Bitcoin: Should investors dance to the ‘load your bags’ rhythm

Bitcoin [BTC] has returned to its undervalued region. That was the position made by CryptoQuant, the on-chain data platform. But how exactly is BTC in an underappreciated zone when its price has remained above $20,000?

Although the overall weekly performance has not been impressive, BTC has held to its consolidation between $20,900 and $21,800. These levels were the points BTC had been moving around for the past few days.

At the time of this writing, one BTC was worth $21,412.38—a 6.12% decrease from seven days ago. Back to its valuation position, the suggestions of the CryptoQuant analysis also indicated that BTC’s bottom could be in or around the corner.

Fill up season yet?

Based on the report, CryptoQuant noted that the 365-day Market Value to Realized Value (MVRV) of Bitcoin was below one.

A look at the data at press time revealed that the value was around 0.9956. The chart showed that the average BTC holder within the said period was currently at a loss, indicating that it could soon be time for an uptick.

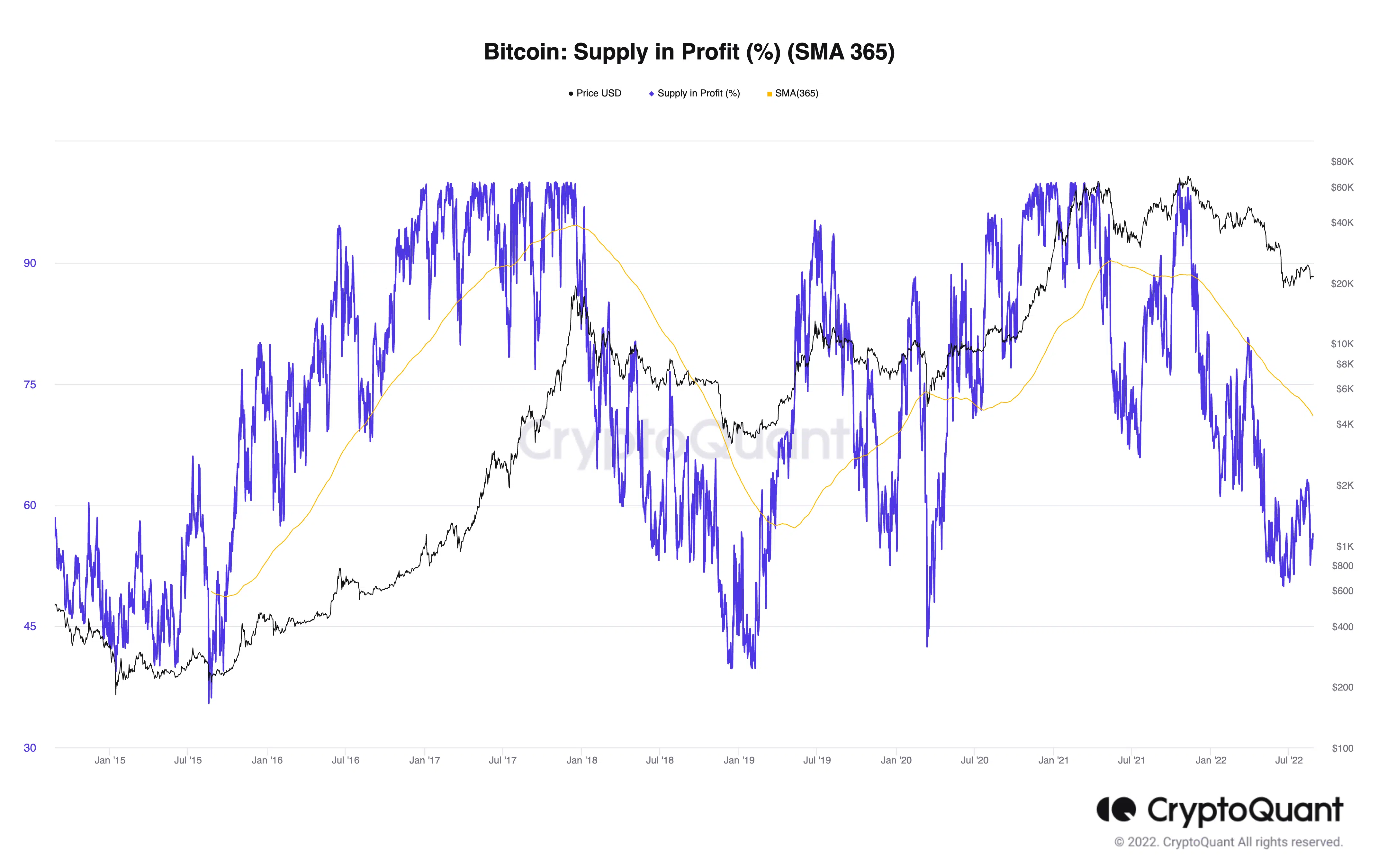

However, it could be too soon to judge from just one metric. The analysis also considered other metrics, including the BTC long-term holder spending within the same period. Additionally, CryptoQuant included the supply in profit percentage.

While assessing the data, it was revealed that BTC’s total supply in profit fell rapidly over the week, with its value at 56.43%. As for the long-term holder spend, it was 0.5774, representing a 44% forfeiture.

With the decline of these metrics, CryptoQuant concluded that it could be time to accumulate. This position may, however, not be surprising.

Earlier, it was reported that there was high institutional demand and BTC whales were in the “fill up my bag” mood. Still, it may be better for retail investors to remain cautious at this point.

Hold on and watch

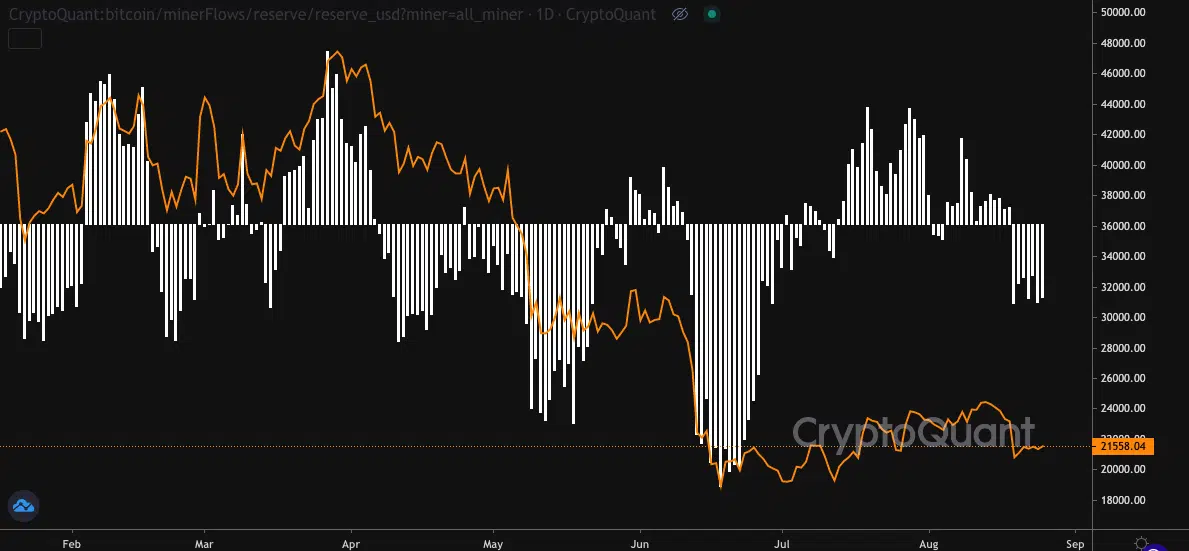

The reasons for adopting a careful approach were identified by an individual analyst active on the CryptoQuant platform—BaroVirtual. According to him, Bitcoin miners’ activity usually affects the price of BTC.

Hence, their current stance may not indicate a bottom already hit or close by.

Historical data showed that a decline in the miner balance or reserves led to a drop in the BTC price.

Furthermore, data from the platform showed that this was the current situation since 8 August, and the initial talks of an uptick soon could be nullified.

The stance of BaroVirtual may also have been confirmed by the position of the Relative Strength Index (RSI). At the time of this writing, the RSI value was 39.94.

Despite the contracting views, the BTC’s next movement may depend on several underlying factors. As such, a rushed decision may not be the best.