Bitcoin – This falling metric could be the key to Ethereum, Solana price rallies

- Top altcoins like Ethereum, Solana, and BNB registered major gains over the last 24 hours

- However, metrics and technical indicators weren’t all bullish

Bitcoin’s last 24 hours have been productive, with the cryptocurrency climbing back above $63,000 on the charts. As expected, most of the market’s altcoins followed suit, with their charts seeing green as well. However, the latter’s performances fueled a fall in Bitcoin’s [BTC] dominance. In fact, it hit such a critical level that a fresh altcoin season could be right around the corner now.

Altcoin season is here

Captain Faibik, a popular crypto-analyst, recently shared a tweet highlighting an interesting development. As per the same, Bitcoin’s dominance is now moving inside a rising wedge pattern. What this means is that the chances of BTC dominance falling over the coming days are quite likely. This would be a positive sign for altcoins as their market cap is likely to surge then.

Mags, another famous crypto-analyst, also shared a tweet mentioning a historical event. The tweet stated that in 2020, the altcoin market was in an accumulation phase. That ended in the second half of the year, kick-starting a massive bull rally.

The analyst believes a similar trend can be seen this time around, further increasing the chances of an altcoin season soon. If the rally happens, then altcoins’ market capitalization can be expected to hike dramatically.

A look at the top altcoins

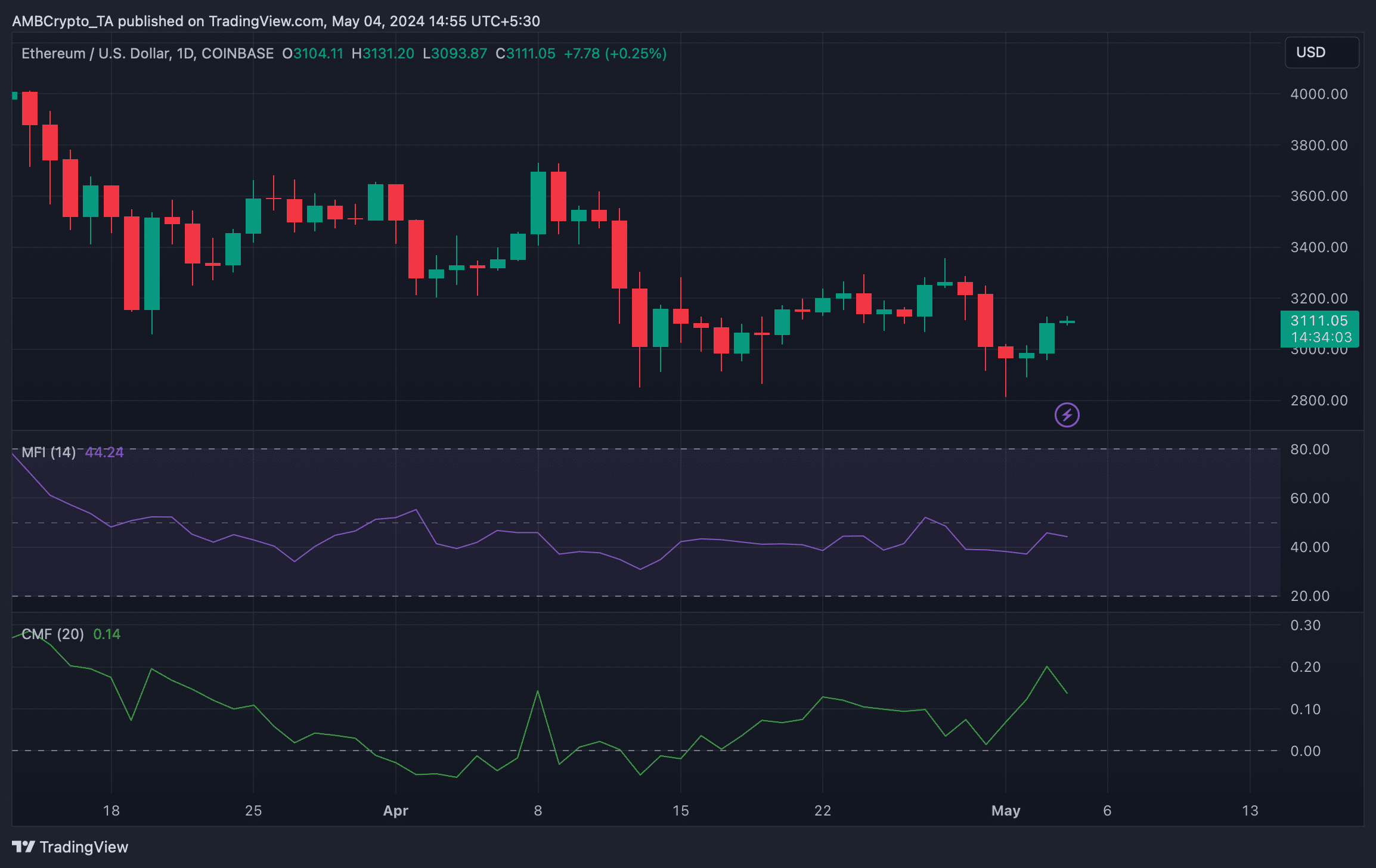

To see whether altcoins are preparing for a rally, what better way than to check the performance of the top alts? According to CoinMarketCap, Ethereum [ETH], the king of altcoins, pushed its price up by more than 4.5% in the last 24 hours. At the time of writing, it was trading at $3,111.72 with a market cap of over $373 billion.

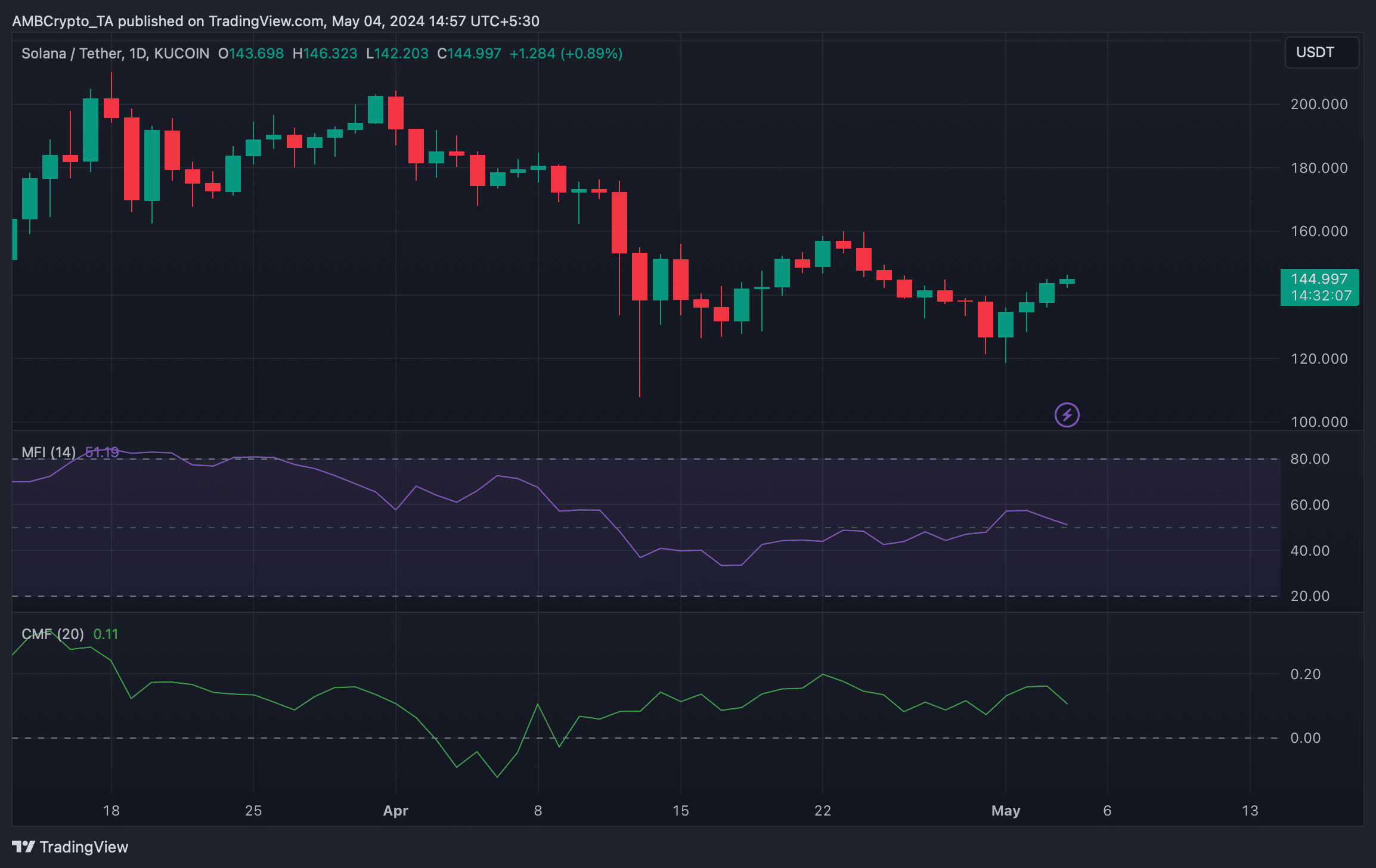

Like ETH, BNB and Solana [SOL] also turned bullish as their values surged by 3.6% and 5%, respectively. At press time, BNB was trading at $586, while SOL’s value rested at $145.2.

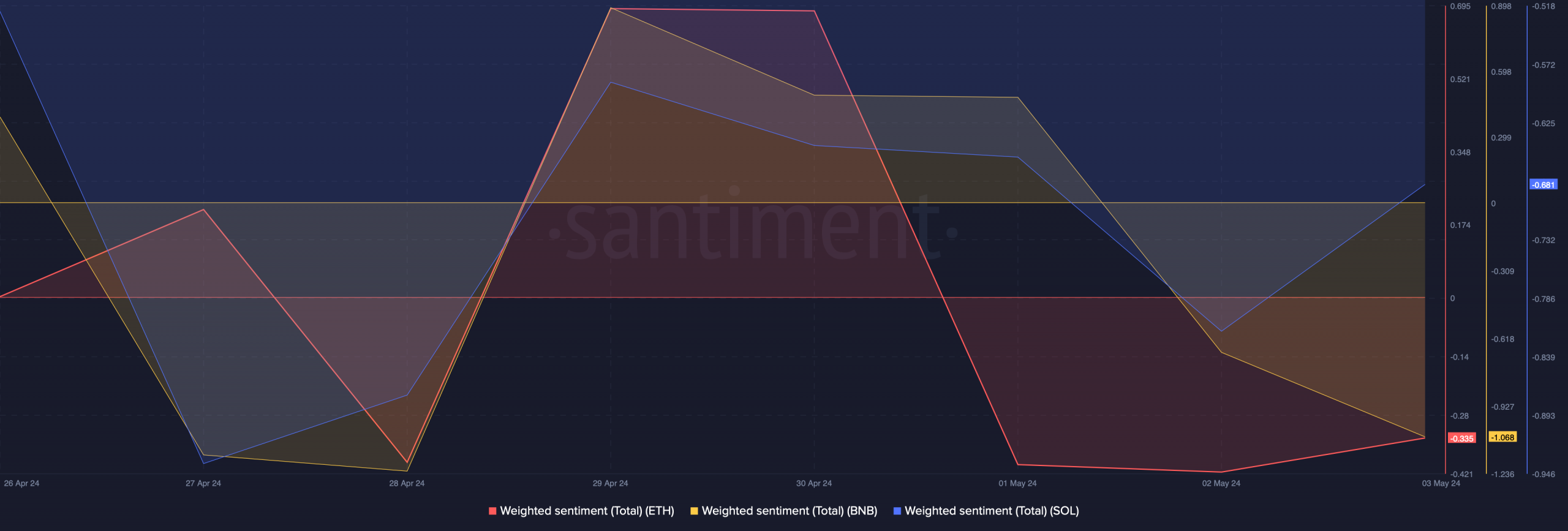

However, it was surprising to note that despite the recent price upticks, investors’ confidence in these top altcoins remained low. AMBCrypto’s analysis of Santiment’s data revealed that ETH, SOL, and BNB’s weighted sentiments all remained in the negative zone.

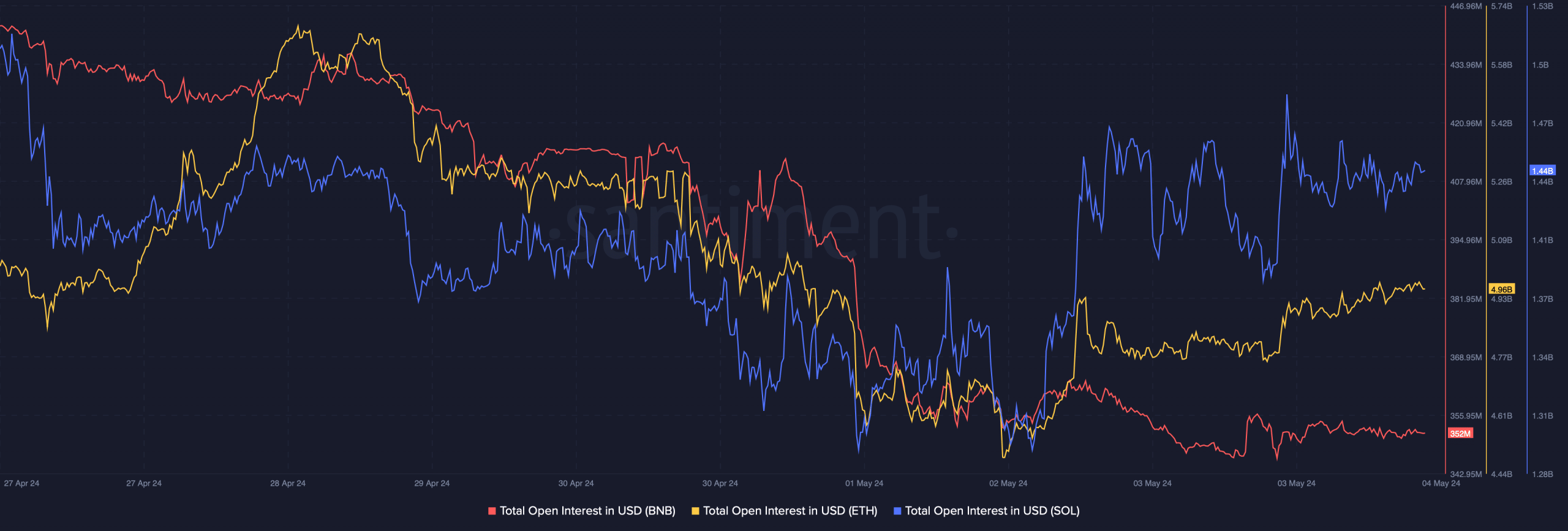

However, the good news was that Ethereum’s open interest rose slightly along with its price. A rise in this metric is usually a sign that the prevailing price trend is likely to continue.

SOL’s open interest took ETH’s lead as it registered an uptick as well. On the contrary, the same for BNB fell, despite its price recording an uptick on the charts.

AMBCrypto then analyzed ETH’s daily chart to see whether it could sustain its bull run. We found that its Money Flow Index (MFI) went sideways after an uptick, while its Chaikin Money Flow (CMF) moved south.

These suggested that investors might not see ETH’s price rise explosively in the short term.

Read Ethereum’s [ETH] Price Prediction 2024-25

Similarly, Solana’s technical indicators looked pretty bearish too. Both its MFI and CMF went south, indicating that the token’s rally might not last.

Considering these data sets, it will be interesting to see how soon a fresh altcoin season comes along.