Bitcoin slips out of bull market again: Will rate cuts spark another rally?

- Will the anticipated rate cuts by FED on 18th September spark another BTC rally?

- Major financial players further institutional investments in Bitcoin.

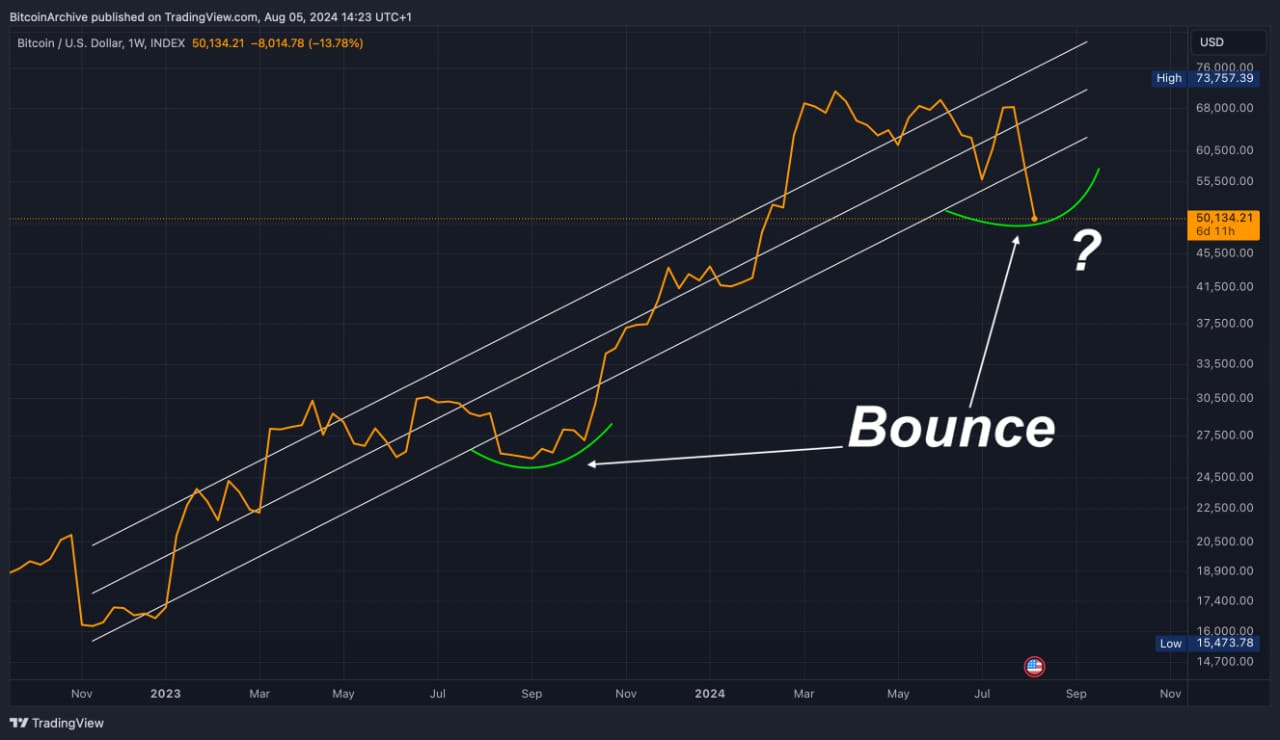

Technical analysis of the Bitcoin [BTC] chart on TradingView showed that the asset has fallen out of the bull market again this year, signaling an entry point for investors.

This mirrors the pattern from 2023 that led to a new all-time high in 2024. Previously, Bitcoin rebounded sharply with the news of Bitcoin ETFs set for approval in January.

Now, with calls for a 1.5% rate cut, there is speculation about whether this will trigger a similar recovery back into the bull market channel.

Investors are watching closely to see if the rate cut will provide the same boost as the ETF news did last time.

Capula and Semler Scientific add more BTC

Capula, Europe’s fourth-largest hedge fund, has invested $500 million in BTC using BlackRock and Fidelity ETFs.

Additionally, Semler Scientific recently invested $6 million in BTC and plans to raise $150 million to buy more. Since adopting a Bitcoin treasury strategy in late May 2024, Semler has bought 929 bitcoins, totaling $63 million.

These investments by major financial players suggest increasing acceptance of Bitcoin in the financial sector and may inspire further institutional investments leading to BTC price rally.

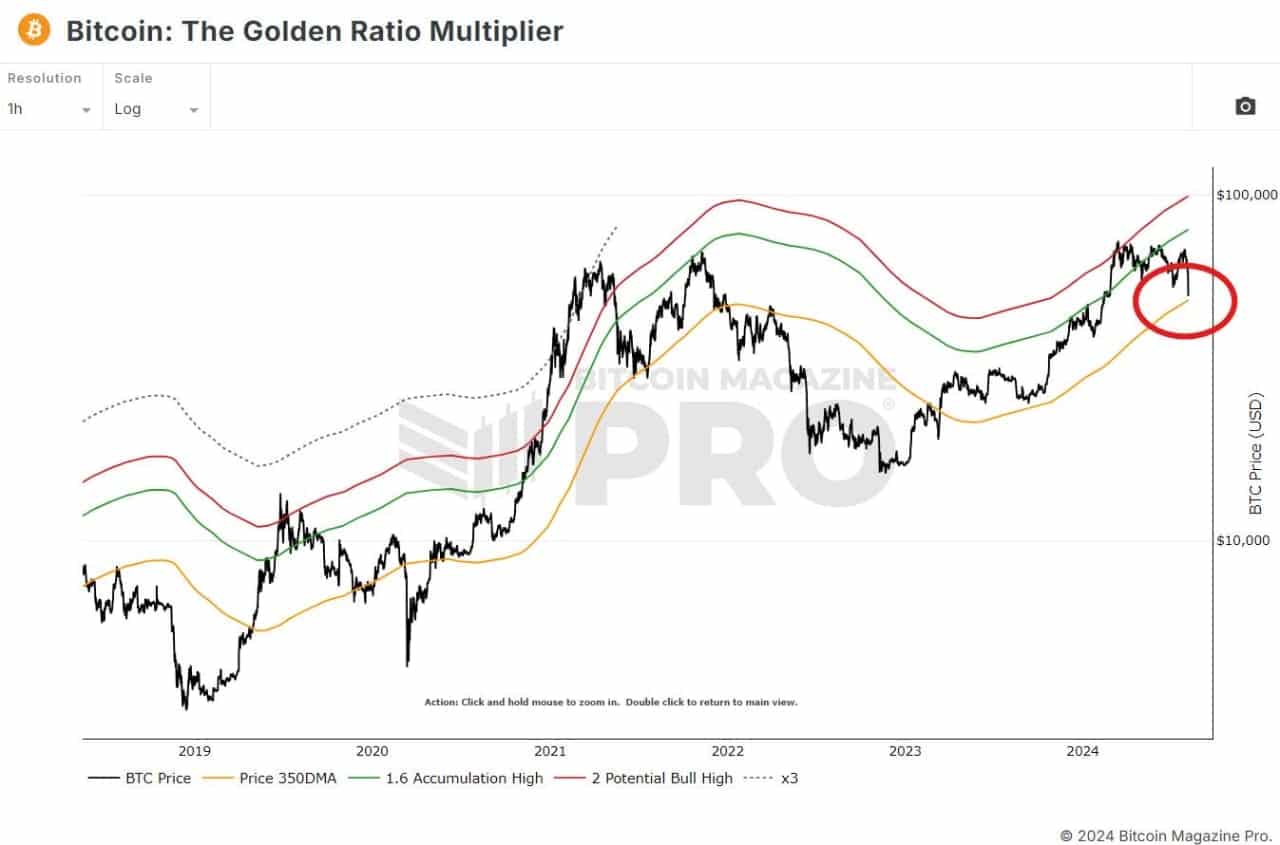

Will BTC secure the 350DMA support?

Bitcoin’s price was hovering around the 350-day moving average, according to the Golden Ratio Multiplier. This long-term projection tool coupled with expected rate cuts suggests that Bitcoin’s price is about to rise.

The 350DMA serves as support when the asset is trending upward. Considering this and the other factors, the recent crypto crash could be an excellent opportunity to buy before Bitcoin rallies.

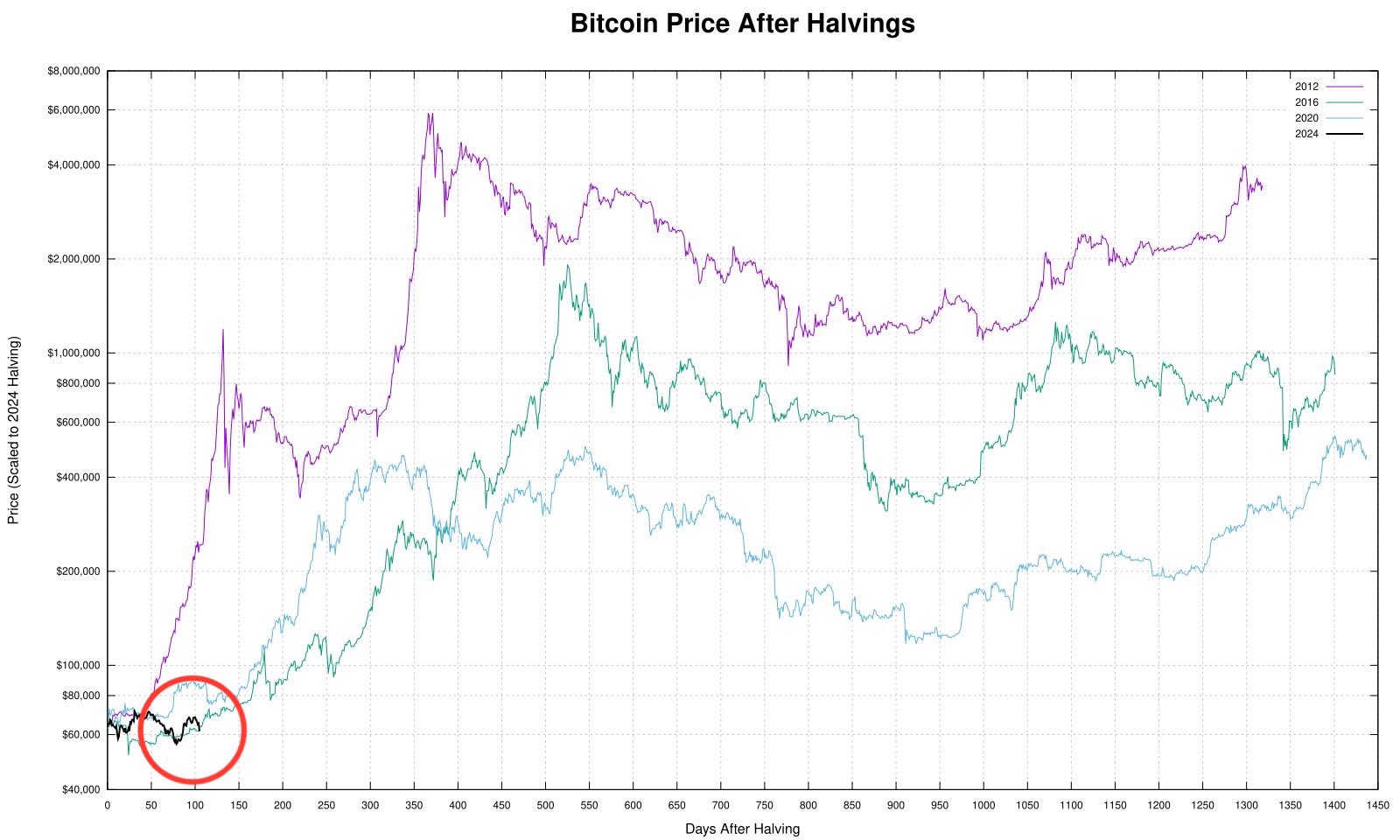

Bitcoin typically experiences a correction or consolidation period for several weeks after a halving event before it starts to rise.

Is your portfolio green? Check the Bitcoin Profit Calculator

Currently, it has hit its lowest point in this cycle, and many expect it to rally in the third quarter of 2024, following replication of patterns seen in 2012, 2016, and 2020.

X user and market analyst Quinten noted despite current concerns, BTC is following its usual cycle behavior.