Bitcoin stuck below $60K: Analysts debate future market direction

- Bitcoin faces resistance at $60K, with prices down 23% from its March peak.

- Analysts suggest mixed signals, debating whether this is a temporary slump or the start of a bear market.

Bitcoin’s [BTC] price performance has remained under pressure in recent months, with the cryptocurrency continuing to struggle at key levels. Despite previous optimism, the asset has consistently faced resistance whenever it approaches the $60,000 mark.

This inability to break through the resistance has kept Bitcoin from regaining its March peak of over $73,000. As of press time, Bitcoin was trading at $56,584, down 1% in the past 24 hours and 23.3% from its high earlier this year.

According to IntoTheBlock, the market sentiment around Bitcoin has shifted significantly since earlier in the year. At that time, both retail and institutional investors were hopeful that the asset would continue its rally and reach new heights.

However, macroeconomic conditions and a slowdown in crypto adoption have led to increased uncertainty about Bitcoin’s future. Many investors are now questioning whether this is a temporary lull or the beginning of a more prolonged bear market.

Market trends and Bitcoin’s struggles

IntoTheBlock, highlighting the shift in market sentiment around Bitcoin in a recently uploaded post shared the factors that might have contributed to its current price struggles.

One of the key challenges mentioned was the broader macroeconomic landscape. IntoTheBlock said that with the possibility of a recession looming, markets have been under pressure, and risk assets like Bitcoin have been no exception.

They added that while some expect that potential interest rate cuts could eventually benefit cryptocurrencies, the impact of such measures may take time to materialize.

Until then, the macro environment will continue to weigh on market sentiment and Bitcoin’s price performance.

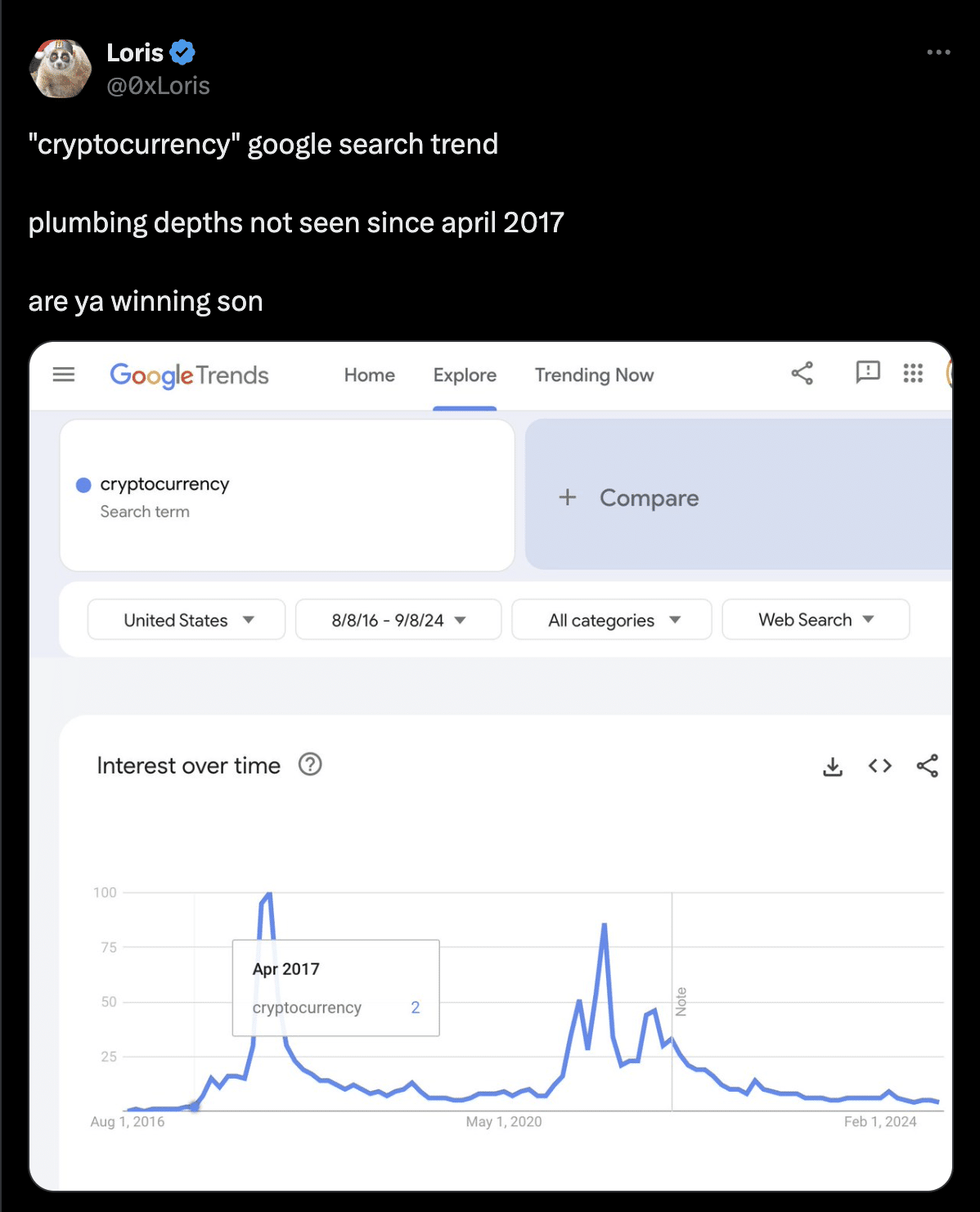

Additionally, interest in cryptocurrencies appears to be declining, as indicated by several metrics. Search trends for cryptocurrency-related topics have seen a noticeable drop, reflecting a cooling of the market compared to the excitement during bull market periods.

This decline is further illustrated by user activity on platforms such as Coinbase, where app rankings have fallen, suggesting that fewer people are actively engaging with crypto assets.

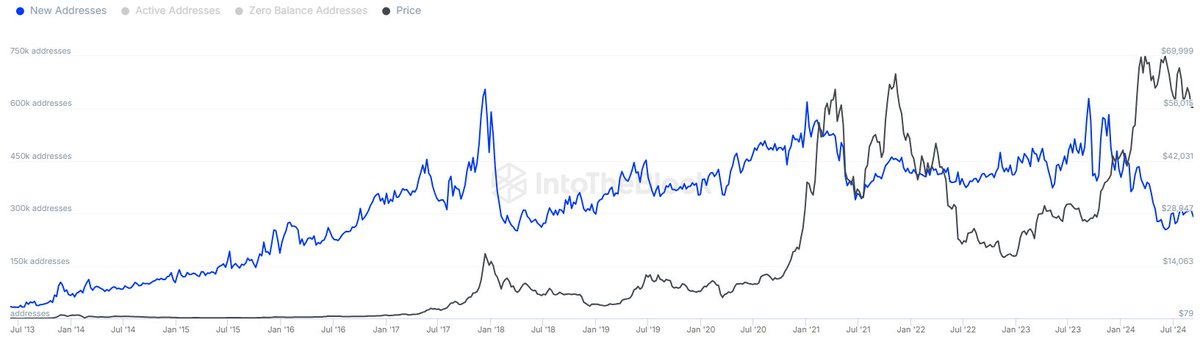

IntoTheBlock also pointed out that on-chain data paints a picture of stagnation in Bitcoin’s market activity. The number of new Bitcoin addresses remains low, signaling a slowdown in the influx of new participants into the market.

Source: IntoTheBlock

This decrease in new users points to waning enthusiasm compared to earlier in the year, when Bitcoin’s price surge attracted a flood of new investors.

The lack of new market participants may hinder Bitcoin’s ability to regain its previous highs in the near term, IntoTheBlock revealed.

Analyst outlook on BTC

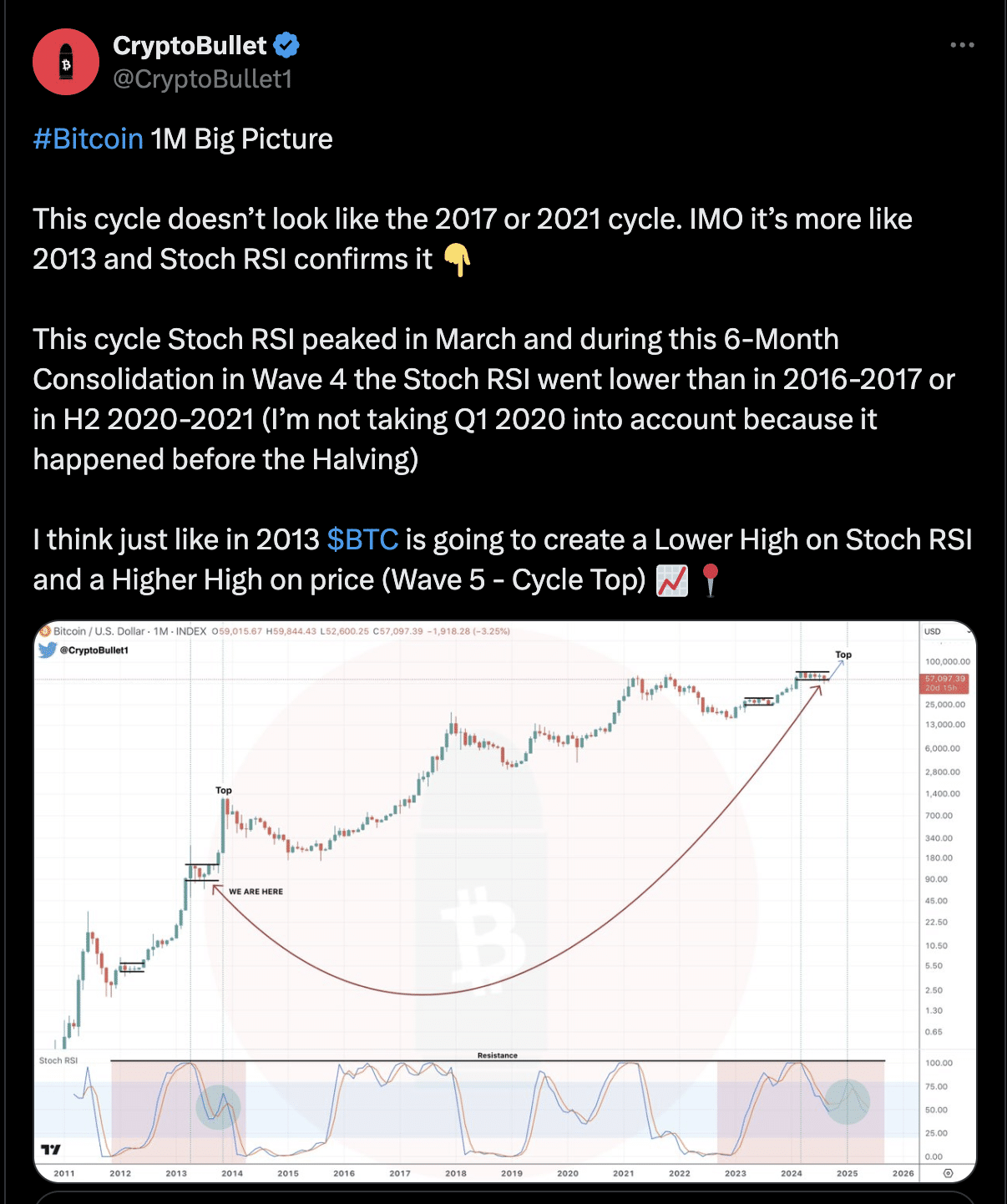

Looking at Bitcoin’s price cycles, some analysts believe that the current phase mirrors previous periods of consolidation.

Particularly, CryptoBullet, an analyst, has drawn comparisons to 2019, a year in which Bitcoin experienced a similar slowdown after reaching a local high.

During that period, the market underwent a prolonged consolidation before eventually turning bullish again. CryptoBulle argue that Bitcoin could be following a similar path now, with the current market dip being part of a broader cycle.

The analyst shared the insights on Bitcoin’s price cycles on X, comparing the current market to previous years.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to his analysis, this cycle does not resemble the 2017 or 2021 cycles but is more similar to the 2013 cycle.

He highlighted the behaviour of the Stochastic Relative Strength Index (Stoch RSI), suggesting that Bitcoin is undergoing a consolidation phase before entering a fifth wave that could lead to new highs.