Bitcoin: These 3 metrics are important to keep track of

Bitcoin and its network’s hash rate took a huge blow when China “banned” mining in the country. This decision’s impact could be long-lasting and while it did affect the investors, it was the miners who in a way suffered the most. But now the miners’ situation seems to be getting better as the “The Great Migration” is seemingly coming to an end.

1. The Bitcoin Network

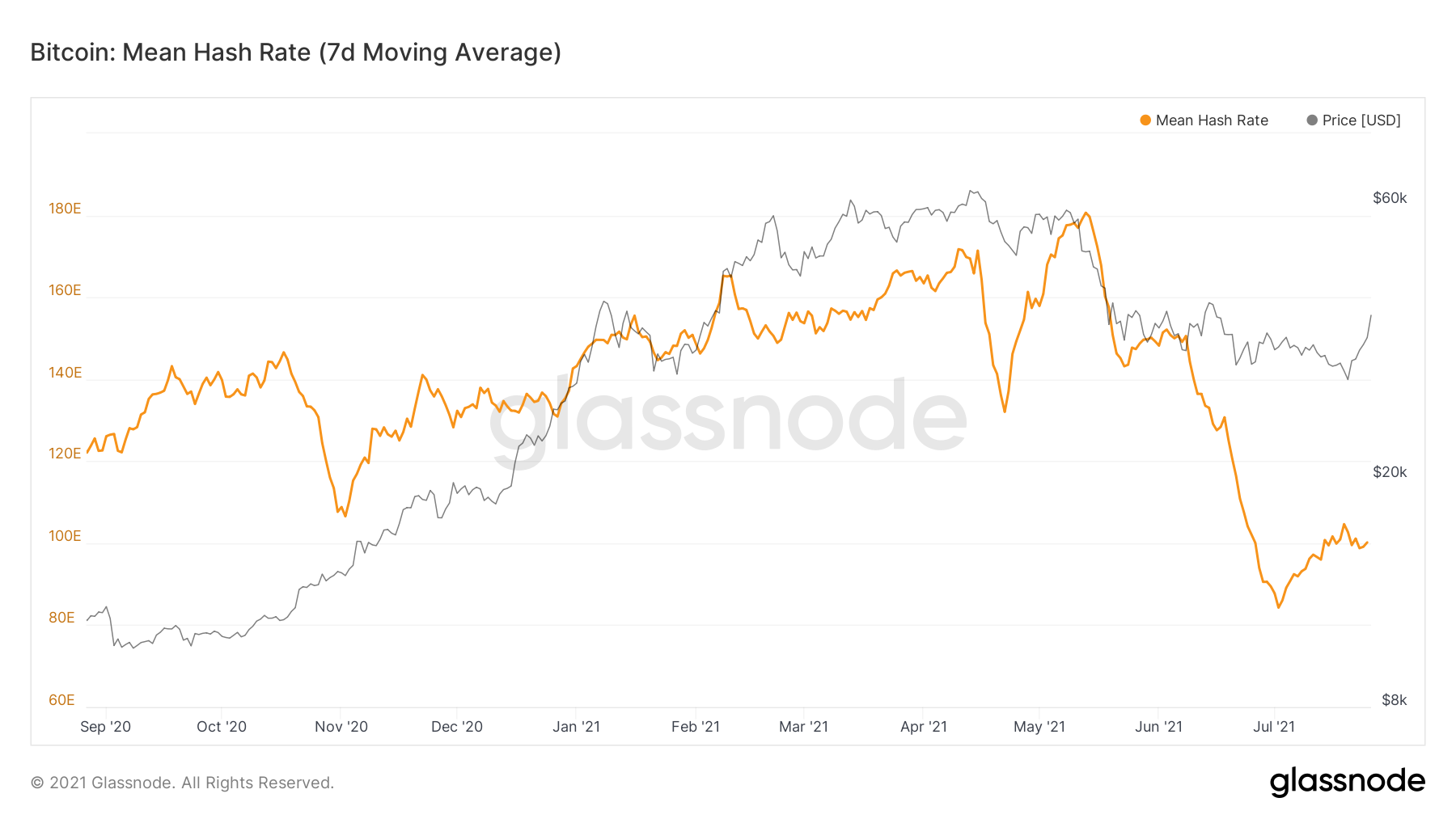

The adverse effects of China’s mining ban were observed on the miners when they were forced to look for options out of the country to keep their businesses running. This drop in hash rate between June and July worsened conditions for the already worried investors. However, at the moment these miners seem to be making a comeback as the hash rate is finally rising at a steady rate.

Bitcoin hash rate | Source: Glassnode – AMBCrypto

The improving hash rate is a sign of the miners who shut off their machines coming back to the network by relocating to a more profitable location. The 19% increase also comes in soon after the news of Black Rock Petroleum Company, a Nevada-based corporation, announced a Bitcoin mining agreement. This contract talks about the company operating 1 million mining machines, with the first 200,000 being set up in Alberta, Canada.

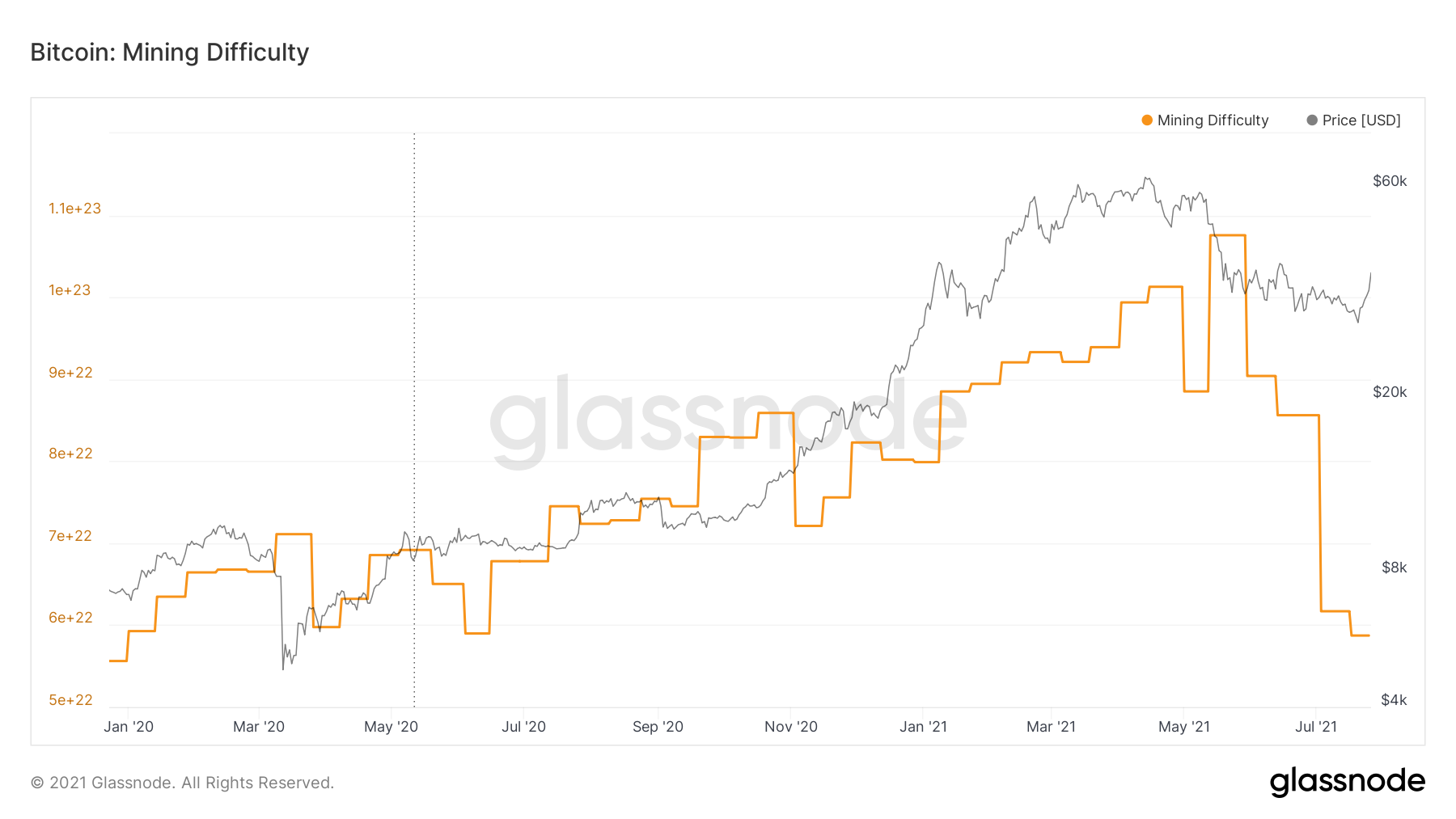

2. Mining Difficulty

However, the shift isn’t complete yet as only a section of the absent miners are back. It will be a while before the network is back to its pre-crash hash mining levels. A complete recovery will be confirmed when the mining difficulty goes back up to the pre-ban range. Currently, mining difficulty is at an 18-month low, however as the miners resettle difficulty levels would recover as well.

Bitcoin mining difficulty | Source: Glassnode – AMBCrypto

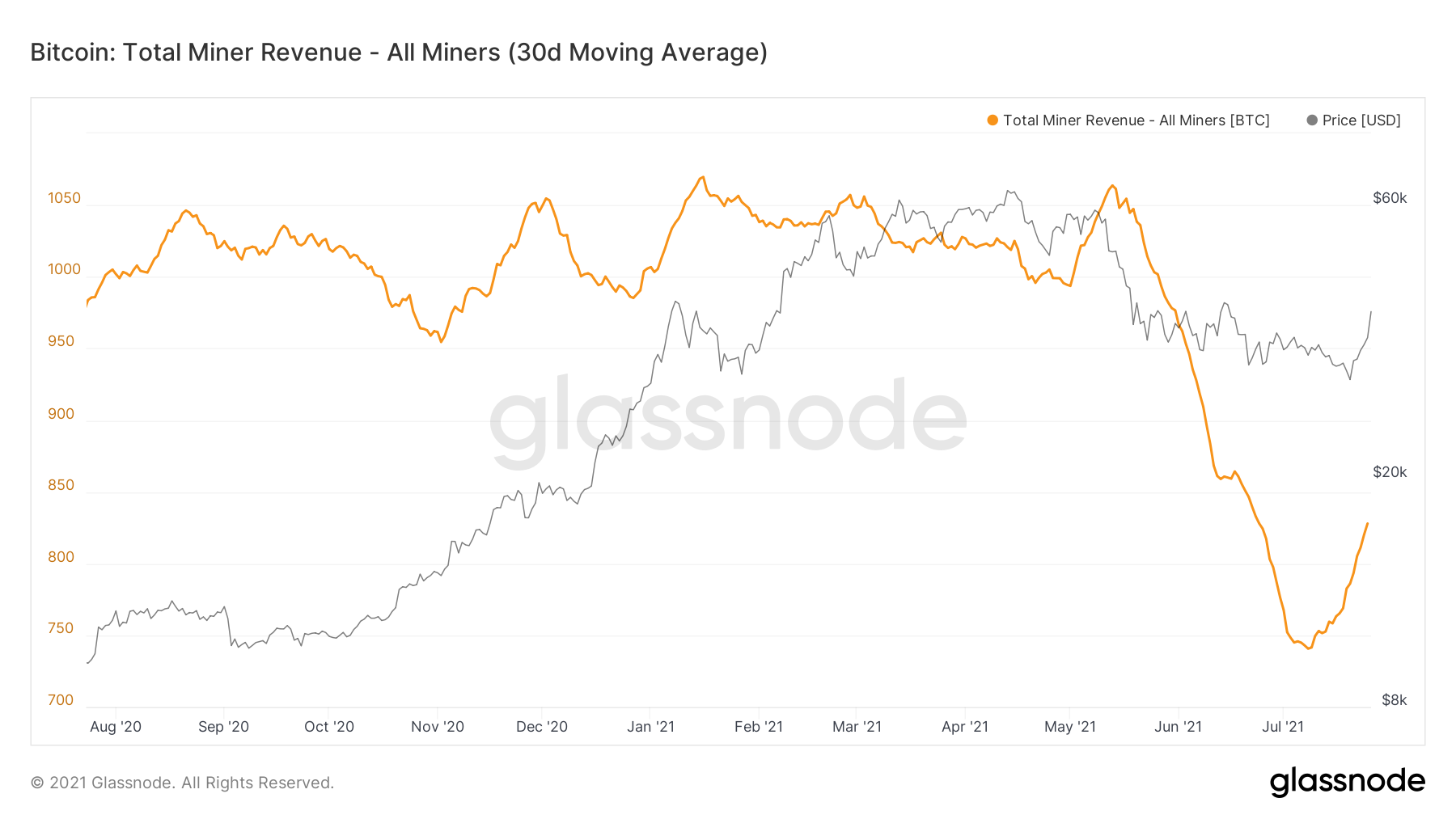

3. Miners making profit

With the improving network conditions, miners’ wallets (the ones which hold money) are also getting heavier. On a 30-day SMA, rising miner revenues can be observed. Since the beginning of this month, a portion of the fallen revenue has been recovered and the trend was seen to be keeping pace. This is an indication that not only are the investors in a good spot at the moment, but the miners are too.

Bitcoin miner revenue | Source: Glassnode – AMBCrypto

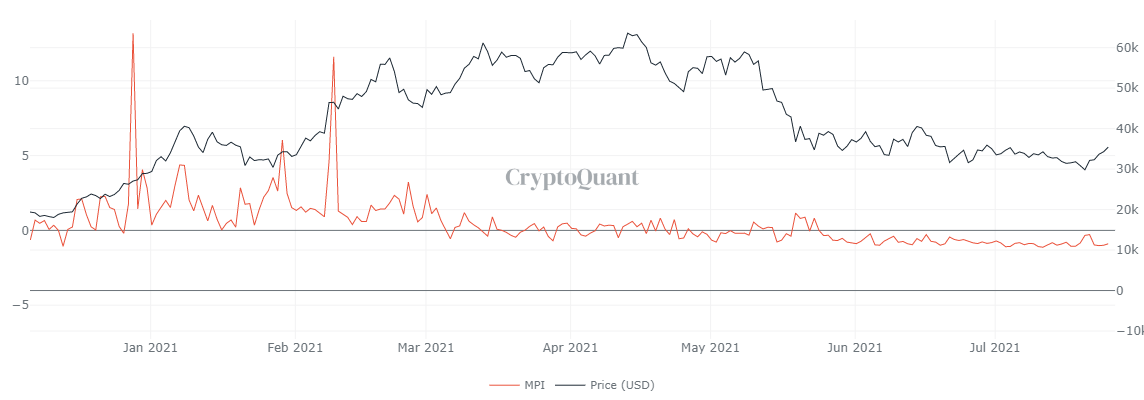

Additionally, this rise in revenue is accompanied by the strong accumulation witnessed on the on-chain metrics. Miners continue to HODL and accumulate additional BTC as the selling pressure continues to fall. According to the miners’ position index, selling pressure is at a yearly low since vales above 2 are the threshold for selling. This accumulation makes sense as the 30.25% price rise BTC witnessed in the last 1 week only makes their Bitcoins more profitable.

Bitcoin miner’s position | Source: Glassnode – AMBCrypto

Thus, the above-mentioned metrics are a strong sign of profits in the market at least in the short term. Rising hash rate and miner revenues are also a good sign for the Bitcoin market.