Bitcoin struggles to hold $60K, but THESE factors could help

- Bitcoin shows signs of improving market confidence but short-term headwinds are still in play, influencing its performance.

- Can Bitcoin drum up enough momentum amid signs of declining dominance?

The Bitcoin [BTC] investment landscape is experiencing a resurgence of confidence despite struggling to stay above $60,000. This is evidence in retail activity, as well as in Bitcoin miners.

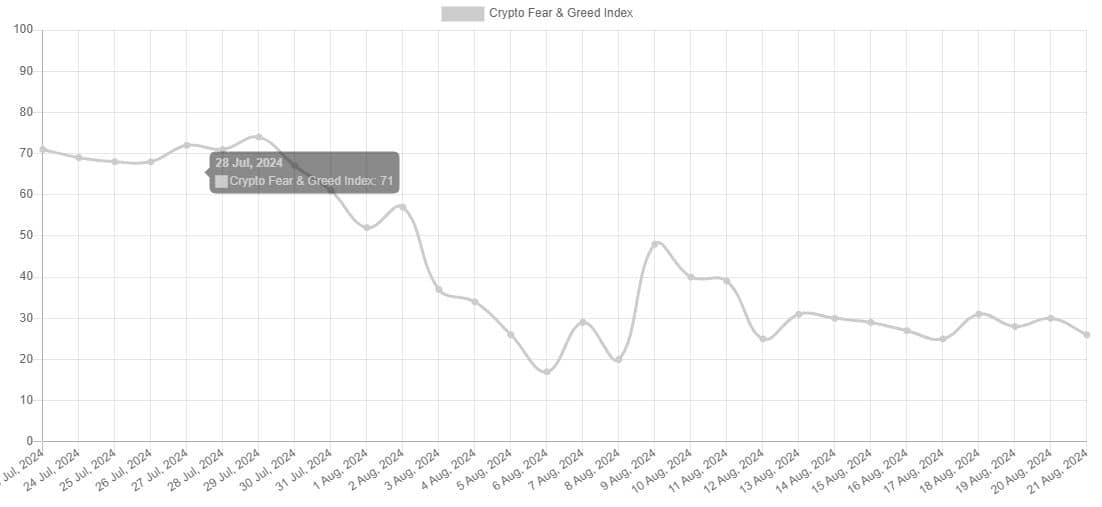

Bitcoin and the overall crypto market are experiencing a confidence recovery, contrary to the situation earlier in the month. The fear and greed index is currently at 26, but it peaked at 30 during Tuesday’s session.

The fear and greed index signals that Bitcoin confidence is currently higher than it was at the start of the year. However, this does not necessarily paint a picture of confidence considering that it dipped to 26 in the last 24 hours.

The possible reason for this the fact that BTC slipped below $60,000 once again. An outcome that has been quite common lately.

The reason for the sell pressure pushing BTC below $60,000 this time could be the revelation that Mt. GOX just moved over 12,000 BTC worth over $700 million.

Are miners accumulating Bitcoin?

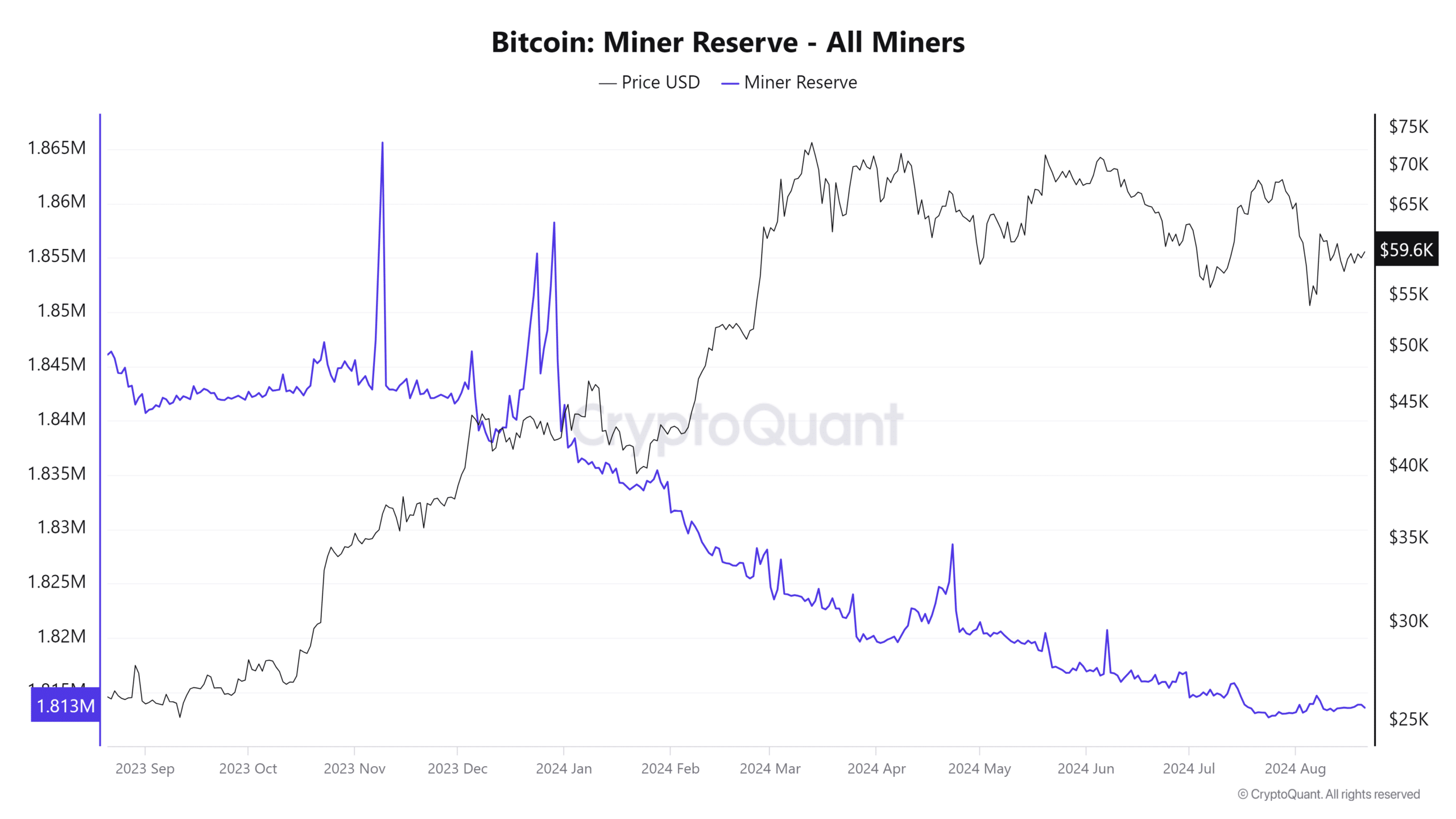

Bitcoin miner reserves have been on an overall downward trajectory in the last 12 months. Reflecting the state of sell pressure as bars became the dominant force.

However, miner reserve data indicates an inversion in the curve so far this month from July lows. This suggests that the number of miners HODLing their BTC has been growing.

Source: Cryptoquant

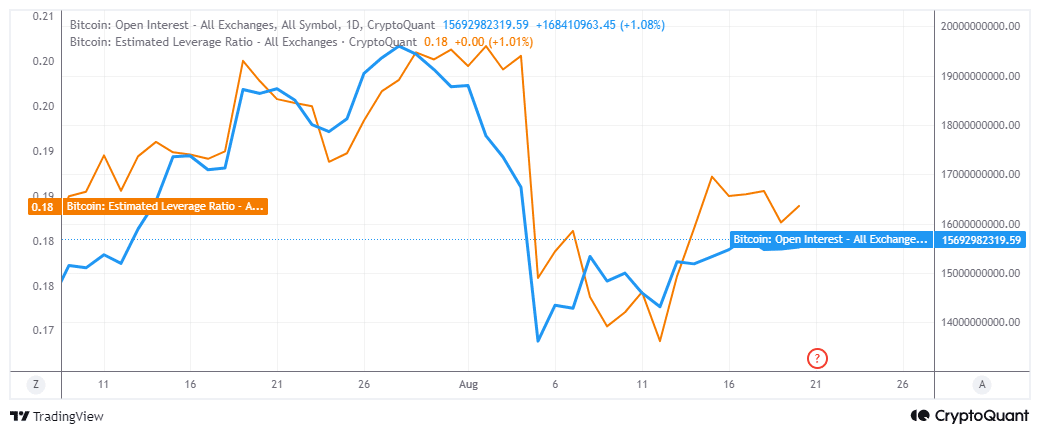

Demand for Bitcoin in the derivatives segment is also recovering. This was evident in the rising open interest after a rough start earlier this month. Similarly, we also observed growing appetite for leverage, resurgence.

Source: CryptoQuant

Despite the resurgence in open interest and leverage, it is clear that the market is still in a cautious mood. Recent liquidations have many traders on edge especially with the prevailing directional uncertainty.

While the current market conditions suggest an improvement in the level of market confidence, Bitcoin is still exposed to certain and uncertain risks. Mt. Gox-induced sell pressure is one of them.

However, there is another risk that is less pronounced. BTC dominance has been declining since 10 August.

A small retracement is perfectly normal considering that Bitcoin dominance achieved a strong rally since 13 July. Nevertheless, this could be the start of a stronger downtrend to come.

If this is the case, then liquidity may start flowing in favor of the altcoins, consequently limiting BTC’s potential upside.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Meanwhile, Bitcoin demand from leading institutions indicates growing competition. For example, Microstrategy has been the leading institutional investor but not anymore.

Recent data shows that Blackrock has been aggressively buying Bitcoin. Its BTC holdings are now almost twice the amount owned by Microstrategy.