Bitcoin starts 2021 with a bang, goes past $30,000

Bitcoin has managed to hit yet another all-time high as it surpassed $30,000 today. The largest cryptocurrency has been witnessing great momentum in the market which has helped it report new highs over the past month.

Unlike 2017, the 2020 ATHs were a result of growing interest in the coin. This was due to the impact of COVID-19 leading many to seek other options apart from traditional finance. Interestingly a large chunk of this interest comes from institutions who have found value in the digital asset.

At $30k, BTC is returning nearly 315% in year-to-date which would have been difficult for any investor to reject. Slowly but promptly Paypal joined the BTC wagon, Square and MicroStrategy also became prominent investors in BTC. According to the latest reports by Bitcoin Treasuries, almost 29 companies have included Bitcoin in their investment portfolios. The holdings have thus surpassed $30 billion with MicroStrategy leading with 70,470 BTC.

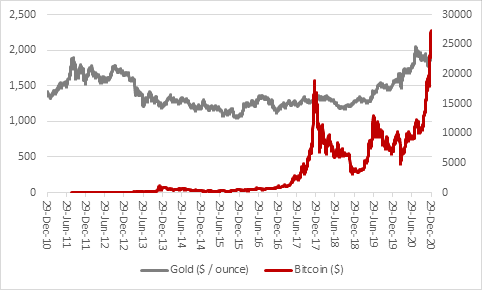

With the US dollar facing a tough time, Bitcoin has been a safe resort for investors, and comparing it once again to Gold, did not feel like a stretch. Gold, like Bitcoin, also marked a new all-time high in 2020.

Source: The Guardian

As governments kept piling more debts and central banks continue to fund borrowing through the backdoor QE, zero interest rates, and bond yield manipulation, the future of Gold and Bitcoin might appear brighter. As Bitcoin’s supply is limited, its scarcity is boosting its value along with the safe haven it is providing against traditional finance.

2020 has seen many critics choose Bitcoin, it will get even more difficult for skeptics to dismiss it as a bubble in 2021.