Bitcoin surges past $87K as miners and investors halt selling – Is $100K near?

- Bitcoin transfer volume has nearly halved since its peak, indicating a lack of demand—however, the asset remains in a critical spot.

- Miners have paused selling and are instead accumulating, a trend mirrored by U.S. and Korean investors.

Bitcoin [BTC] is on the rise, crossing into the $87,000 region following a 3.26% rally in the past 24 hours, bringing its cumulative gain to 4.38% over the past week.

Analysis suggests this could mark the beginning of a major price rally for the asset, which traded around $84,000 for days, as miners, U.S. and Korean investors, and derivative traders place long bets.

Here’s what AMBCrypto found.

Key metrics decline, but hope remains

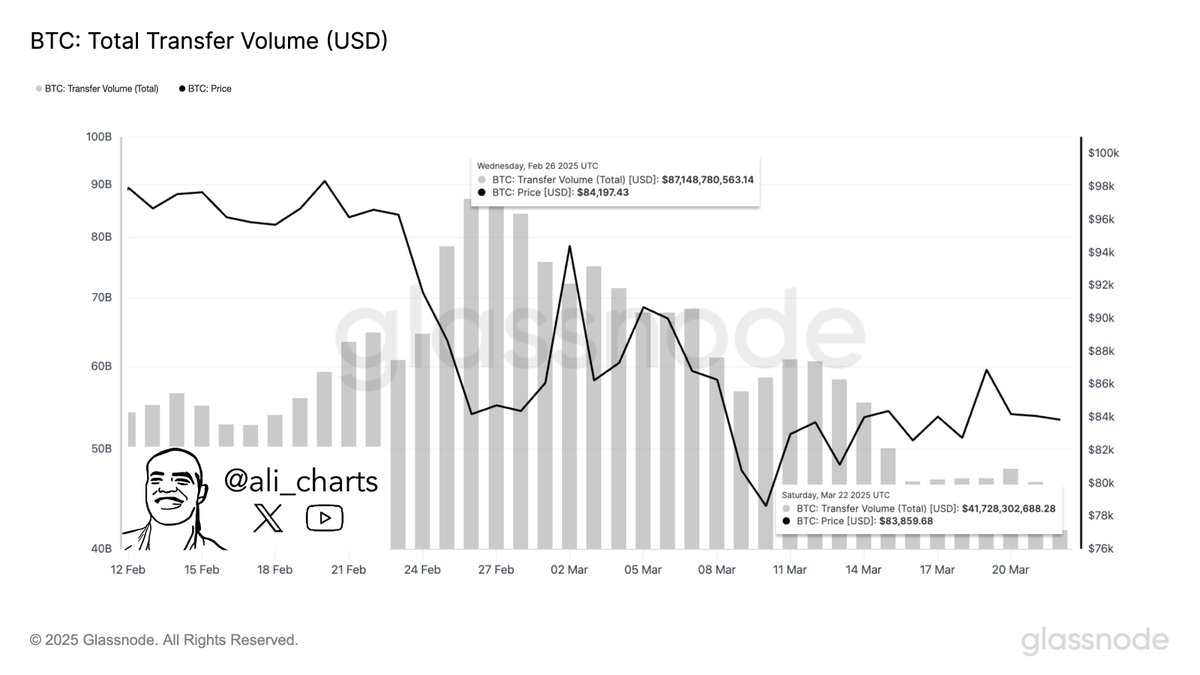

Bitcoin’s price has dropped over 9.83% in the past month, according to CoinMarketCap, largely due to a sharp decline in transfer volume.

Transfer volume has fallen from a peak of $87 billion to $42 billion—nearly half in the past month. Such a decline signals reduced trader interest, leading to lower market activity.

Further analysis showed that Bitcoin’s recent upward move has been driven by buying activity between the $82,590 to $85,150 price levels, where 625,000 BTC was purchased with some orders filled.

Bitcoin is expected to face significant selling pressure as it approaches the $95,400 to $97,970 supply zone, where sell orders for 1.44 million BTC are stacked.

If the asset fails to gain more momentum heading into this region, a further decline could follow.

Will Bitcoin gather the needed momentum?

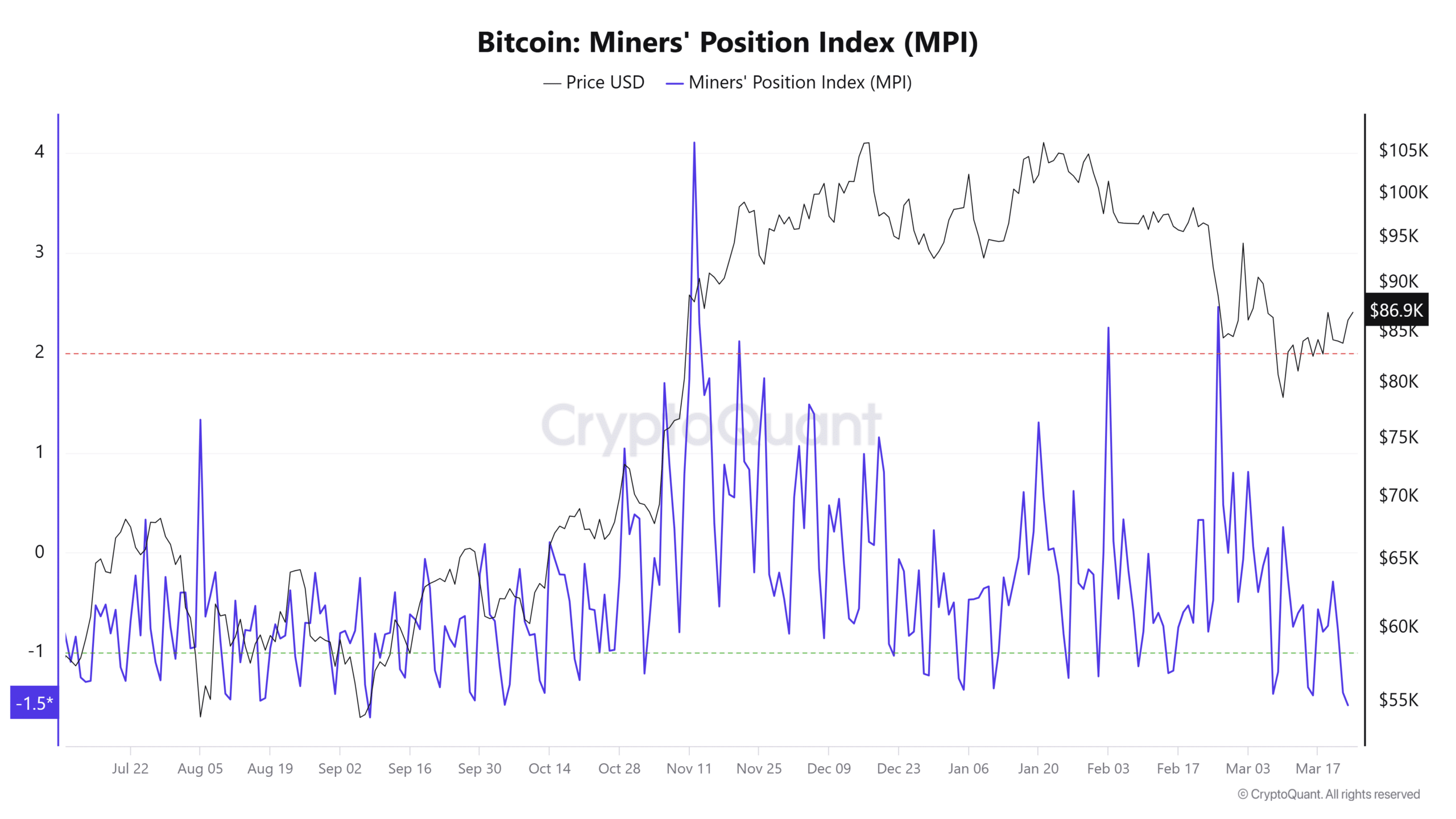

Buying activity in the market suggests Bitcoin’s momentum could continue growing. This is supported by the Miner’s Position Index (MPI), which indicates whether miners are buying or selling based on token movement.

Currently, the MPI has turned negative, dropping as low as -1.5, meaning miners have stopped selling and are accumulating Bitcoin—a signal that could trigger a rally in the coming trading sessions.

Alongside miners, U.S. and Korean investors are adding to buying pressure, as reflected in the rising Coinbase Premium Index and Korean Premium Index, both of which remain above the neutral zone of 0.

When both metrics rise, it suggests increased Bitcoin buying activity on exchanges dominated by these regions.

Historically, these investors have played a key role in Bitcoin’s price direction, and if that trend holds, the asset could be gearing up for a major upward move.

Derivative traders aren’t silent

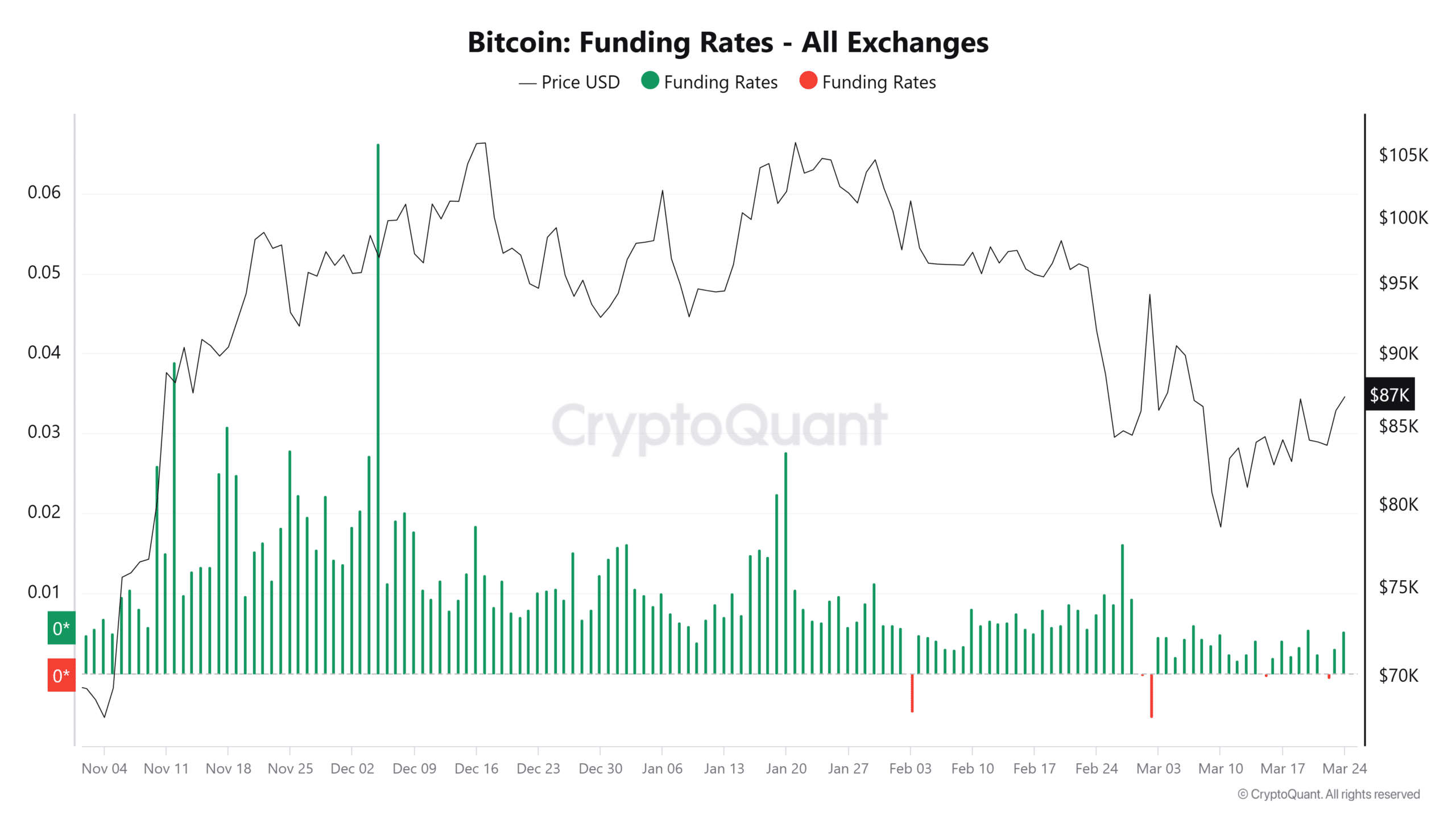

Derivative traders are also responding to Bitcoin’s recent 24-hour surge, with the aggregated Funding Rate across multiple cryptocurrency exchanges rising.

The Funding Rate determines which side of the market pays a premium to maintain price parity between the spot and Futures markets. Currently, longs are paying the fee, confirming their commitment to the bullish trend.

If the market continues aligning with this bullish phase, Bitcoin could rally toward the $95,000 region, where a major supply level awaits.