Bitcoin

Bitcoin: Rising spot ETF frenzy affects these areas

The fervor around spot ETFs leads to a noteworthy increase in people trying to increase their exposure to Bitcoin through indirect investments.

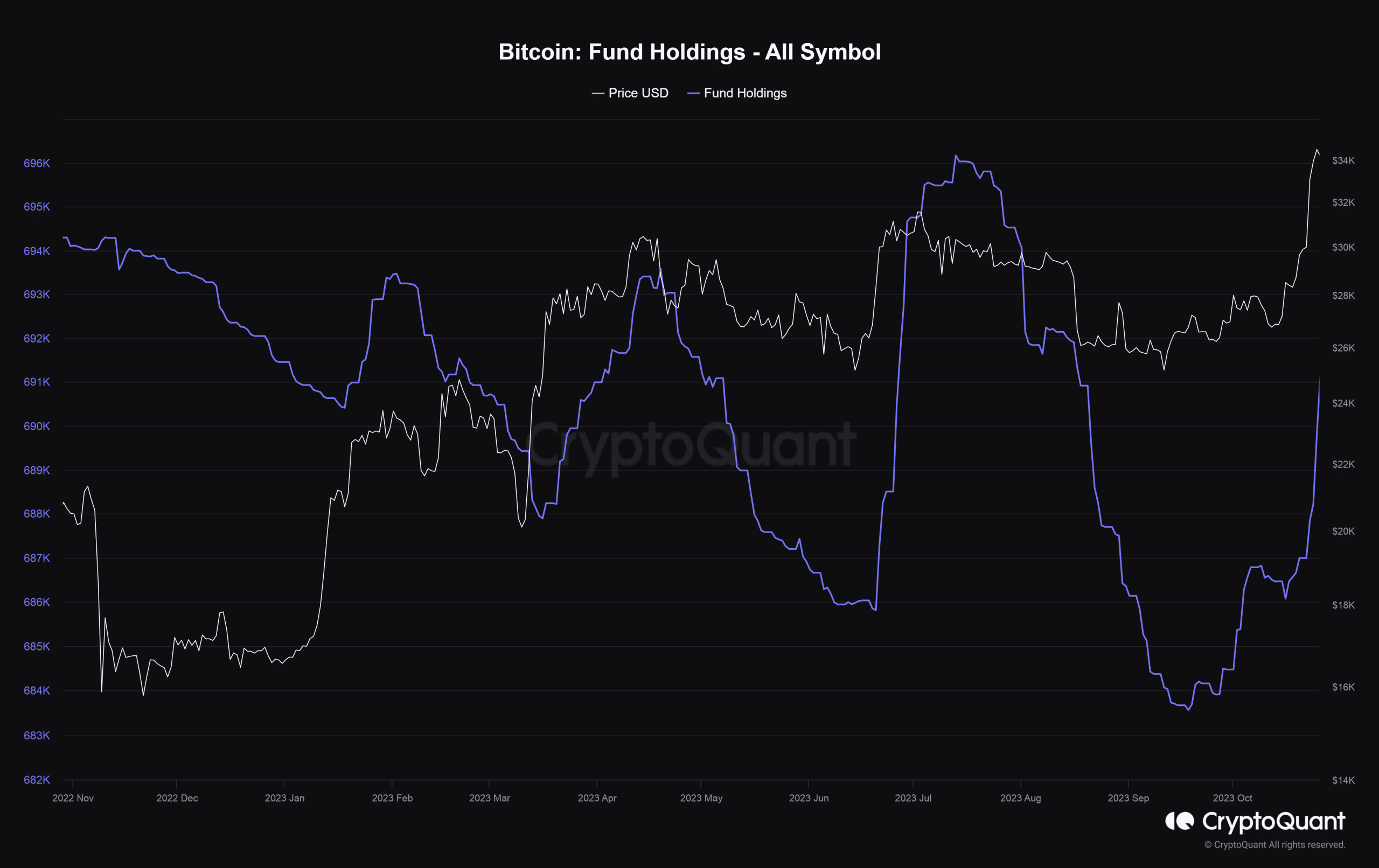

- Bitcoin’s Fund Holdings indicator spiked to its highest value in two months.

- Bitcoin’s Open Interest leaped to the highest level since April 2022.

Excitement around the potential approval of half-a-dozen odd spot Bitcoin [BTC] exchange-traded fund (ETF) applications started to reach a fever pitch.

How much are 1,10,100 BTCs worth today?

The king coin held on to its gains from last week’s fake news-induced rally, settling around the $34,000 levels at the time of publication, data from CoinMarketCap showed.

Indirect investments in Bitcoin jump

The fervor resulted in a noteworthy increase in people trying to increase their exposure to Bitcoin through indirect investments. According to on-chain analytics firm CryptoQuant

, Bitcoin’s Fund Holdings indicator spiked to its highest value in two months.For the uninitiated, Fund Holdings tracks the total amount of coins held by indirect investment vehicles such as trusts, funds, and ETFs.

Unlike direct investments, which investors own themselves, indirect investments pool investor money to buy and sell assets. As a result, even if the investor does not have direct exposure to the asset, they buy in shares that normally respond to the underlying asset’s value.

As evident in the graph above, the index soared in June when world’s largest asset manager BlackRock applied for a spot Bitcoin ETF for its American clients.

However, subsequent delays in approval by the U.S. Securities and Exchange Commission (SEC) started to dampen investors’ spirits, causing the index to dip sharply.

However, the developments of last week led to a dramatic shift in sentiment. The total number of Bitcoin in such investment vehicles jumped to 691k from 683.5k.

CryptoQuant also noted that the market’s next directions would heavily depend on SEC’s decision on the pending spot ETF applications.

Bitcoin sees jump in OI, but…

The heightened optimism spread to the derivatives market as well. As per Coinglass, Open Interest (OI) in Bitcoin futures leaped to $15.61 billion as of press time, the highest since the bear market roiled the markets in May 2022.

Is your portfolio green? Check out the BTC Profit Calculator

OI has been on a steady uptrend over the last 10 days, complimenting a rise in Bitcoin’s market value. Scenarios like these are indicative of new money entering the market.

Surprisingly, the number of short positions opened for Bitcoin trumped longs in the last few hours of trading. The Longs/Shorts Ratio was well below 1 at the time of writing.