Bitcoin, Tether on-chain data may suggest increasing institutional activity

Since China’s Xi Jinping embraced blockchain technology last month, discussions regarding its effect on the cryptocurrency community have been taking place left, right and center. CoinFund analyst Devin Walsh is one of those to lead such a discussion, with the analyst recently taking to Twitter to discuss his analysis of Bitcoin and Tether’s on-chain data, an analysis meant to see if new users had been on-boarded onto the crypto-space, after Jinping’s declaration.

According to on-chain intelligence source TokenAnalyst, there had been 169,000 transactions worth 475,000 BTC during Chinese waking hours, while 175,000 transactions worth 962,000 BTC took place outside of waking hours, following Xi’s announcement.

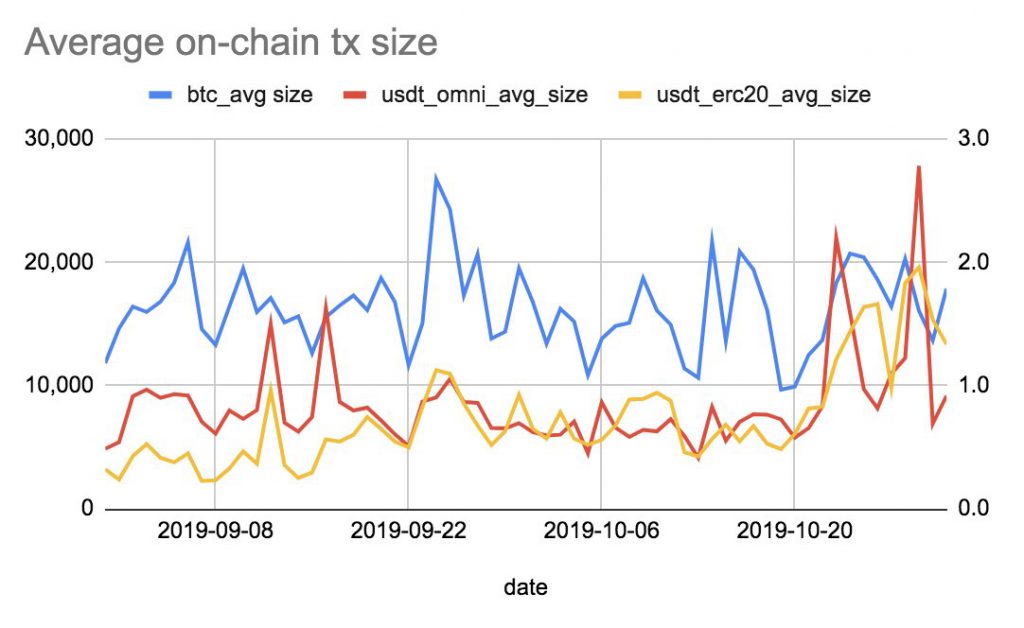

According to Walsh however, on-chain data does not suggest new members entering the space, adding that the increase in transaction sizes could be a sign of institutional action. He also noted that the number of addresses sending and receiving Bitcoin and USDT, along with the number of distinct transactions for these assets, has remained relatively stagnant since.

Walsh also mentioned that only on-chain transaction volume for USDT had increased since the announcement, citing data collected by TokenAnalyst

“Even after adjusting volume data for a 300M Omni–> ERC-20 USDT swap on Oct 29, we still see a large increase in average tx size for USDT.”

Source: TokenAnalyst

Consequently, the CoinFund analyst claimed that on-chain data pointed towards the fact that larger volume transactions had been happening, while the number of distinct transactions and the number of senders & recipients, remained stagnant. According to Walsh, this indicates that the transactions are more likely driven by larger institutional players, rather than retail users.