Bitcoin SV — Can the $50 level prevent further pullback?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- BSV retraced to the $50 psychological level at press time.

- The Futures market demand eased, but sentiment remained positive.

Bitcoin SV [BSV] faced a major threat to its last week’s 50% gains after hitting the overhead hurdle at $60. The altcoin jumped from $33 to $58 between 16 – 22 October but quickly retraced to the $50 psychological level as of press time.

Is your portfolio green? Check out the Bitcoin SV Profit Calculator

Meanwhile, Bitcoin [BTC] made a new high of $30.9k in Q4 2023 as bullish momentum extended. But the kingcoin fronted a slight correction as at the time of writing.

Will Bitcoin SV’s pullback stop at $50?

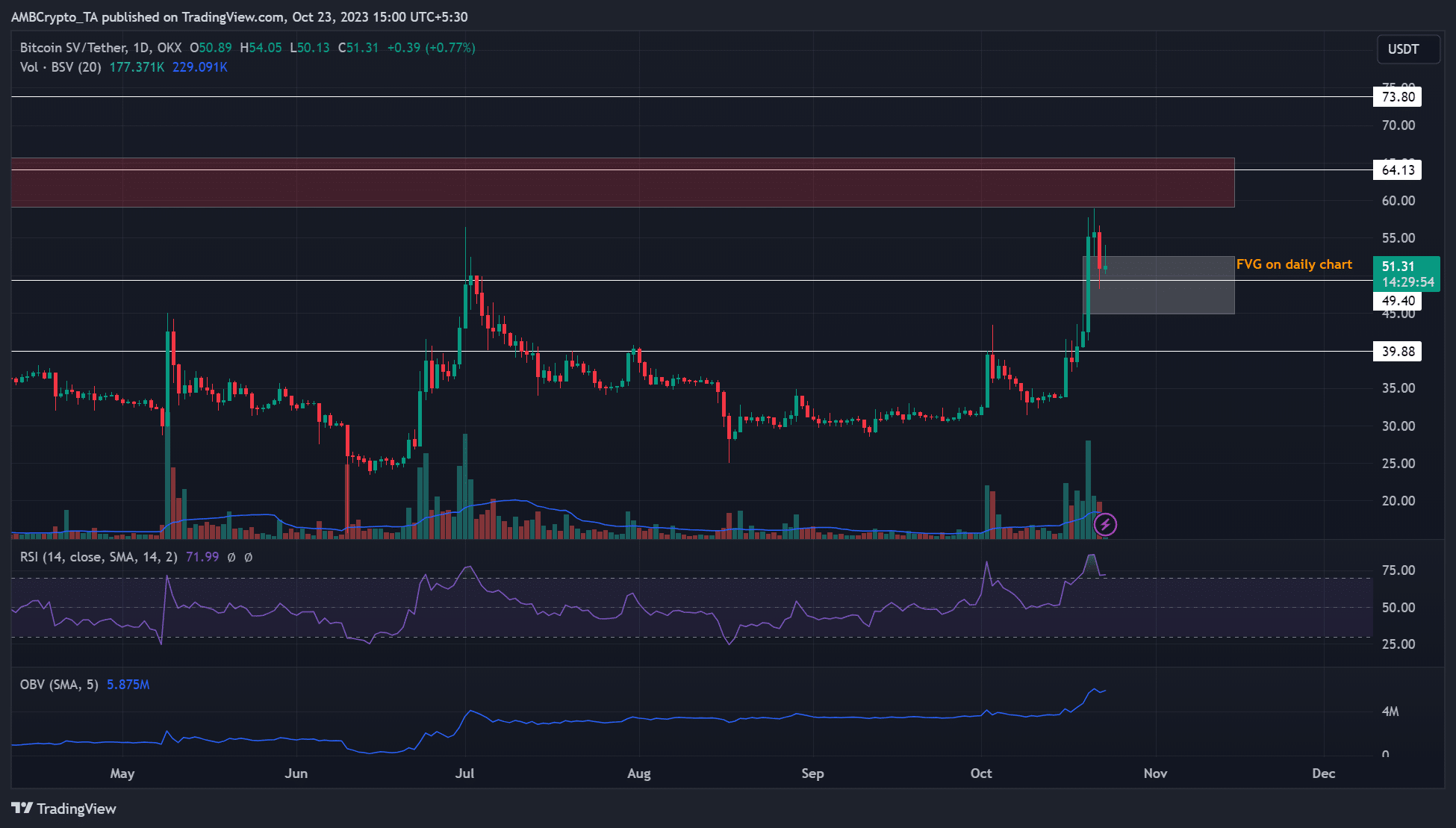

On the daily charts, liquidity existed at the marked white area of $44.90 – $52.5. Interestingly, the region aligned with the $50 psychological level, and the recent pullback eased temporarily at the confluence area.

Ergo, the confluence area could slow the pullback and offer buyers re-entry chances to the market. If so, the bullish target will be the immediate overhead hurdle and bearish order block (OB) of $59.0 – $65.68 (red) formed on 10 May 2022.

But an extended drop below the Fair Value Gap (FVG) could drag Bitcoin SV to the $40 mark or lower.

However, buying pressure was still high, as shown by the Relative Strength Index’s (RSI) overbought condition at the time of writing.

Besides, the Spot market’s demand for BSV spiked over the last week, as shown by On-Balance Volume’s (OBV) uptick. But, the flat movement showed a slight wavering in demand in the past few hours before press time.

Open Interest rates dipped slightly

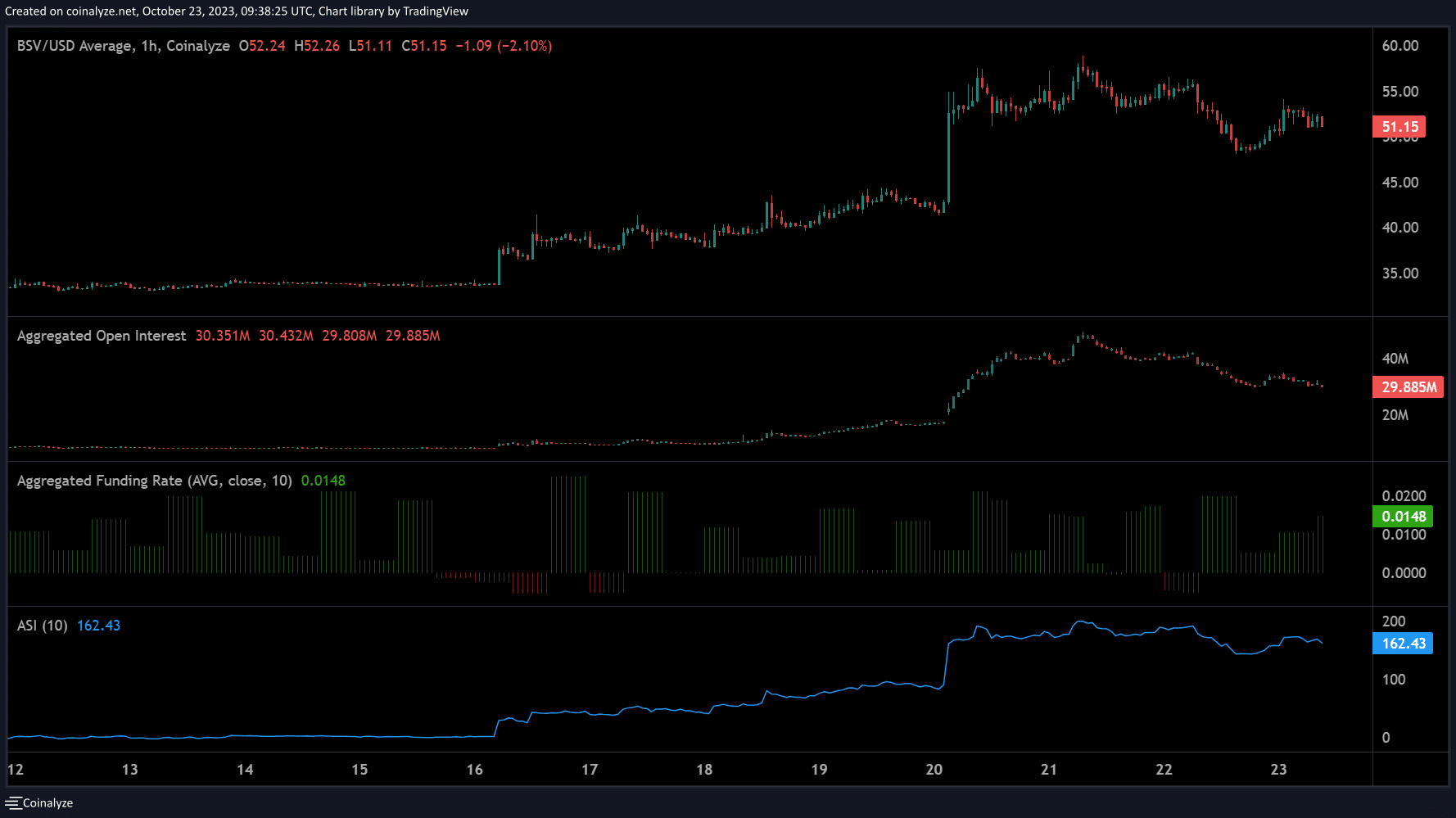

The demand in the Futures market dropped from $47 million to >$30 million at press time, as shown by the dip in Open Interest (OI) rates. The demand drop captured the recent pullback.

How much are 1,10,100 Bitcoin SV worth today?

However, the overall investment sentiment was still positive, as demonstrated by the positive funding rates. In addition, the long-term price trend was firmly in an uptrend, as indicated by the Accumulative Swing Index (ASI).

Based on the above indicators, BCH could attempt to defend the $50 psychological level.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)