Bitcoin to $50K? Why whales will have role to play either way

Bitcoin price has been stuck moving sideways for the fourth day after rallying vertically on 27 March. The consolidation phase without volatility is soon going to end with BTC exploding again. But this time, reaching for a level that has not been tagged roughly three months.

Bitcoin bulls to wake up soon

On 21 March, Bitcoin’s price retested the 50-day Simple Moving Average (SMA) and formed a swing high at $40,516. This base set the precedent, allowing BTC bulls to trigger a 19% ascent that shattered through the 100-day SMA that was hovering at $42,386.

While this up move was impressive, it faced resistance at the 200-day SMA at $48,323 and has been consolidating below it for the fourth day. The sideways movement indicates a lack of volatility or a coil-up that eventually leads to a volatile breakout.

Therefore, sidelined investors need to be prepared for another leg-up that pushes through the 200-day SMA and tags the $50,000 psychological level. Moreover, the constant buy pressure from Terraform Labs sets bullish precedence with the retail investors, which multiplies the buying pressure.

Regardless of the underlying reason, market participants can expect Bitcoin price to not just retest the $50,000 psychological level but make its way toward the significant hurdle at $52,000.

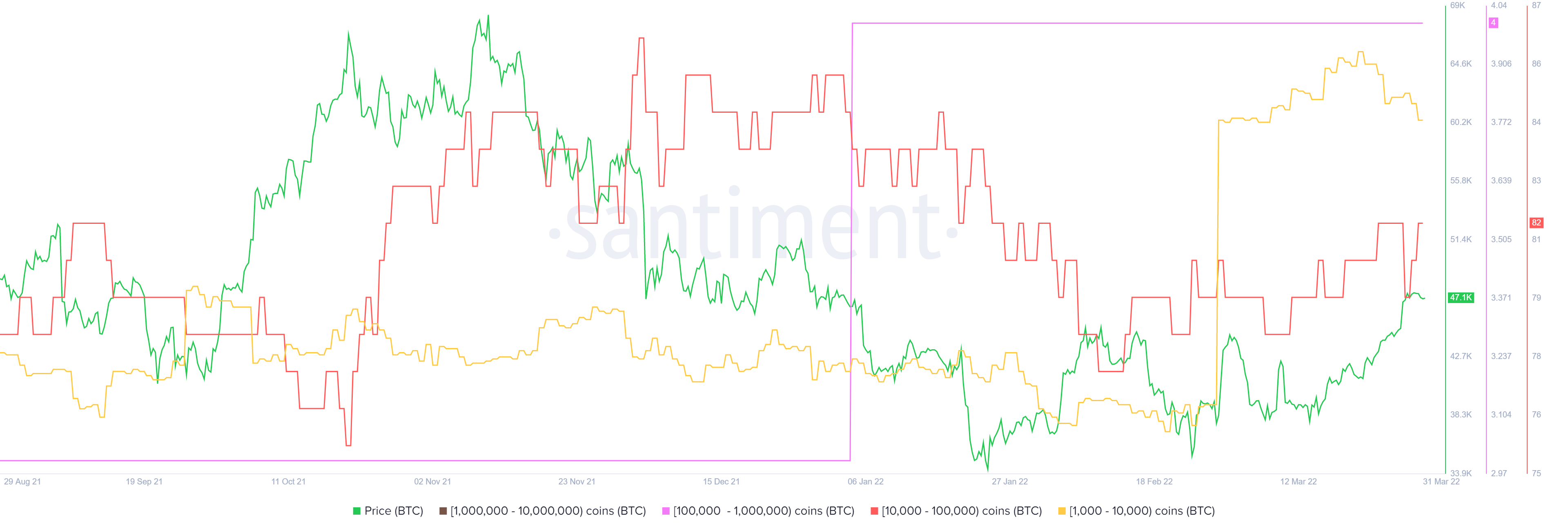

Supporting the outlook for Bitcoin price is the uptick in the number of whales accumulating BTC tokens. This buying the dip activity has been going on since August 2021. High network investors holding between 1,000 to 10,000 BTC tokens have increased from 2069 to 2181, denoting a net increase of 112 such investors.

Similarly, institutions holding between 10,000 to 100,000 BTC have increased their numbers from 79 to 82, while those holding one million to 10 million BTC have spiked from three to four.

This massive accumulation from high net worth investors, whales, and institutions paints all but one picture – Bitcoin price is ready for higher highs.

While the technical and on-chain metrics are both indicating a bullish outlook for Bitcoin price, a crash in the traditional markets could turn this setup bad. In such a case, BTC is likely to retrace to the immediate support level at $45,000.

In a highly bearish case, the $42,000 foothold could be retested by sellers, where sidelined buyers could come crawling out of the woodwork and prevent a further crash.