Bitcoin supporters can thank these holders for BTC’s return to $30k

- Bitcoin bulls are back, after dispelling expectations of a sizable retracement.

- Low demand (for now) underpins the rally as most whales and retail sit on their coins.

Bitcoin [BTC] was shaping up for what seemed like a sizable retracement earlier this week but that might not be the case. A quick recovery above $30,000 confirmed that the bulls were nowhere close to ready for a recess.

How many are 1,10,100 BTCs worth today

You may have noticed that BTC and some top altcoins maintained a bullish bias since the start of the year. The same applies to the market conditions this week especially with BTC going against the bearish expectations. But will it maintain the same bias above the $30,000 range for a while longer?

Bitcoin traded at $30,272 at press time. Its one-day price chart confirmed that it maintained relative strength above the 50% Relative Strength Index (RSI) level.

Furthermore, a look at the four-hour time frame revealed something even more interesting. The bullish momentum resumed after the price briefly dipped into the oversold zone on 17 April.

A classic Bitcoin whale move?

BTC’s Money Flow Indicator (MFI) confirmed that liquidity was flowing back into the coin. Whether or not it will maintain the bullish momentum largely depends on whale activity.

Bitcoin’s supply distribution further confirmed that addresses holding between 100 and 10,000 BTC were largely responsible for the bounce back. This was because they had control of slightly over 35% of BTC’s circulating supply. This meant that they had the most influence on BTC’s price action.

The aforementioned whale categories grew slightly in the last two days, thus confirming that they have been accumulating. As far as BTC’s ability to maintain above $30,000, the current rally wasn’t exactly backed by heavy accumulation.

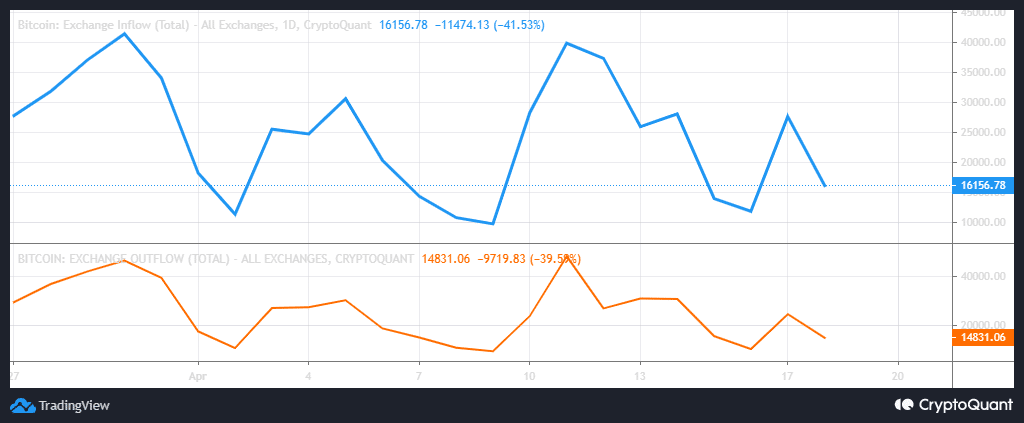

In fact, exchange flows have been slowing down, while inflows slightly outweighed outflows as per the latest observations.

Source: CryptoQuant

Based on the above observations, one can conclude that the current momentum may not necessarily be heavy enough to support a robust rally. However, the volatile state of the market may allow for a rapid shift as investor confidence flows back into the market. It would not be surprising if BTC buyers flood back in.

Market confidence improved slightly in the derivatives market. Both, the BTC open interest and funding rates were slightly up in the last 24 hours, indicating that demand was recovering.

There was also a noteworthy surge in short liquidations, which may have partly contributed to the bounce back. It acted as further confirmation that quite a number of traders expected prices to continue slipping.

Whales may have bought to take advantage of the momentum from leverage liquidations. Note that this is just speculation and may not necessarily be the driving factor for the rally.

Is your portfolio green? Check out the Bitcoin Profit Calculator

On the other hand, Bitcoin bulls were aided by the fact that many Bitcoin holders are long-term biased. Supply last active 3-6 months stood at a five-month high at press time.

? #Bitcoin $BTC Amount of Supply Last Active 3m-6m (1d MA) just reached a 5-month high of 1,880,438.993 BTC

Previous 5-month high of 1,880,340.270 BTC was observed on 14 April 2023

View metric:https://t.co/xD7zWV6u5s pic.twitter.com/vUdOXvZjqW

— glassnode alerts (@glassnodealerts) April 18, 2023

Furthermore, addresses holding at least 0.1 BTC were also at a new ATH according to the latest Glassnode data. In short, more people are buying Bitcoin for the long-term.