Bitcoin – THIS could be the breakout setup that changes everything!

- Traders piled into Bitcoin ahead of strong U.S. jobs data, triggering a $100 million Binance volume spike.

- Despite macro factors, analysts see rising altcoin momentum and potential for a broader crypto breakout.

Traders rushed into Bitcoin [BTC] ahead of the U.S. jobs report, betting big on a continued rally.

Over $100 million in net taker volume poured in on Binance alone, just before the data surprised to the upside. Now, with the Fed likely to hold rates higher for longer, crypto’s bullish momentum is facing a fresh test.

Aggressive Bitcoin buying on Binance

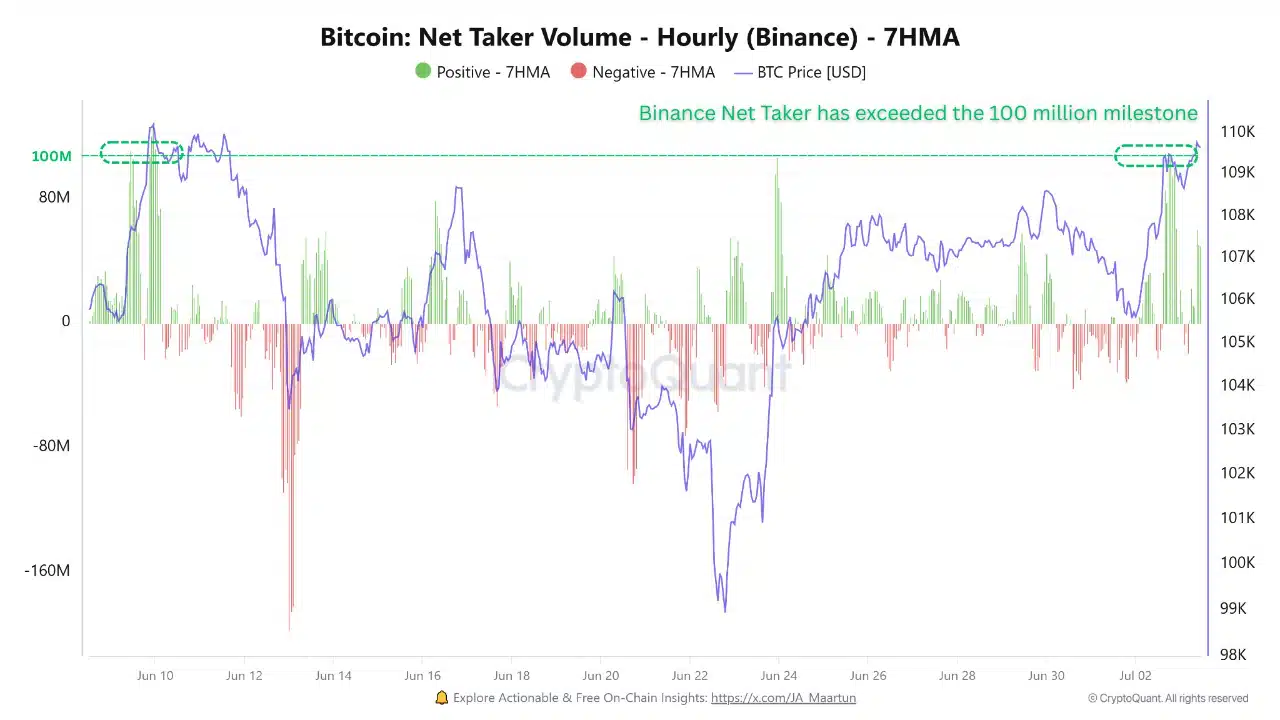

Bitcoin’s Net Taker Volume on Binance spiked sharply above the $100 million threshold in the hours leading up to the U.S. Nonfarm Payrolls report, as shown in the chart below.

Net Taker Volume shows the difference between market buys and sells; so this surge means traders were aggressively placing buy orders, not waiting on dips.

The timing is key: the buildup happened just before the data release, suggesting speculative positioning tied to macro expectations.

The pronounced green bars and steep rise in BTC price show classic FOMO behavior, with traders chasing momentum ahead of a potentially market-moving catalyst.

According to Matt Mena, Crypto Research Strategist at 21Shares, risk-on sentiment was evident across broader markets.

He highlighted that S&P 500 Futures were close to all-time highs and that Bitcoin appeared range-bound between $108,000 and $110,000, positioned for a potential breakout.

Mena stated,

“Perhaps most tellingly, Bitcoin dominance has dropped by 3% in recent days to 62% – a signal that the altcoin market is beginning to show signs of life.”

Jobs report for upside

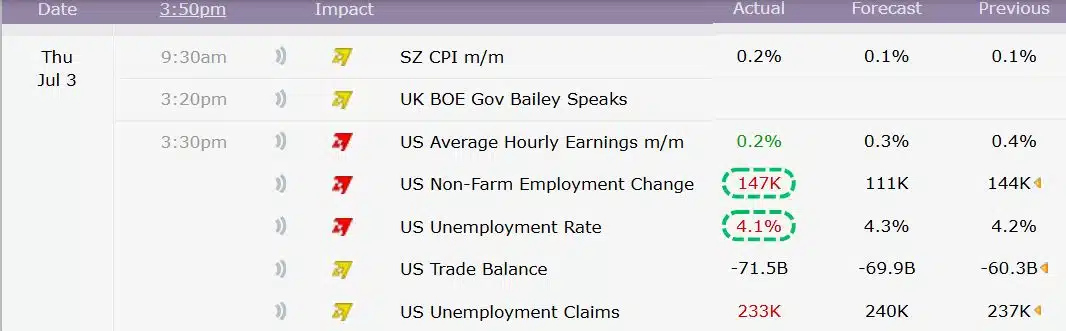

On the 3rd of July, the U.S. labor market delivered a stronger-than-expected performance. Nonfarm Payrolls rose by 147,000, significantly above the consensus forecast of 110,000 to 118,000.

Meanwhile, the unemployment rate fell to 4.1%, its lowest level since February.

These upbeat figures highlight the resilience of the U.S. economy and suggest that the Federal Reserve may hold off on easing monetary policy in the near term.

As a result, traders quickly adjusted their rate expectations: Fed funds futures now show a 95% probability that the central bank will keep rates unchanged at its July meeting, up from 75% before the data release.

Mena noted that the combination of strong economic data, improving investor sentiment, and potential regulatory clarity could create ideal conditions for digital assets.

He added,

“For Bitcoin, that could mean a decisive breakout toward $200,000 and beyond,”

He also highlighted that altcoins could benefit even more as capital begins to rotate across the broader market.

Bitcoin bulls vs. a stronger dollar

Traders loaded up on Bitcoin before the jobs report, but the data now points to a tougher backdrop.

A strong labor market means the Fed is likely to keep interest rates high, which supports a stronger U.S. dollar.

That’s usually bad news for Bitcoin – historically, strong jobs numbers and fewer rate cuts have pressured crypto prices.

So while bullish bets are rising, the macro environment could work against them, creating a risky setup for traders. Mena concluded that a runway is forming, saying,

“With labor markets stable, inflation cooling, and liquidity on the horizon – both traditional and digital risk assets are responding accordingly.”