Bitcoin subject to massive short liquidations: What happens now?

- BTC has been heavily shorted for the last three days, but the recent price hike has increased liquidation.

- Bitcoin’s investors FUD and doubt in the rally will increase prices, suggesting volatility.

Bitcoin [BTC], the largest cryptocurrency by market cap, has recently experienced a moderate recovery in its price charts. In fact, at press time, BTC was trading at $57110 after a 4.27% gain over the past day.

As the prices recovered, trading volume spiked over the past day by 53.38% to $33.57 billion. Also, BTC’s market cap has increased by 4.24% to $1.13 trillion.

Before this increase, BTC was in a strong downward trajectory, dropping by 6.54% over the last 30 days. Therefore, despite the recent gains, it remained relatively low from its recent high of $65103 and 22.8% from its ATH.

The current market conditions give BTC signs of life, with analysts showing optimism. For instance, Santiment analysis suggested further price hikes, citing Bitcoin’s market value.

What market sentiment says

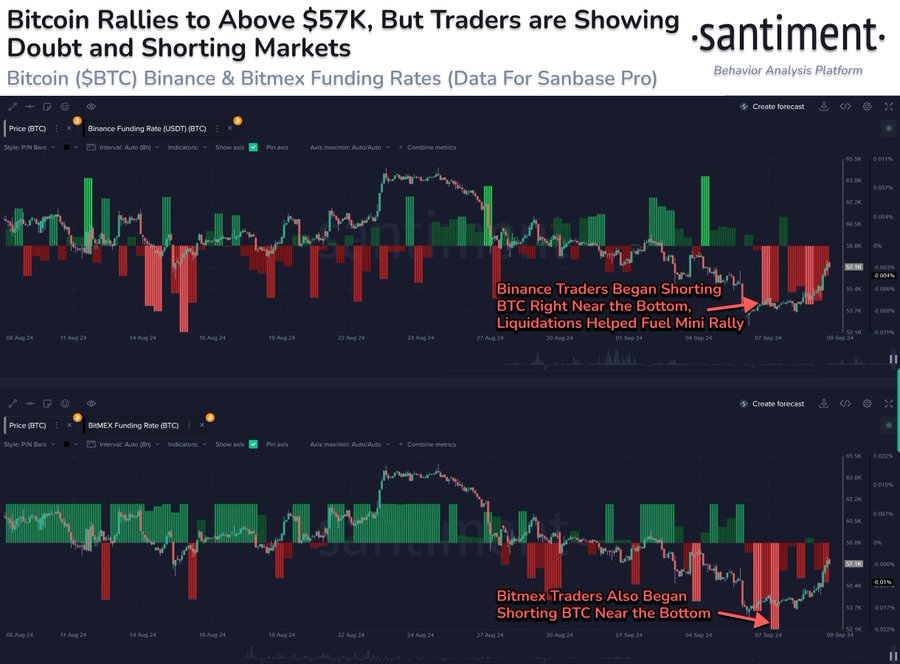

Santiment noted that BTC’s value has increased over the past 24 hours, although it has been shorted over the last four days on major exchanges such as Binance & Bitmex.

In context, many traders are betting on BTC prices to decline. Mostly, shorting occurs when traders borrow BTC and sell it, with the intention of buying it again at lower prices.

Thus, heavy shorting witnessed since Saturday implies that many traders expect prices to prices. This market sentiment is usually driven by FUD, as investors lack confidence in price direction and expect a pullback.

However, if the prices fail to decline as short sellers expect and rise, they come under pressure.

These investors are forced to buy back the assets they borrowed to cover their positions, especially when there’s a risk of higher losses. As noted by the last 24 hours gains.

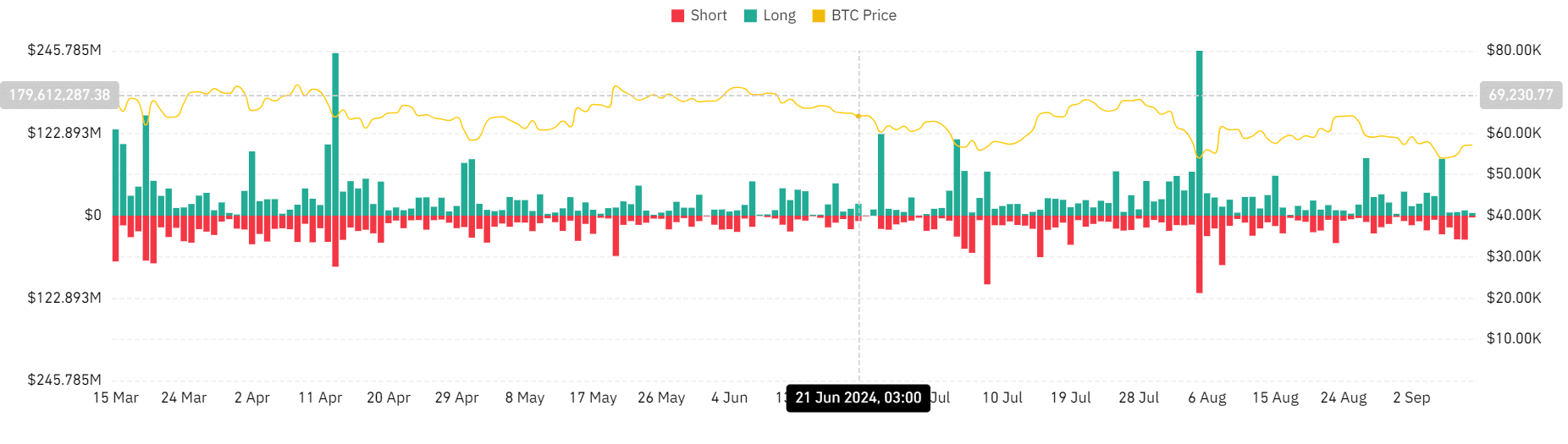

Thus, the price increase has resulted in increased liquidation of short positions, suggesting market volatility. This forced purchase results in higher demand, which drives prices up, resulting in a short squeeze.

Bitcoin’s price charts

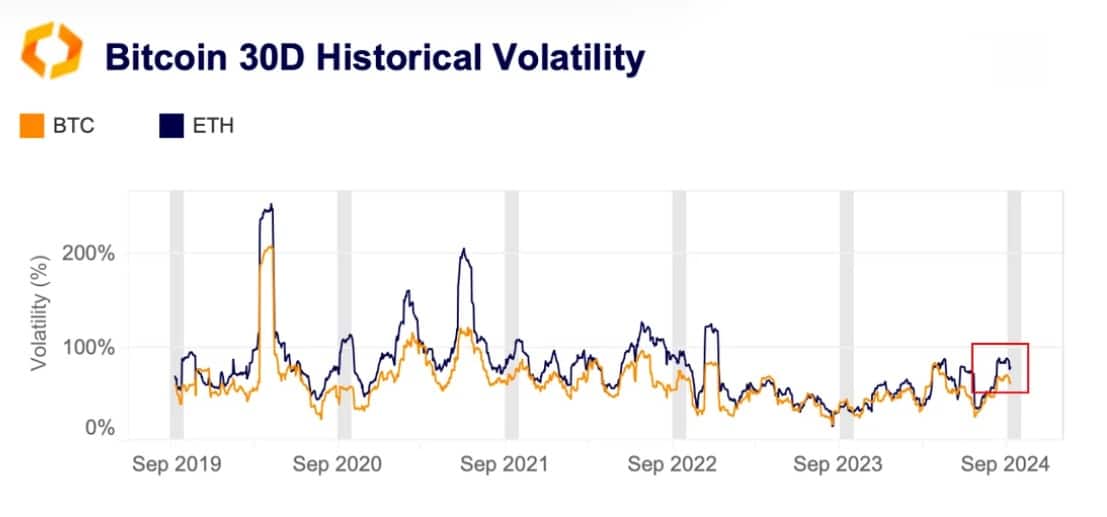

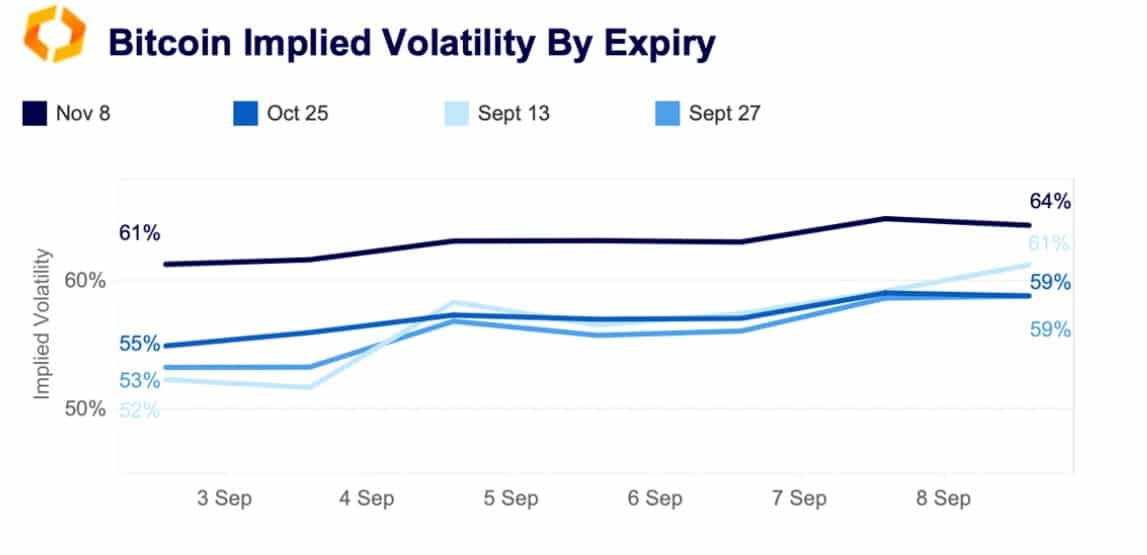

As noted by Santiment, Bitcoin’s market is experiencing higher uncertainty, resulting in increased volatility. Usually, September is historically associated with volatility, with this year’s BTC’s 30-day volatility spiking by 70%.

Thus, indicators such as Implied Volatility have increased since September started after a drop in August. In particular, short-term options have surged by 60% from 52%.

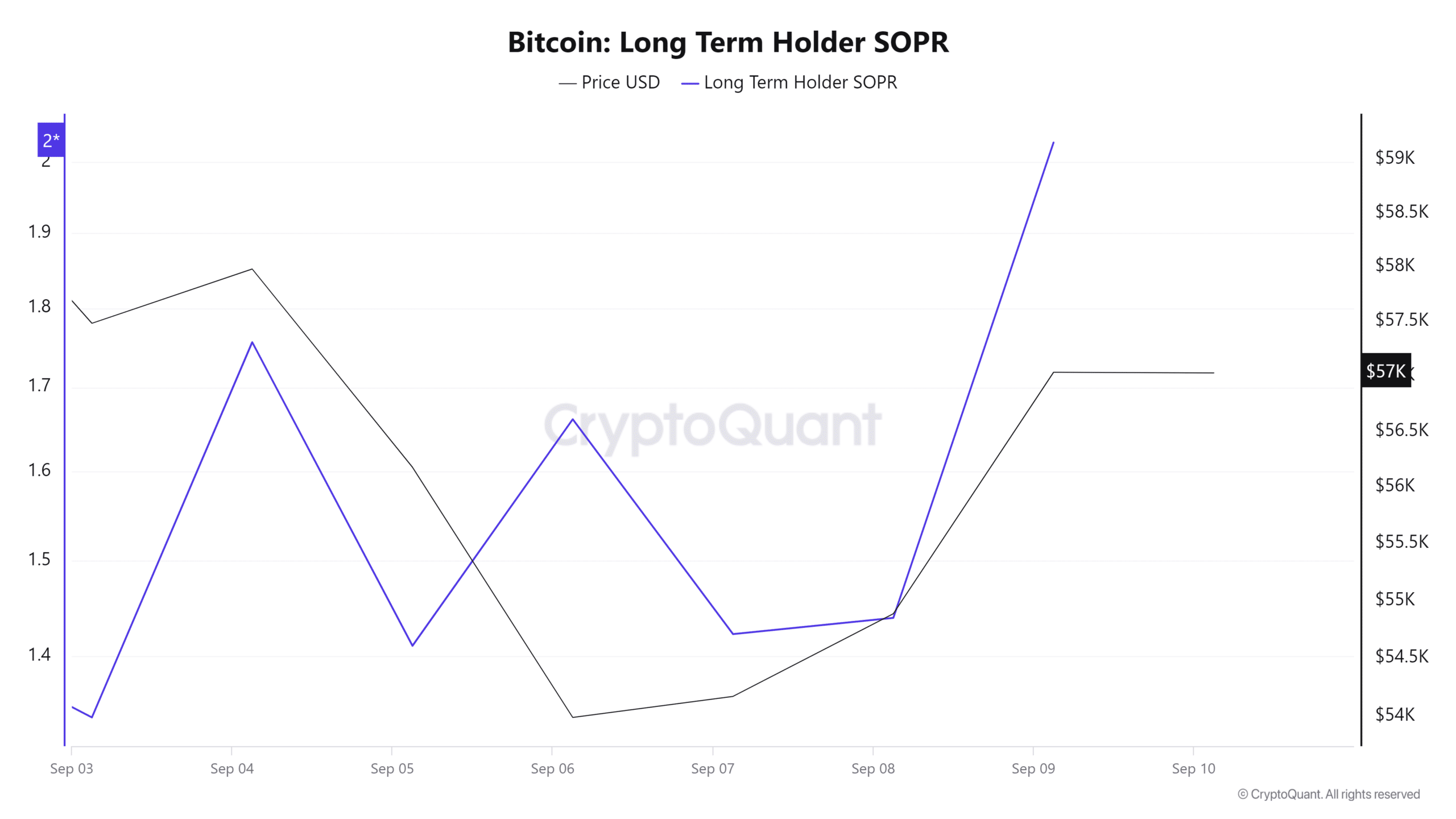

Additionally, the upcoming U.S. presidential elections are contributing to current market uncertainty. This FUD is further supported by a sudden rise in Long Term Holder SOPR from 1.4 to 2.0.

So, although prices are in rising, they may experience a pullback this sell to close the realized gains.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Therefore, demand for shorts positions signifies that investors expect the prices to decline. However, the demand for short positions may lead to increased demand, which further results in further price increases.

If FUD drives prices up, BTC will challenge the $59363 resistance and strengthen it to cross the $60k mark.