Bitcoin rises to $66K – Who benefits from BTC’s latest surge?

- More Bitcoin holders have remained in profit despite the recent decline.

- BTC was trading above $66,000 at press time.

Bitcoin’s [BTC] recent price movements have impacted different classes of holders, with some experiencing notable gains.

A study of the time BTC was held, the purchase price relative to the current price, and other factors showed which class of holders has had the most positive experience.

Bitcoin trades at over $66,000

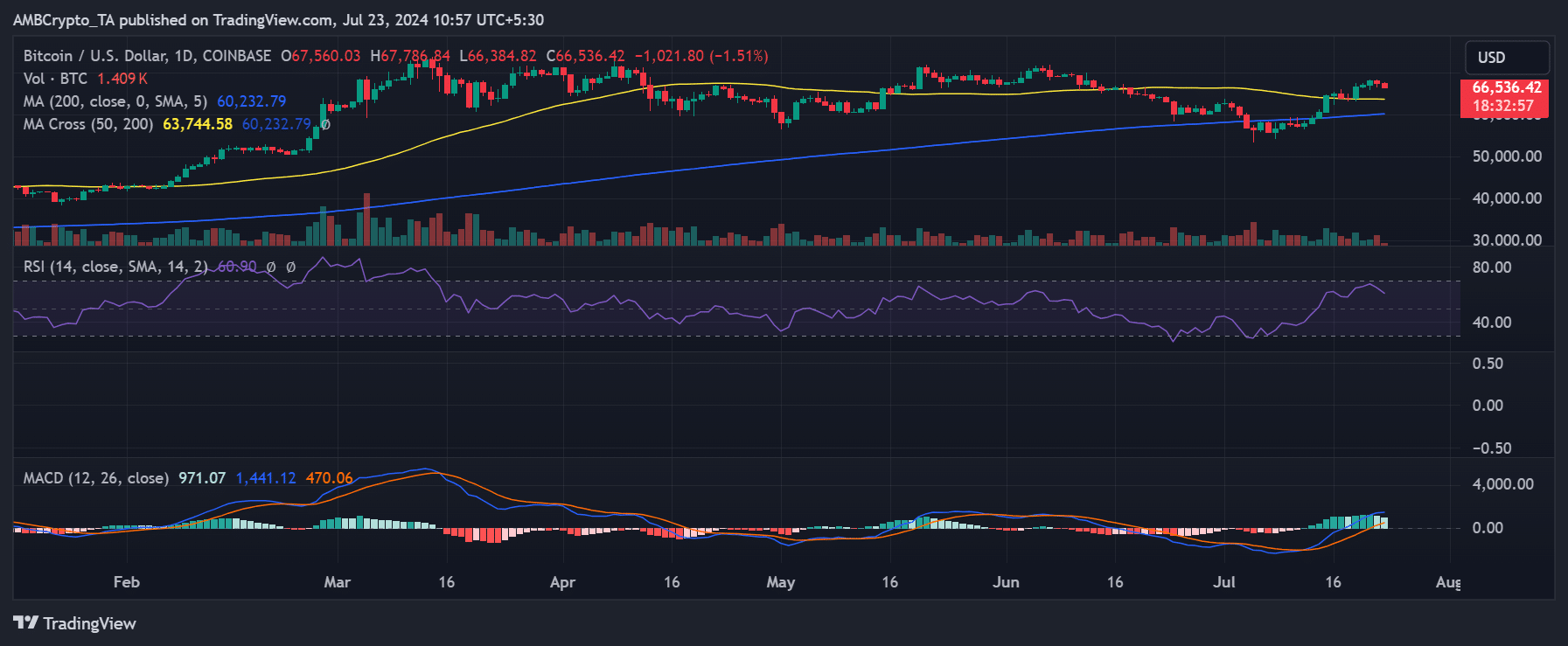

Bitcoin’s price trend analysis on a daily timeframe highlighted a series of recent uptrends that have allowed it to regain a significant price level.

According to an analysis by AMBCrypto, on the 21st of July, BTC’s price climbed to over $68,000, marking an increase of more than 1%.

This rise peaked after several days of upward movement, an important recovery considering the sharp drop it experienced at the beginning of the month.

Despite this positive momentum, some gains were subsequently lost, yet it has maintained its value above the $60,000 threshold. As of this writing, it was trading at around $66,500, with a slight decline of over 1%.

How the rise affected holders

The analysis of the Global In/Out of Money Index on IntoTheBlock provided a compelling overview of the current state of Bitcoin.

Most holders are in a profitable position at the press time BTC price. Specifically, nearly 49 million addresses, representing over 92% of all holders, were profitable.

This showed the overall market health and the gains most participants have experienced during past price increases.

Conversely, about 2.2 million addresses, accounting for approximately 4.14% of holders, faced losses, indicating that these holders may have purchased their assets at higher price levels.

Additionally, around 2 million addresses were at a break-even point, neither in profit nor loss, making up about 3.78% of all holders.

These statistics underscored a predominantly bullish sentiment in the Bitcoin market. The Relative Strength Index (RSI), around 60, further reinforced this sentiment.

An RSI value above 50 typically signaled bullish momentum, suggesting that the market might continue to see positive trends.

Long-term holders enjoying more profit

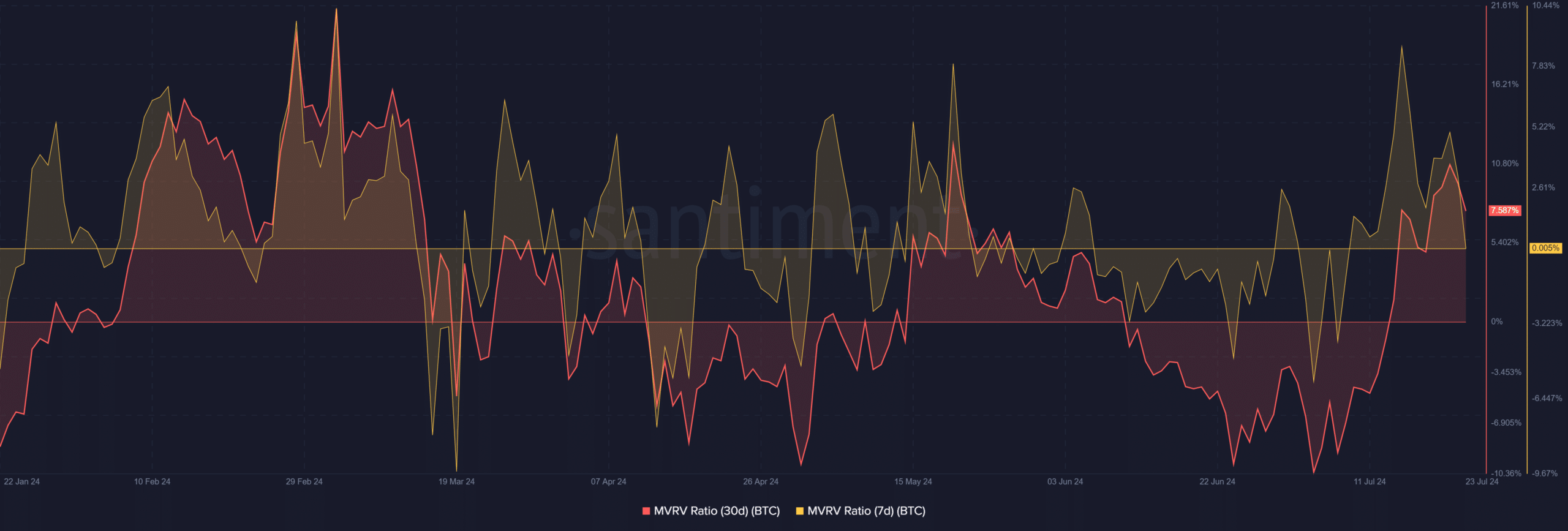

AMBCrypto’s look at Bitcoin’s Market Value to Realized Value (MVRV) ratios over different timeframes provided valuable insights into the performance of various classes of holders.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The seven-day MVRV was around 0.6%, indicating a marginal profit for recent buyers. However, this value was declining and signaled that the short-term gains for these recent purchasers were diminishing.

In contrast, the 30-day MVRV painted a more favorable picture for longer-term holders, standing at over 8%. Thus, those who purchased Bitcoin a month ago have accrued significantly higher profits than more recent buyers.