Bitcoin struggles below $60K, but can still rally to 68K – Here’s how

- Bitcoin struggled to stay above $60,000, with some analysts forecasting a potential rally to $68,000.

- Whale transactions and a possible “golden cross” signaled positive signs for Bitcoin’s near-term performance.

Bitcoin [BTC] has faced difficulty in maintaining a rally above the $60,000 mark, despite brief periods of trading above it last week.

As of the time of writing, the cryptocurrency was trading at $58,947, marking a modest 2.1% increase over the past 24 hours.

The market’s current volatility has kept Bitcoin from making a significant upward movement, and the asset has now dipped below the critical $60,000 level.

However, despite this recent performance, some analysts continue to express optimism about Bitcoin’s potential for a rally in the coming weeks.

Rebound amid market uncertainty?

Captain Faibik, a well-known crypto analyst on X (formerly Twitter), recently shared his optimistic outlook for Bitcoin, suggesting that the asset may still be poised for a significant rally. According to Faibik,

“BTC is still moving within a Bullish Flag Pattern. It may test the $54k support area again, and it’s crucial for the bulls to defend this level. If Bitcoin bounces back from the $54k support, it could rally up to $68k in September.”

For context, a bullish flag pattern is a continuation pattern that appears after a strong price movement, typically characterized by a brief consolidation or pullback phase that forms a rectangular shape resembling a flag.

This pattern suggests that the asset could resume its upward trend once it breaks out of the flag formation, potentially leading to a significant price increase.

Faibik’s analysis indicated that while Bitcoin may face short-term volatility, the overall trend could still be upward, especially if the $54,000 support level holds.

Another positive sentiment in the crypto community comes from Crypto Jelle, who highlighted the formation of a weekly golden cross on Bitcoin’s chart.

Jelle noted,

“Bitcoin is forming a weekly golden cross for the first time in its history. The 100-week MA is crossing above the 200-week MA this week. In traditional markets, these crossovers are considered a bullish sign; will it work for BTC too?”

Notably, a golden cross occurs when a short-term moving average crosses above a long-term moving average, typically viewed as a strong indicator of an upcoming bullish trend.

The occurrence of a golden cross on the weekly timeframe for Bitcoin is seen as a potentially significant event that could signal further upward momentum.

Bitcoin’s growing whale activity

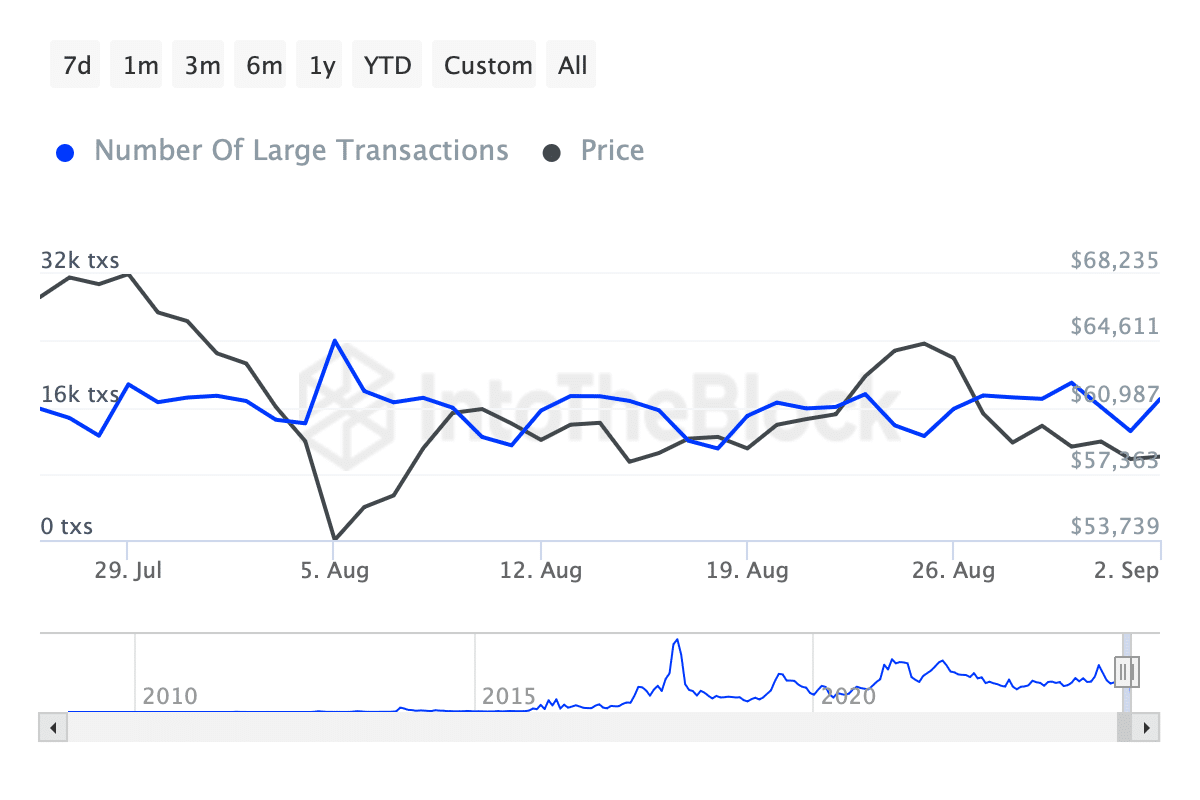

Beyond technical indicators, Bitcoin’s fundamentals also suggested a positive outlook. Data from IntoTheBlock revealed a notable increase in whale transactions—those exceeding $100,000—over the past week.

Specifically, these transactions have surged from below 13,000 last week to approximately 16,940 as of today.

This increase in large transactions often signals growing interest from institutional investors or high-net-worth individuals, which could drive further price appreciation.

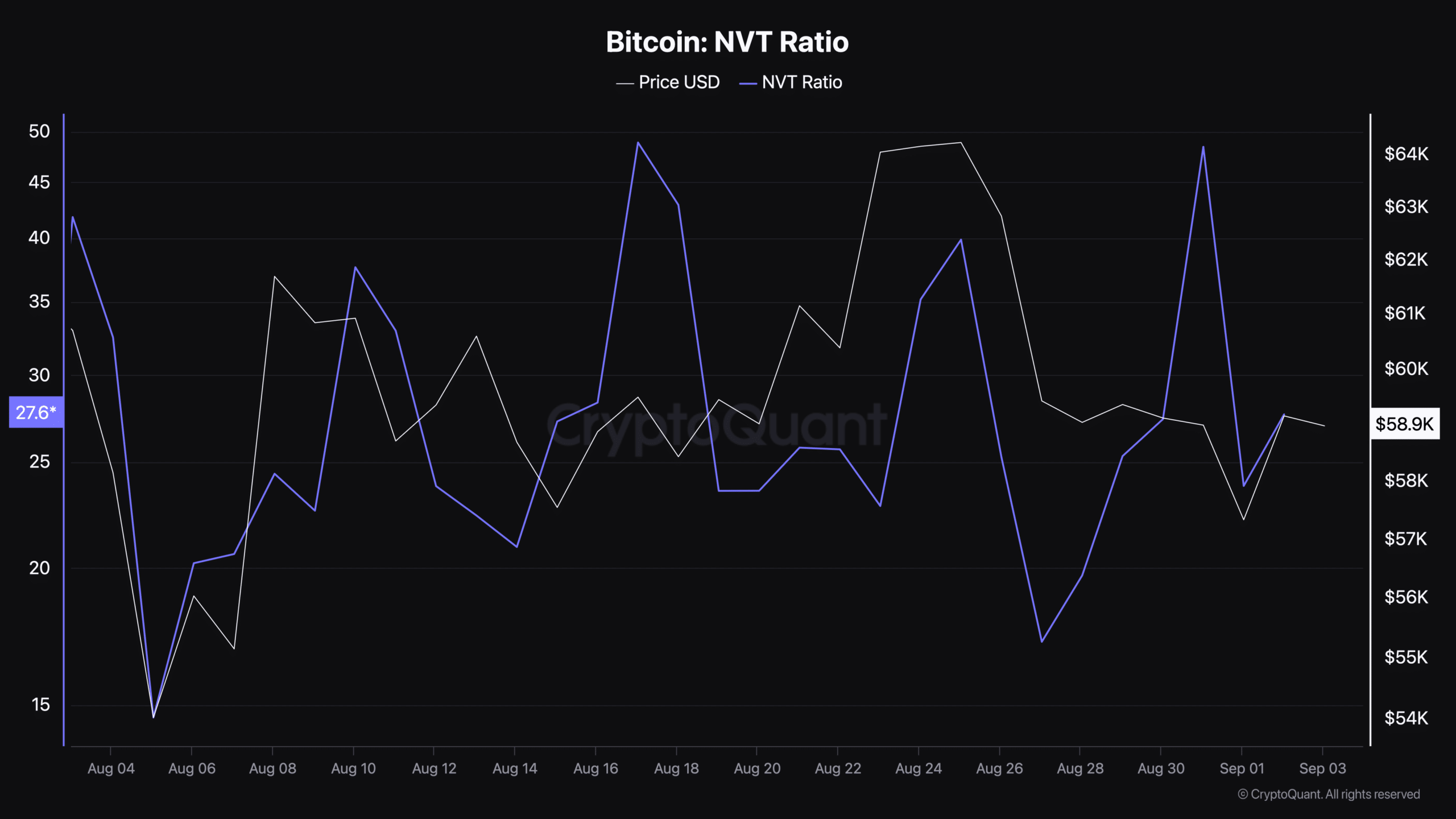

Additionally, Bitcoin’s Network Value to Transactions (NVT) ratio, used to assess the asset’s valuation relative to its transaction activity, sat at 27.63 at press time, according to data from CryptoQuant.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The NVT ratio is often compared to the price-to-earnings (P/E) ratio in traditional markets, where a lower NVT ratio could indicate that Bitcoin is undervalued, while a higher ratio might suggest it is overvalued.

With the press time NVT ratio of 27.63, Bitcoin’s valuation appeared to be in a reasonable range, potentially supporting further growth if transaction activity continues to increase.