Bitcoin sees rebound, but are bulls ready to push BTC past $70K?

- Bitcoin has rebounded 8.9%, approaching a critical $70K resistance level, with analysts predicting a potential breakout.

- Key metrics like open interest volume and NVT ratio suggest strong market interest and potential for further gains.

Bitcoin [BTC] is gradually recovering after experiencing a significant drop to the $50,000 level earlier this month on 5th August. Currently, the leading cryptocurrency is trading at $63,742, marking an 8.9% increase over the past week.

This price movement has sparked discussions among crypto analysts about the potential direction of Bitcoin in the coming weeks. One such analyst, Mags, recently shared his insights on X, discussing the current price action of Bitcoin.

Breakout above $70,000 near?

Mags highlighted that Bitcoin’s current sideways movement should not necessarily be viewed as bearish. He pointed out that before each major move, Bitcoin typically undergoes a period of consolidation within a specific range.

Historically, these consolidation phases have lasted between 8 to 30 weeks.

As of now, Bitcoin is 25 weeks into its current consolidation phase. While it is difficult to predict the exact duration of this phase, Mags emphasized that Bitcoin remains in a bull market.

If this pattern holds, he suggested that the eventual breakout could be significant.

As Bitcoin approaches the critical $70,000 resistance level, other analysts are also weighing in on the potential for a breakout.

Captain Faibik, another well-known crypto analyst on X, noted that while Bitcoin bulls appear to be in control, the true test lies ahead.

He speculated that Bitcoin might retest the $70,000 resistance this week but questioned whether the bulls would have the strength to break through this key level.

Fundamental indicators: What they signal for Bitcoin’s future

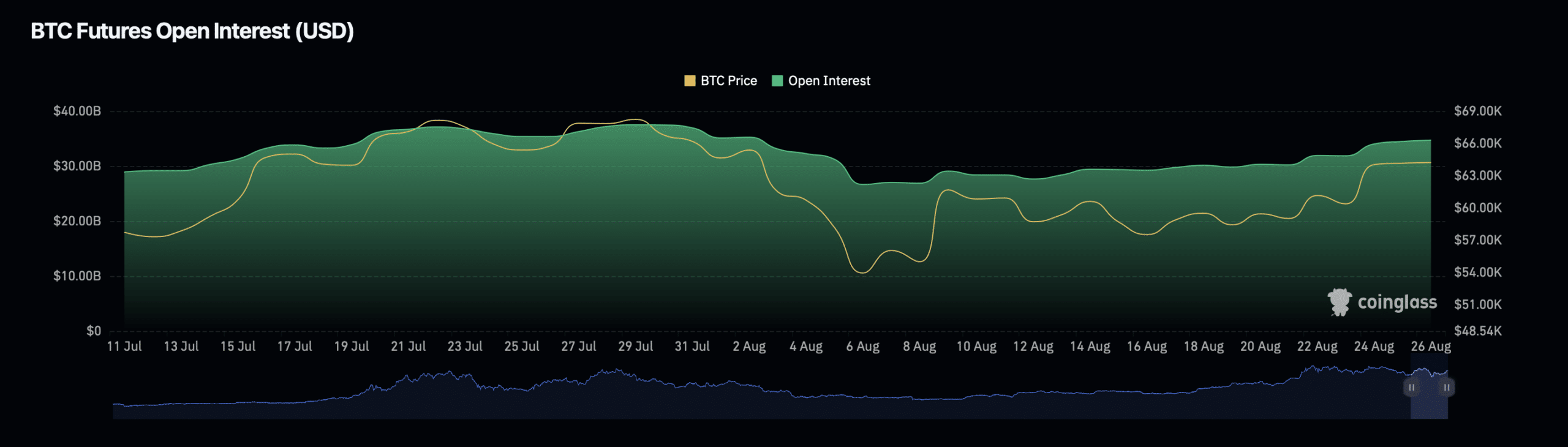

To understand Bitcoin’s potential for a sustained surge, it’s worth examining the asset’s underlying fundamentals. According to data from Coinglass, Bitcoin’s open interest has seen a slight decline of 1% over the past day, bringing the current valuation to $34.39 billion.

Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled.

A decline in open interest could indicate a reduction in market activity or a shift in trader sentiment.

However, despite this decline, Bitcoin’s open interest volume, which measures the total value of these contracts, has increased by 1.84% over the same period, reaching $39.06 billion.

This increase suggests that while the number of contracts has decreased, the value of the remaining contracts has risen, potentially indicating increased confidence among traders about Bitcoin’s near-term prospects.

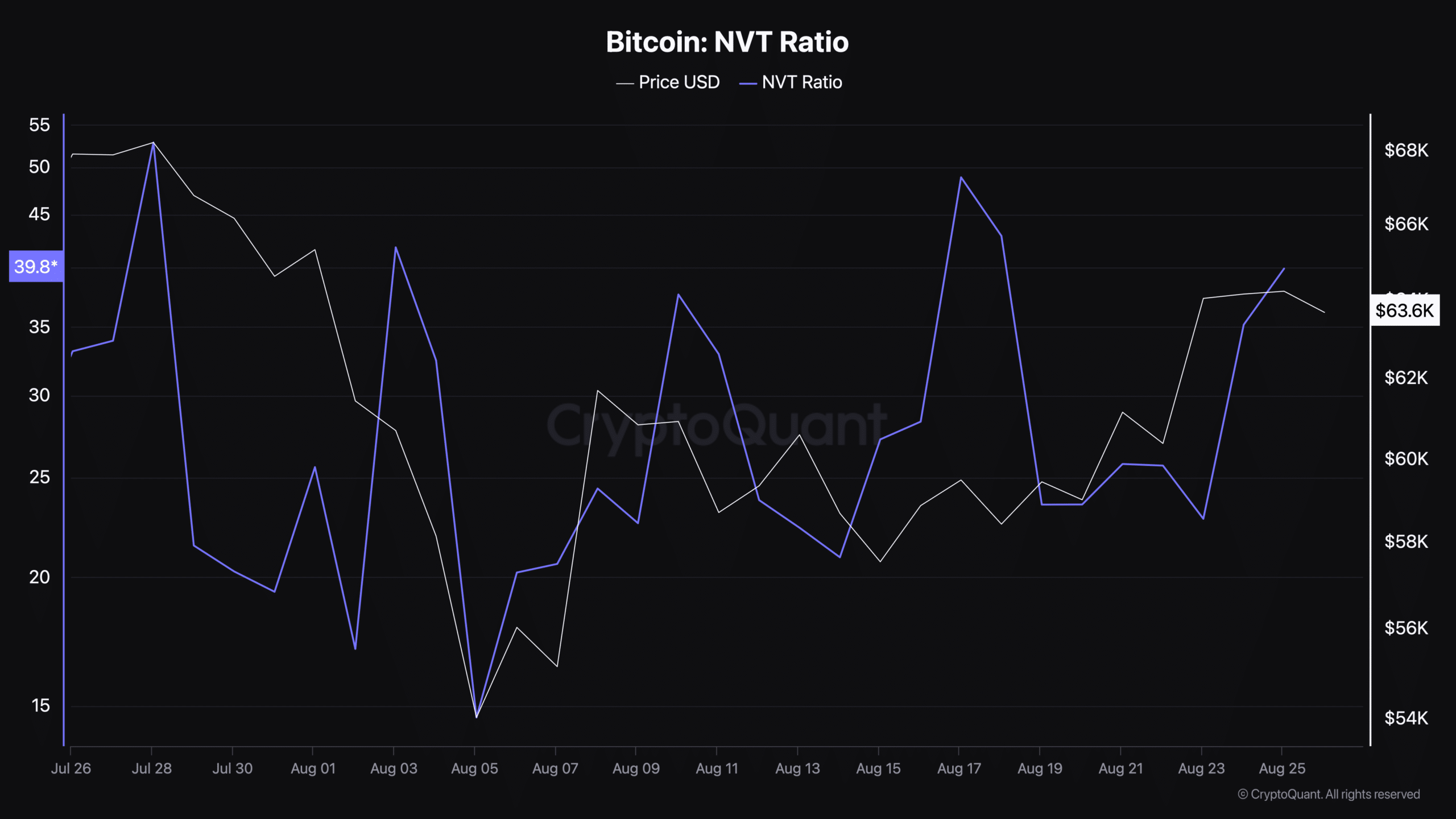

Another key metric to consider is Bitcoin’s Network Value to Transactions (NVT) ratio, which is currently on the rise, sitting at 39.8 according to data from CryptoQuant.

The NVT ratio is a valuation metric that compares Bitcoin’s market capitalization to the volume of transactions on its network.

A higher NVT ratio can indicate that Bitcoin is overvalued relative to its transaction volume, potentially signaling caution.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, it can also suggest that the market is expecting future growth in transaction volume, which would justify the current valuation.

In Bitcoin’s case, the rising NVT ratio could imply that investors are anticipating continued price appreciation, supported by the broader market trend.