Bitcoin sentiment declines, but it’s a good sign for BTC’s prices

- Sentiment across social media platforms for Bitcoin declined significantly over the past few days.

- ETF inflows for BTC surged despite the negative sentiment.

Bitcoin’s [BTC] recent decline in price has impacted several cryptocurrencies across the board, as the overall market outlook has turned negative.

Sentiment gets bearish

According to Santiment’s data, this week, Bitcoin sentiment across social media platforms like X (formerly Twitter), Reddit, Telegram, 4Chan, and BitcoinTalk has plunged to its most bearish point in a year.

Traders were expressing extreme fear, uncertainty, and doubt (FUD) at an unprecedented level. This negativity could actually signal a buying opportunity.

Historically, when the crowd gets this bearish, it can create a chance for a sharp rebound that catches the majority off guard.

So, while the FUD might be deafening, it could also be a sign that a price swing is on the horizon.

Inflows on the rise

Bitcoin spot ETFs witnessed their highest daily net inflow in over three weeks on the 8th of July. The total inflow reached $295 million, indicating strong investor appetite for Bitcoin despite the recent price slump.

This positive sentiment came even as the German government sold a record-breaking amount of BTCs yesterday, amounting to $915.3 million.

Breaking down the ETF inflows, Grayscale’s GBTC attracted $25.08 million, while BlackRock’s IBIT saw a significantly larger inflow of $187 million. Fidelity’s FBTC also recorded a healthy inflow of $61.54 million.

These figures suggest that investors are increasingly turning to spot ETFs as a convenient and regulated way to gain exposure to Bitcoin.

The $295 million net inflow represents new capital entering the Bitcoin market through ETFs. This increased demand could push the price of BTC upwards, especially if it’s sustained over time.

It also indicates that despite declining sentiment across social media, institutions and fiat investors are bullish about BTC’s future.

How are holders doing?

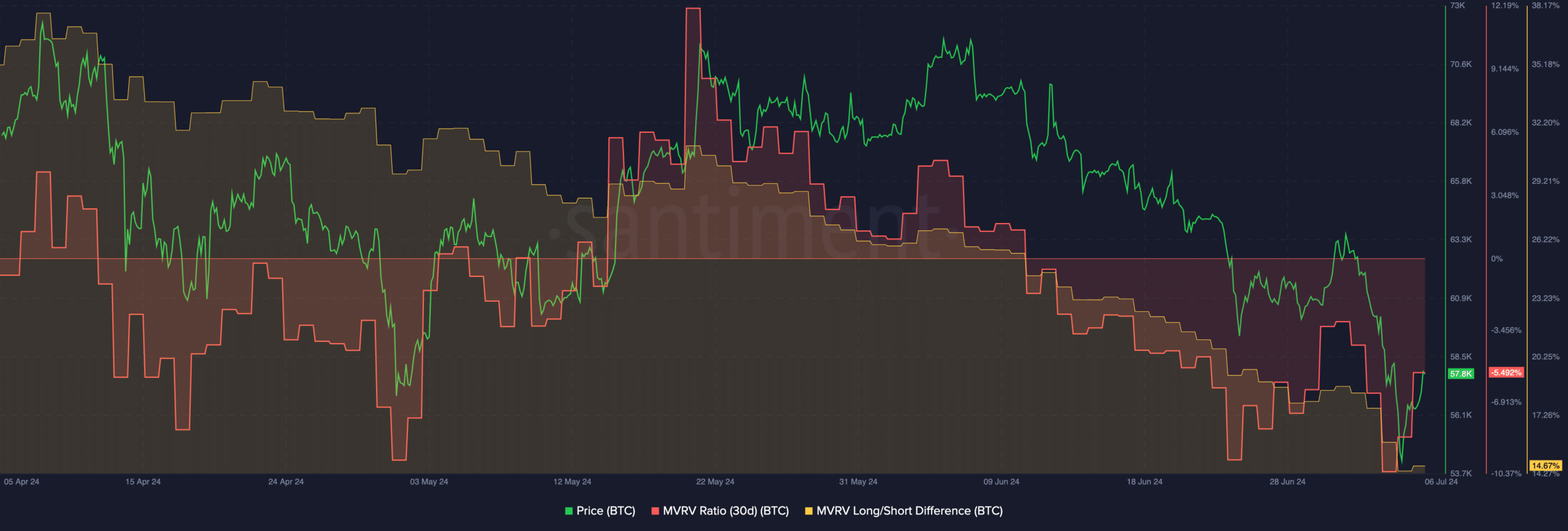

At press time, BTC was trading at $57,404.26. In the last 24 hours, the price of BTC grew by 3.87%. Also, the MVRV ratio for BTC fell significantly in the last few days despite the recent surge in price.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This indicated that the profitability of the addresses had declined, and most addresses would not profit if they sold their holdings.

Even though this can impact sentiment negatively, it also gives less of an incentive for BTC addresses to sell their holdings, which results in reduced selling pressure on the network.