Bitcoin slides below $66k: Here’s what whales are up to

- Crypto whales accumulated 5,900 BTC worth $397 million from CEXs amid the price drop.

- BTC’s trading volume surged by 65%, signaling higher participation from traders and investors.

On 29th July, the United States government moved $2 billion worth of Bitcoin [BTC] to new wallets. This notable move gained massive attention from crypto enthusiasts and badly impacted the overall market.

Following this incident, BTC was trading near the $66,520 level and experienced a 4.6% price drop in the last 24 hours. Amid this price drop, participation from investors and traders surged by 65%, signaling potential “buy the dip” activity.

Whales scoop up 5,900 Bitcoin

Additionally, whales and institutions took this price drop as an opportunity and accumulated a significant amount of BTC.

On 30th July, an on-chain analytic firm spotonchain made a post on X (previously Twitter) stating that four whales have added a notable 5,900 BTC worth $397 million from Centralized Exchanges (CEXs) in the last 24 hours.

As per the spotonchain report, the whale address “12QVs” withdrew a massive 4,500 BTC worth $303 million from Binance at an average of $67,298. Out of this, 3,500 BTC worth $233 million were withdrawn just after the BTC price plunged.

Meanwhile, the other three whales, which are likely to be one entity, withdrew 1,400 BTC worth $94 million from Bitfinex at an average of $67,185.

Additionally, since 12th June, they have withdrawn a massive 3,910 BTC an an average of $65,764, and now hold an unrealized profit of over $4.59 million.

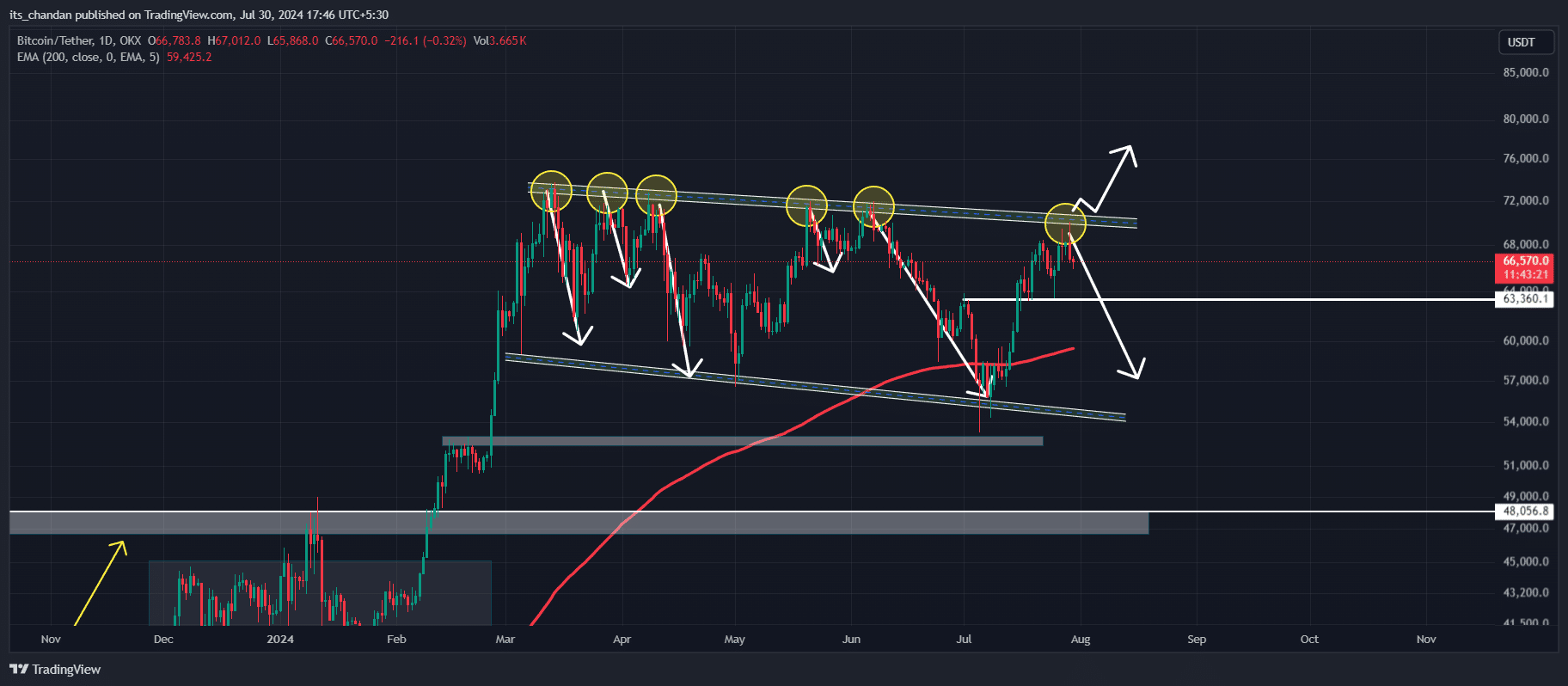

Bitcoin technical analysis and upcoming levels

According to expert technical analysis, BTC is moving in a downside channel pattern and is currently experiencing resistance from the top.

Historically, whenever BTC reaches this level, it experiences a massive price fall. Since March 2024, BTC has reached the top of this channel pattern five times, and each time it experienced a price reversal.

If the sentiment remains the same, there is a high chance BTC could fall to the $63,350 level and even lower.

However, to experience upside momentum, it will be necessary for BTC to give a breakout of this downside channel pattern and a strong daily candle closing above the $71,800 mark.

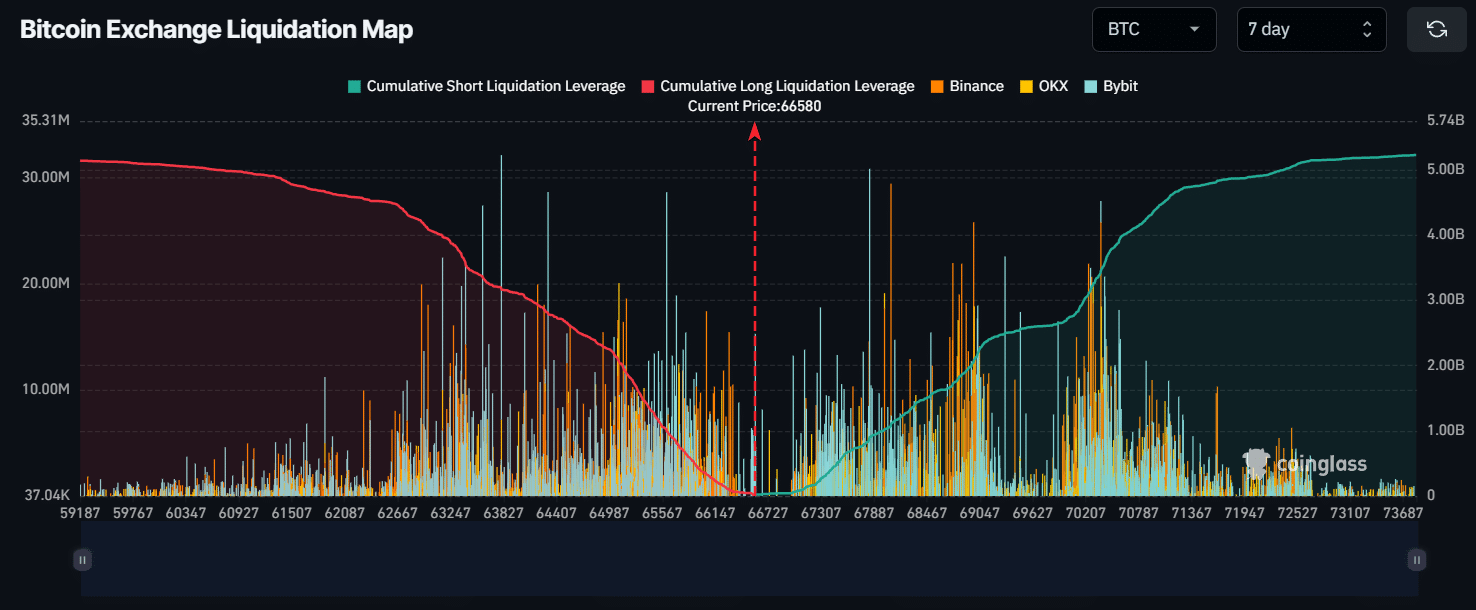

BTC’s major liquidation level

In the last seven days, two major liquidation levels were observed near the $70,330 level on the higher side and $63,800 on the lower side.

If history repeats and the BTC price falls to the $63,800 level, nearly $3.20 billion worth of long positions will be liquidated.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Conversely, if BTC’s price experiences an upside move and hits the $71,800 mark, nearly $3.3 billion short positions will be liquidated.

Along with this bearish outlook, BTC futures Open Interest (OI) experienced a fall of 6% in the last 24 hours. This decline in OI suggests lower interest from traders and investors.