Bitcoin

Bitcoin soars, but what’s causing a shadow on the breakout?

The huge demand from large investors, combined with reduced selling pressure, could see Bitcoin surge again.

- Bitcoin saw a positive reaction on the price charts, but social metrics underlined weakness.

- The high demand for Bitcoin in May could propel prices past the ATH soon.

Bitcoin [BTC] saw an interesting week in terms of price action. It had a lively breakout past the local range high at $67k on the 20th of May.

On the 23rd and the 24th of May, Bitcoin retested the $66.3k-$66.6k zone as support and bounced higher to trade at $69.1k at press time.

More gains are likely to follow as demand for the king of crypto continues to grow.

The CEO of the blockchain-based payments’ app Strike, Jack Mallers, asserted that “Bitcoin is the best thing you can own” in a conversation with Antony Pompliano.

The social metrics and on-chain activity were weakening

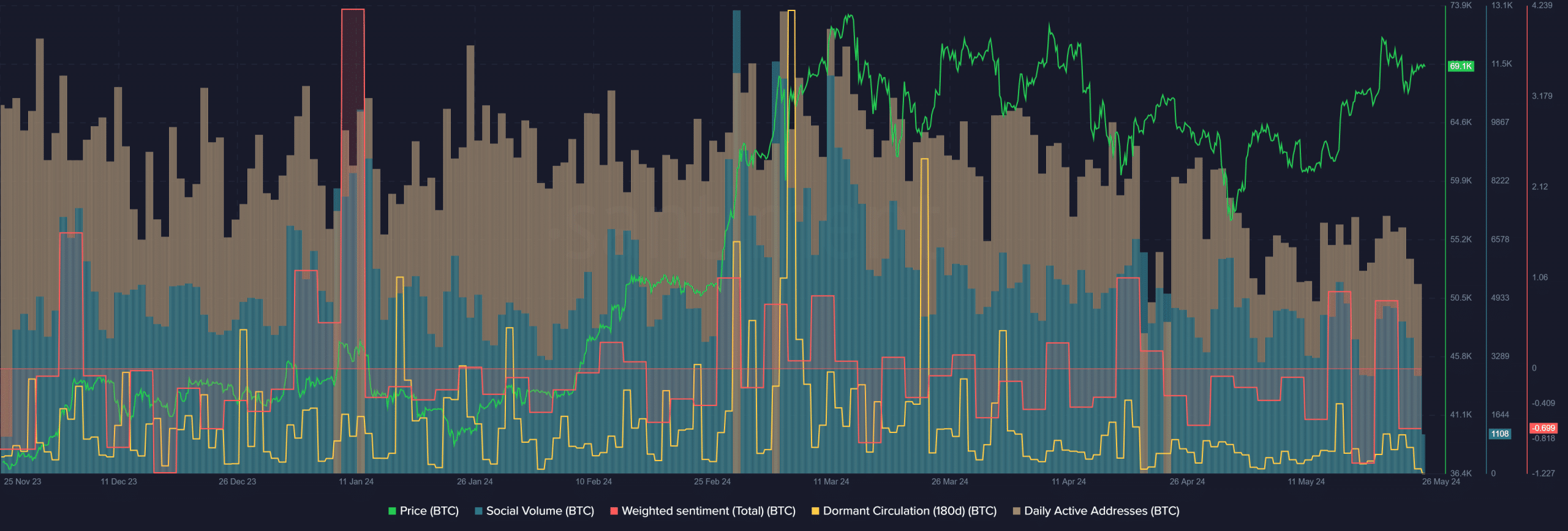

Source: Santiment

The Social Volume behind Bitcoin has slowly slid lower since the 11th of March. The Weighted Sentiment was negative throughout May, with two positive surges since mid-May.

Together, they pointed toward reduced social media engagement.

The daily activity also trended lower since mid-March. On the other hand, the dormant circulation last saw noticeably large spikes on the 18th of April and the 15th of May.

However, their size did not rival the ones in March or late February.

This revealed that the on-chain movement of dormant Bitcoin was absent recently, which suggested a large wave of selling was not yet upon us. This was a good sign as it underlines lowered selling pressure.

Is the demand for Bitcoin higher than ever before?

Source: AxelAdlerJr on X

In a post on X (formerly Twitter) crypto analyst Axel Adler showed that the demand was red-hot. This conclusion was made based on the entity-adjusted transaction count.

Based on the chart’s readings, the demand was close to the levels of the 2016 rally.

Read Bitcoin’s [BTC] price prediction 2024-25

He also added that the price of Bitcoin back then was $300, compared to $69.1k now. Hence, the capital involved is vastly greater than eight years ago.

This demand from retail and institutional investors, combined with a reduced selling pressure from the dormant circulation metric, indicated that Bitcoin is very likely to break out past the $71.4k region once again.