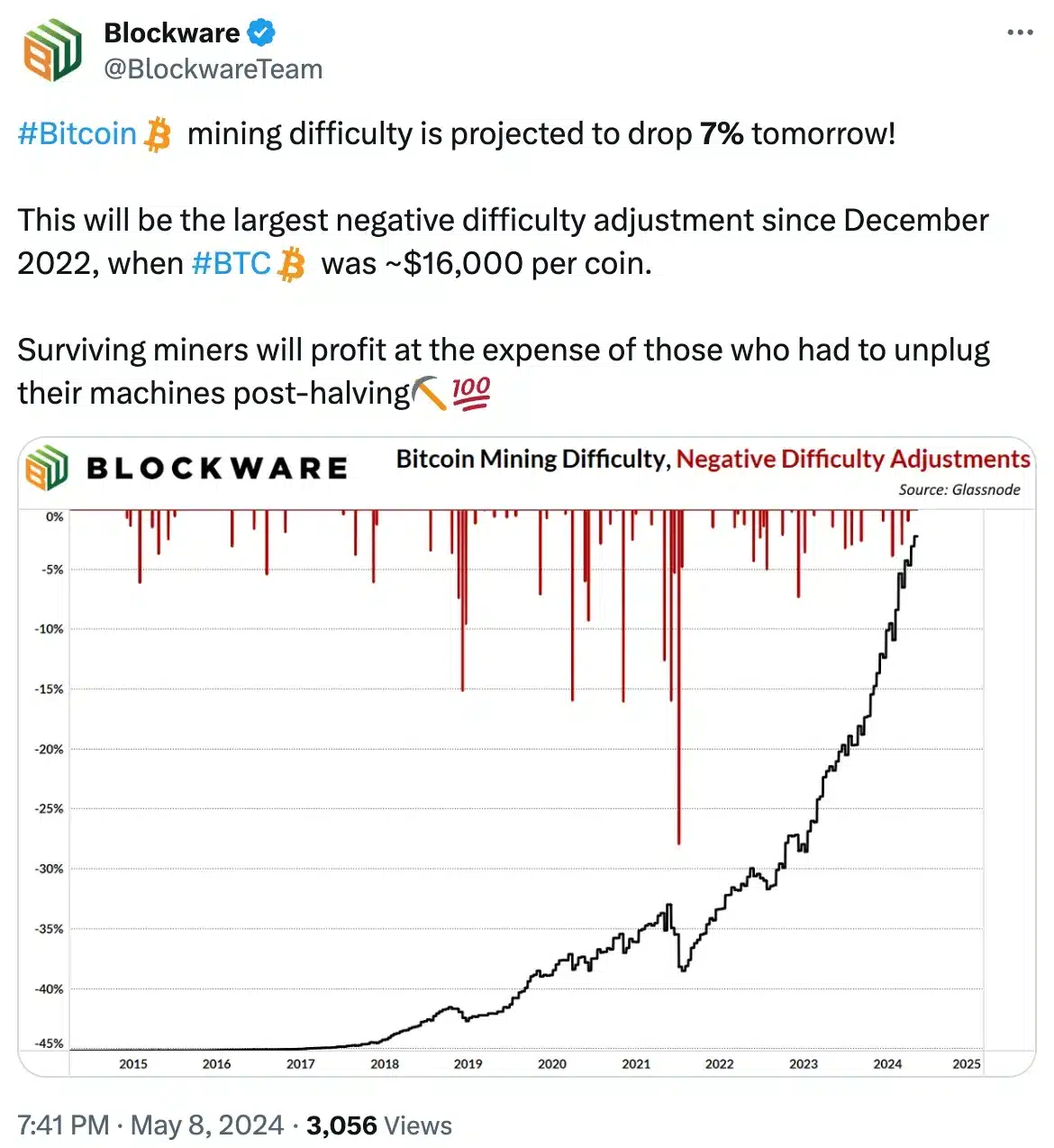

Blockware, a Bitcoin mining firm, noted that BTC’s difficulty is projected to decrease by 7% starting the 9th of May.

These instances highlight the growing acceptance of Bitcoin where traditional norms are being tested, and new paradigms are emerging. As claimed by Cook.

“Nothing stops this train.”