Bitcoin – Should you panic as key metric nears ‘negative zone?’

- Bitcoin’s 1-year percentage change is nearing the negative zone

- Previous dips have led to downturns, but 2020’s example suggests there might be hope for recovery

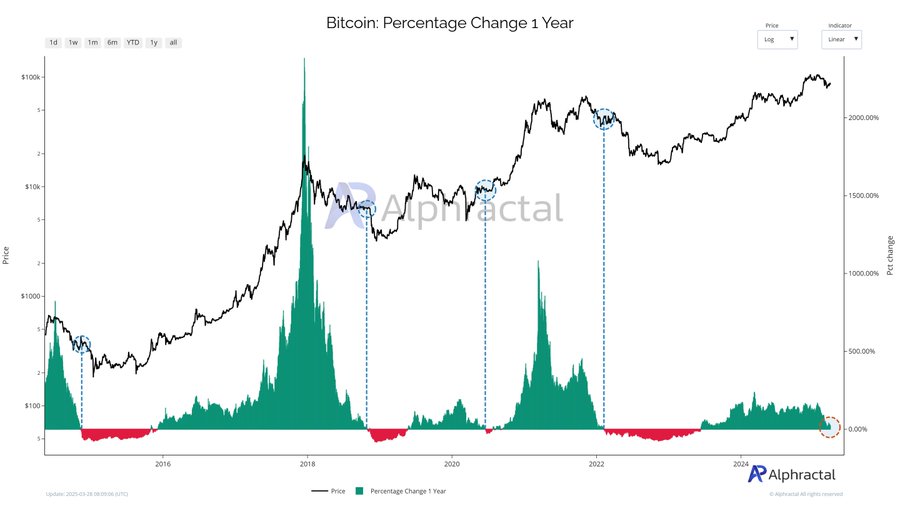

Bitcoin’s [BTC] 1-year percentage change is approaching the negative zone – A signal that has historically been associated with bearish market trends. While three out of the last four instances of such a dip led to declines, there’s a chance that this time might mirror 2020’s market behavior. Back then, the negative shift was part of a broader consolidation phase.

If this downward trend continues, it could signal the potential for new lows in the near future.

1-Year percentage change – Significance of the negative zone

The 1-year percentage change of Bitcoin tracks its price difference over a rolling 12-month period, serving as a key indicator of market sentiment. When this metric enters the negative zone, it shows that Bitcoin’s price is lower than it was a year ago.

Historically, this has been linked to bearish momentum, signaling waning buying interest or a hike in selling pressure. In fact, out of the last four instances, three led to sustained downturns, while one had minimal impact.

Now, while the negative zone hinted at reduced volatility and lower risk, it doesn’t always guarantee further losses. External factors also play a role.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)