Bitcoin stays above $85K: Will THIS drive BTC to $100K?

- Bitcoin sustains the level above $85,000, with $95,000 as a significant next resistance area.

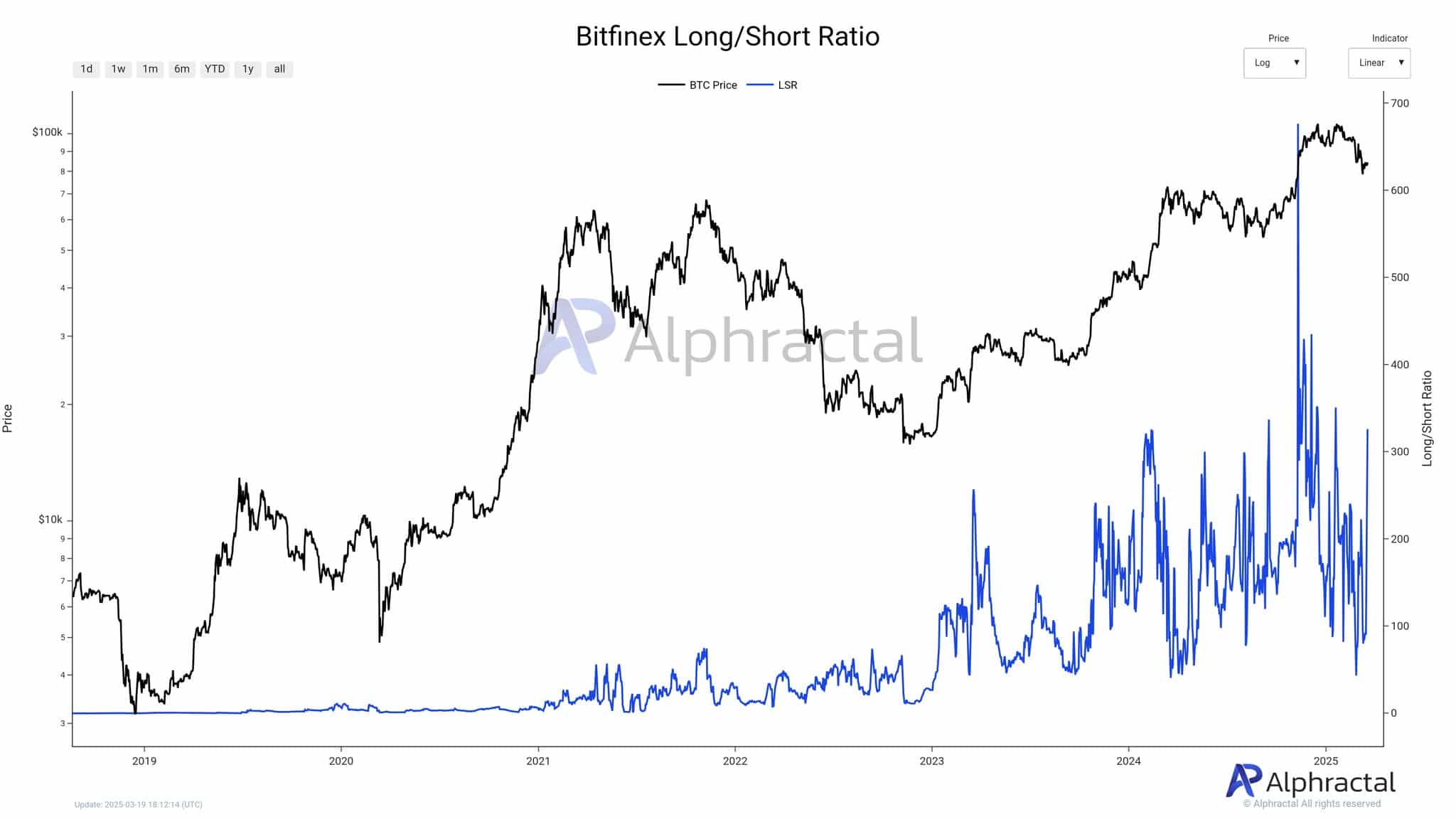

- The Long/Short Ratio reached 650 in early 2025.

Bitcoin’s [BTC] long positions on Bitfinex experienced significant growth, which validated that traders had positive market expectations.

The Long/Short Ratio reached 650 during early 2025 at levels, going far beyond the essential 320 critical threshold.

A continuous preference for long positions among its users materialized through the Long/Short Ratio reaching numbers exceeding 100 since mid-2023.

The number of BTC traders holding long positions reached its maximum peak of 80,000 at this time, alongside declining short position levels, falling to 20,000.

The price surge of BTC reached $90,000 due to the market imbalance that strengthened its upward trajectory.

Additionally, buying pressure exceeded 320, which demonstrated increased chances for BTC to achieve $100,000 price value.

Thus, the continued maintenance of a ratio above 320 acted as the key factor. This further enabled a bullish trajectory, yet any drift below this threshold might cause it to move toward $85,000.

Bitcoin market sentiment

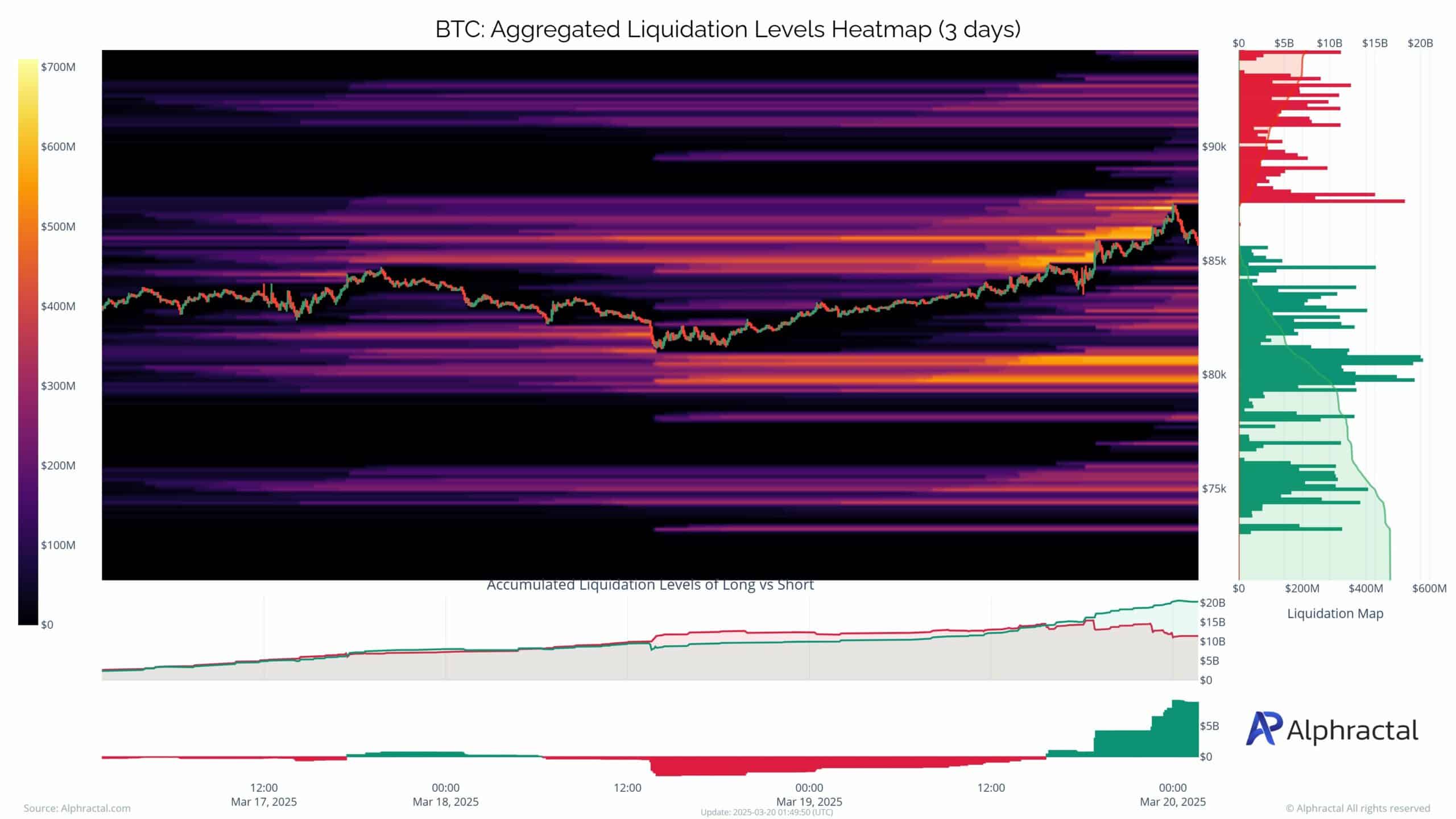

At the time of writing, a mass of shorts suffered liquidation on BTC’s heatmap, which contributed to advancing the bullish market momentum.

A substantial $200 million worth of short positions got cleared at $85,000 when Bitcoin dropped momentarily before reverting to $90,000.

Also, over $500 million worth of short positions got automatically liquidated in only three days inside the price range of $80,000 through $85,000, thereby amplifying market buy pressure.

Thus, bearish traders had to close their positions, which created additional upward momentum for BTC.

If BTC sustains the level above $85,000, it may result in a price objective for $95,000 as a significant next resistance area.

Sequentially, BTC exhibited an upward trend after major whale accumulation events, thus raising the possibility of reaching $95,000.

The combination of whales selling at elevated price points and market sell pressure could have forced prices down to $85,000 levels.

Therefore, whale activity combined with Bitfinex’s Long/Short Ratio trends and liquidation data showed that the market remains currently optimistic.