Bitcoin spot ETFs – Not the catalyst most thought it would be in 2024?

- Grayscale’s Bitcoin ETF recorded a negative outflow of over $43M, triggering outflows for the other products

- However, Bitcoin’s market wasn’t particularly affected by it

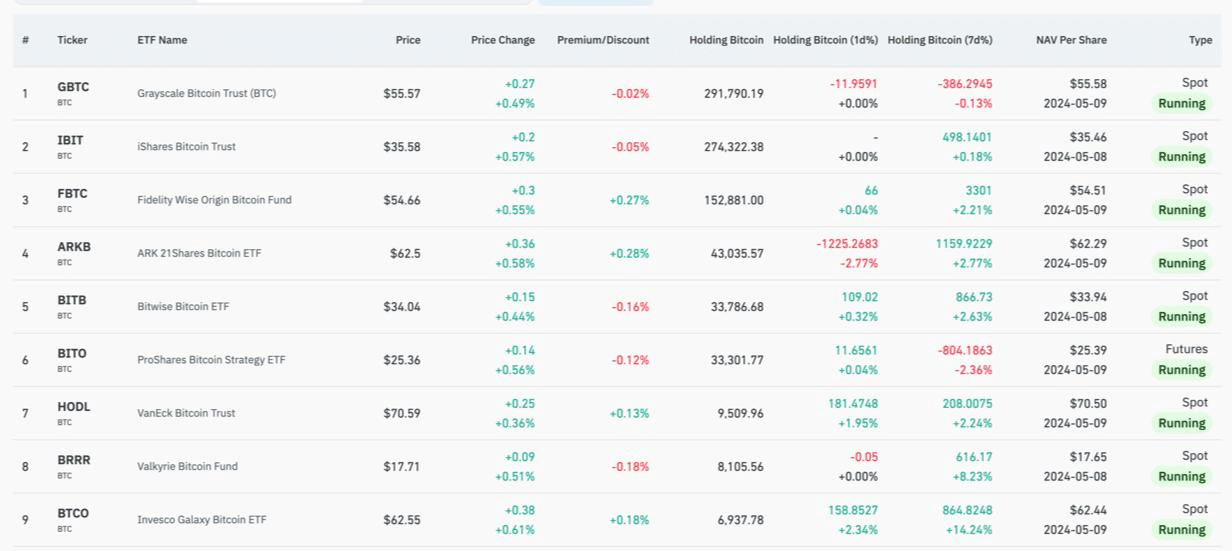

It has been a slow month for U.S. spot Bitcoin ETFs, once lauded as the big catalyst for a 2024 bull run that might see Bitcoin climbing to as high as $100,000. In fact, just yesterday, the products saw about $11.3 million in outflows, triggered by Grayscale.

Change in investor sentiment?

Data from Coinglass revealed an unsettling trend for Grayscale’s GBTC, which continued to bleed with $43.4 million fleeing the fund. Despite this exodus, GBTC had a brief moment of respite last Friday, with a surprising $60 million pouring in, hinting at its still potent market presence.

Conversely, optimism seemed to sparkle for BlackRock’s IBIT Bitcoin ETF, which welcomed an impressive $14.2 million. This rebound paints a picture of growing investor trust in this particular Bitcoin ETF. Fidelity’s Wise Bitcoin ETF wasn’t left behind either, enjoying a $2.7 million boost.

Bitwise’s BITB ETF also caught the investor’s eye, pulling in $6.8 million and standing out as Thursday’s favorite with $11.5 million in inflows, while its peers lagged behind. Meanwhile, Ark 21shares (ARKB) ETF caught a $4.4 million wave of support on the same day. WisdomTree’s BTCO and Franklin Templeton’s EZBC Bitcoin ETFs saw more modest gains, with inflows of $2.2 million and $1.8 million, respectively.

It was a quieter day for ETFs from Hashdex, VanEck, Valkyrie, and Invesco Galaxy, which recorded no new flows, highlighting a possible disinterest in these Bitcoin ETF products among institutional investors.

Since their inception, these funds have collectively seen an influx of $12.1 billion, with giants like BlackRock’s iShares and Fidelity’s investments capturing the lion’s share. Despite similar performance across the board, with returns hovering around 28%, investor reactions have varied significantly.

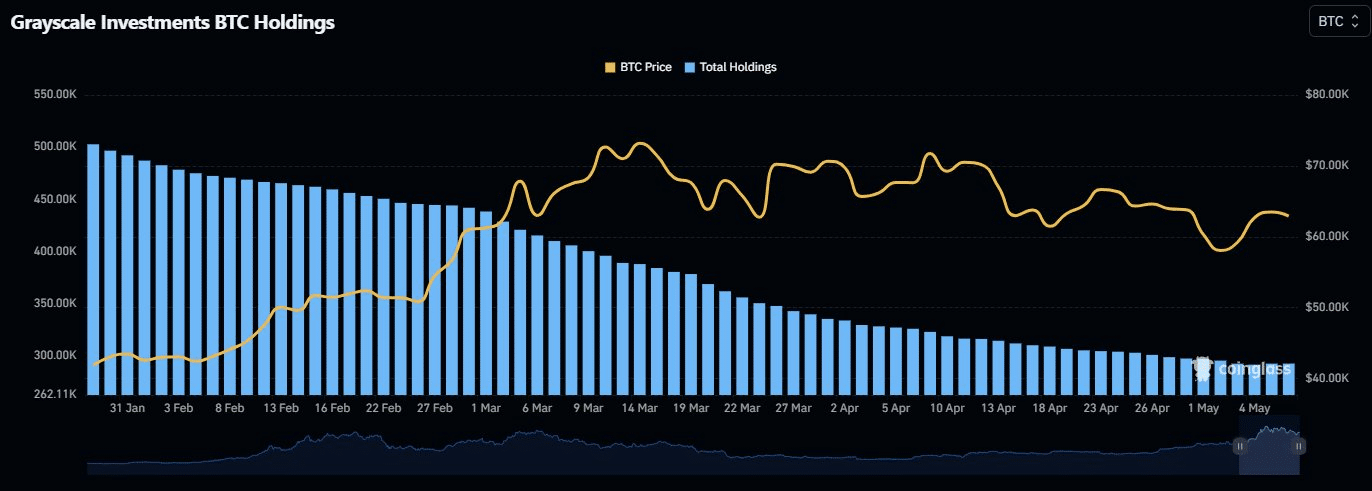

The big loser? Grayscale. The fund has witnessed a staggering $17.2 billion withdrawal since its conversion. Even after slashing its fees, Grayscale’s charges remain significantly higher than its competitors, who mostly hover around a 0.20%-0.25% expense ratio.

Meanwhile, Coinglass revealed that Grayscale still holds nearly 293 BTCs, which are worth $18.4 million.

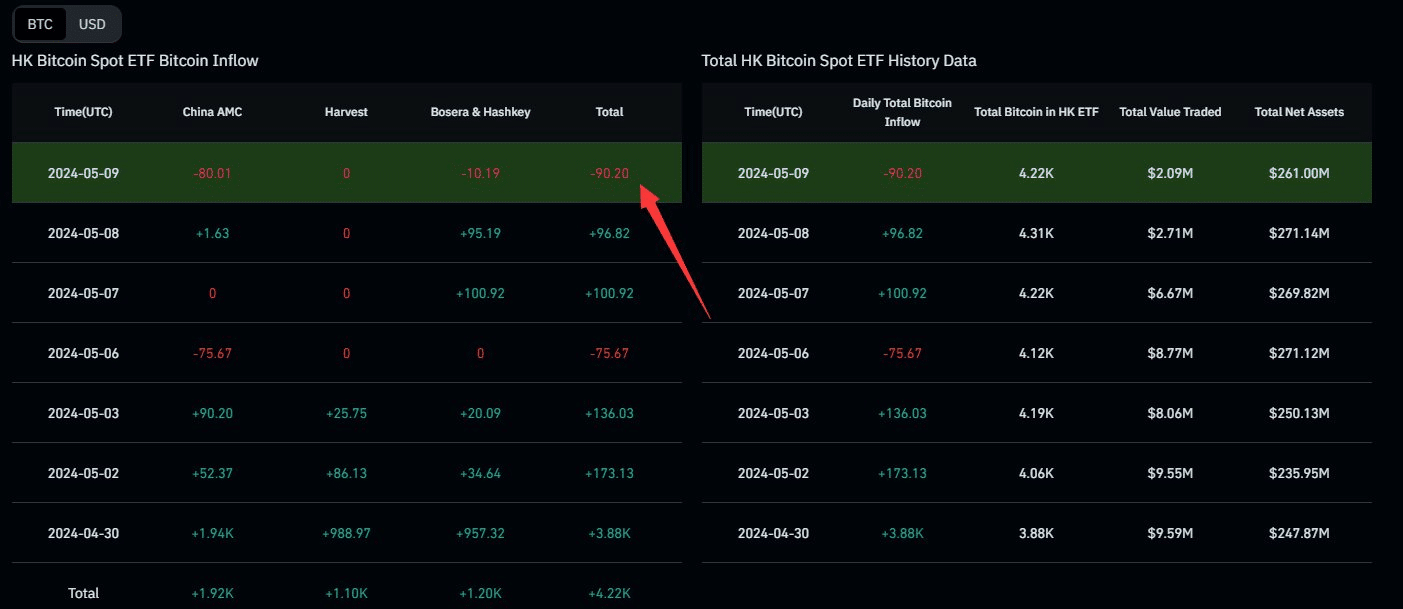

The outflows in crypto ETF products isn’t isolated to just the United States alone.

In fact, data showed that Hong Kong’s spot Bitcoin ETFs have seen outflows of over $5.5 million in the past 24 hours, indicating a general loss of interest in the products.

What about BTC?

Amid this, Bitcoin has managed to hold its ground. At press time, the king of cryptos was still managing to hover above $63,000, with a hike of 4% in the last 24 hours. Also, the community is currently 78% bullish on BTC, according to data from CoinGecko.

The Bitcoin halving didn’t yield the results many of us were hoping for and since then, all the top ten cryptocurrencies have been seeing mostly bullish sentiments by investors and sometimes, even traders.

However, with doubts peaking, the ongoing exit of smaller investors might ironically clear the stage for Bitcoin and its fellow cryptos to stage a comeback as summer approaches, hinting at a potential reset in the volatile cycles of the crypto-market.

![Cardano [ADA] price prediction - 8% rally next, but here's why you should be careful!](https://ambcrypto.com/wp-content/uploads/2025/07/ADA-price-prediction-Featured-400x240.webp)