Bitcoin supply on exchanges hits 5-year low: BTC to $70k next?

- Buying pressure on BTC was rising, which suggested a continued price hike.

- However, a few technical indicators hinted at a correction.

Bitcoin [BTC] investors enjoyed much profit last week as the coin’s price surged by double digits. Thanks to the price rise, bullish sentiment around the coin increased, causing a record drop in the supply of BTC on exchanges. Will this propel further price rises?

Investors are buying Bitcoin

CoinMarketCap’s data revealed that Bitcoin witnessed an over 11% price hike in the last seven days. At press time, the king coin was trading at $67,866.54 with a market capitalization of over $1.34 trillion.

In fact, AMBCrypto reported earlier that there were chances of BTC moving above $67k. Thanks to the latest price increase, over 50 million BTC addresses were in profit, which accounted for more than 94% of the total number of BTC addresses.

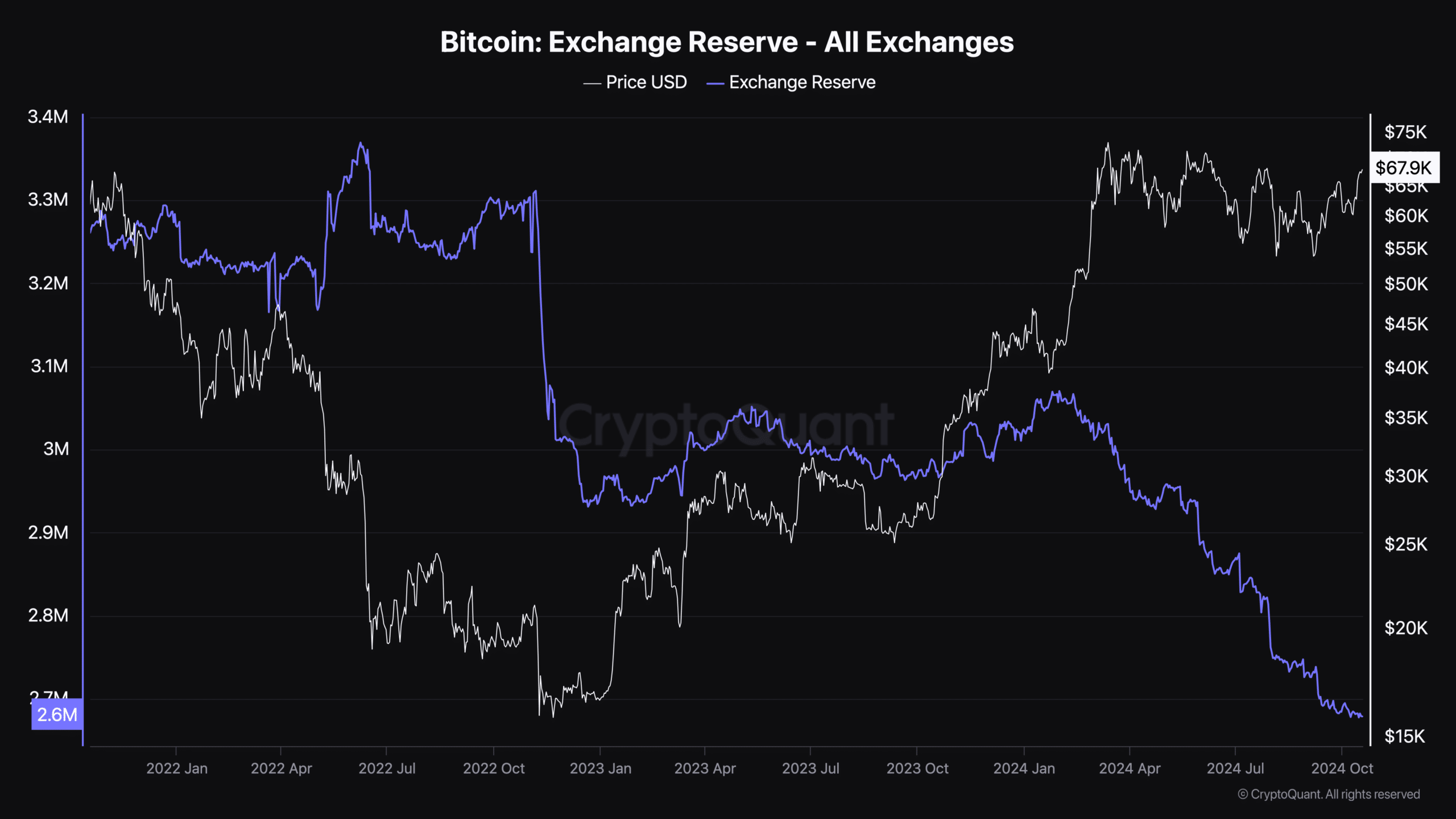

While all this happened, a key BTC metric reached a record low. To be precise, Bitcoin’s supply on exchanges dropped to the lowest in the last five years. A drop in this metric means that investors were buying BTC in anticipation of a further price rise.

Therefore, AMBCrypto checked other datasets to find out whether buying pressure was high.

Where is BTC headed?

AMBCrypto’s analysis of CryptoQuant’s data established the aforementioned fact. Bitcoin’s exchange reserve dropped sharply over the last months, indicating a clear motive of investors to buy the king coin.

Long-term holders were willing to hold their coins, which was evident from the coin’s green binary CDD. Things in the derivatives market also looked pretty optimistic.

The coin’s funding rate was rising, meaning that long position traders were dominant and were willing to pay short traders. Additionally, Bitcoin’s taker buy/sell ratio indicated that buying sentiment was dominant in the derivatives market.

However, US investors were thinking otherwise. This was evident from the low Coinbase premium, meaning that selling sentiment among US investors was dominant. Rising selling pressure could put an end to BTC’s bull rally.

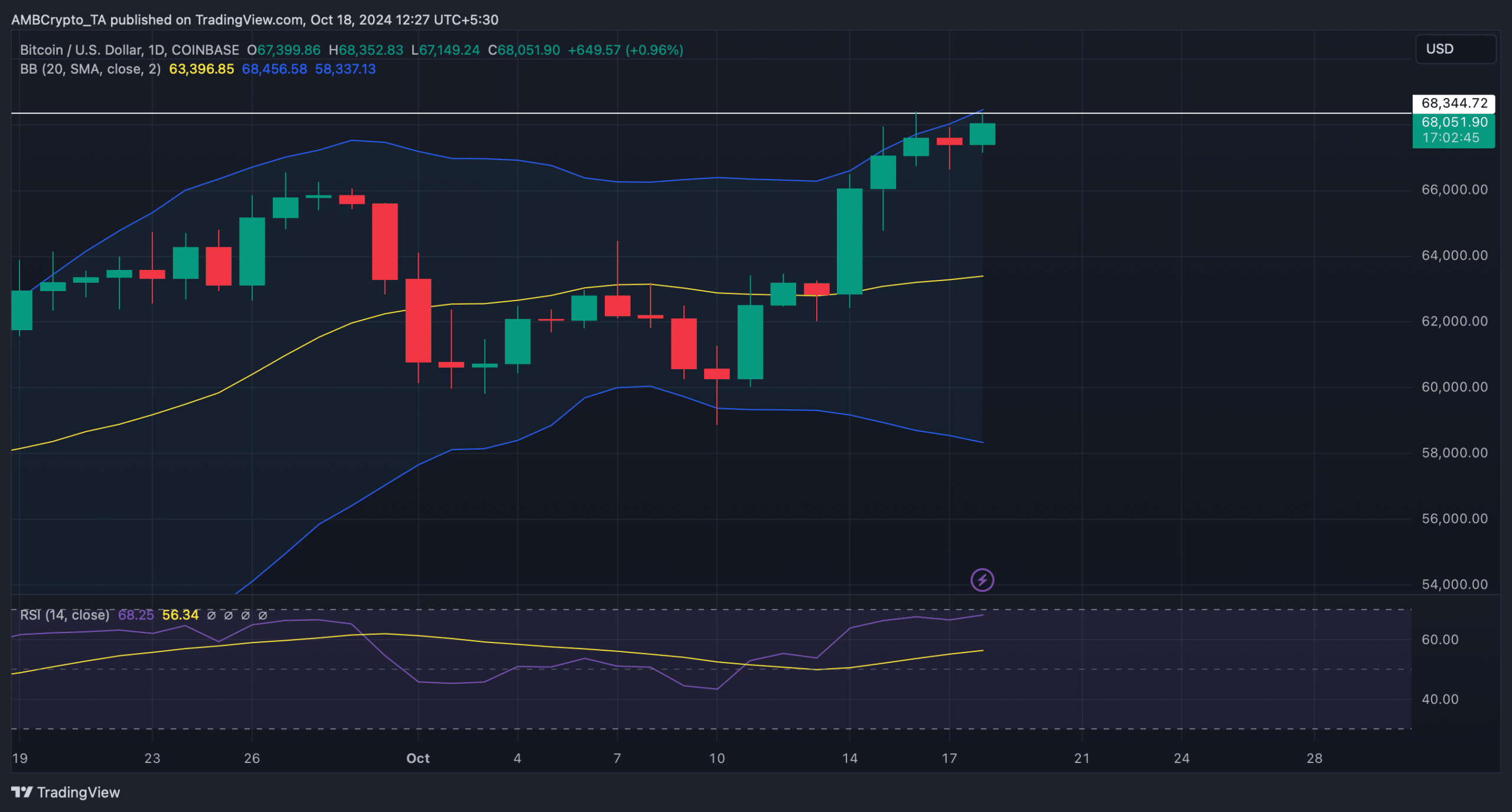

Therefore, AMBCrypto planned to take a look at Bitcoin’s daily chart to better understand which way the king coin was headed. As per our analysis, Bitcoin was testing its resistance at the $68k mark. However, the market indicators suggested a rejection.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

For instance, BTC’s price touched the upper limit of the Bollinger Bands, which often causes price corrections.

Additionally, the Relative Strength Index (RSI) was also about to enter the overbought zone. If that happens, selling pressure might rise, which might result in a price drop in the coming days.