Bitcoin

Bitcoin to hit new ATH? Look out for these new metrics!

Bitcoin may have depreciated, but it’s not out of the game yet.

- Volume of large transactions by whales and investors surged by 7.85%, indicating a bullish outlook

- At press time, 55% of top BTC traders were holding long positions, while 45% held short positions

Bitcoin (BTC), the world’s largest cryptocurrency by market cap, is poised for an upside rally after recording an 8% price decline in recent days.

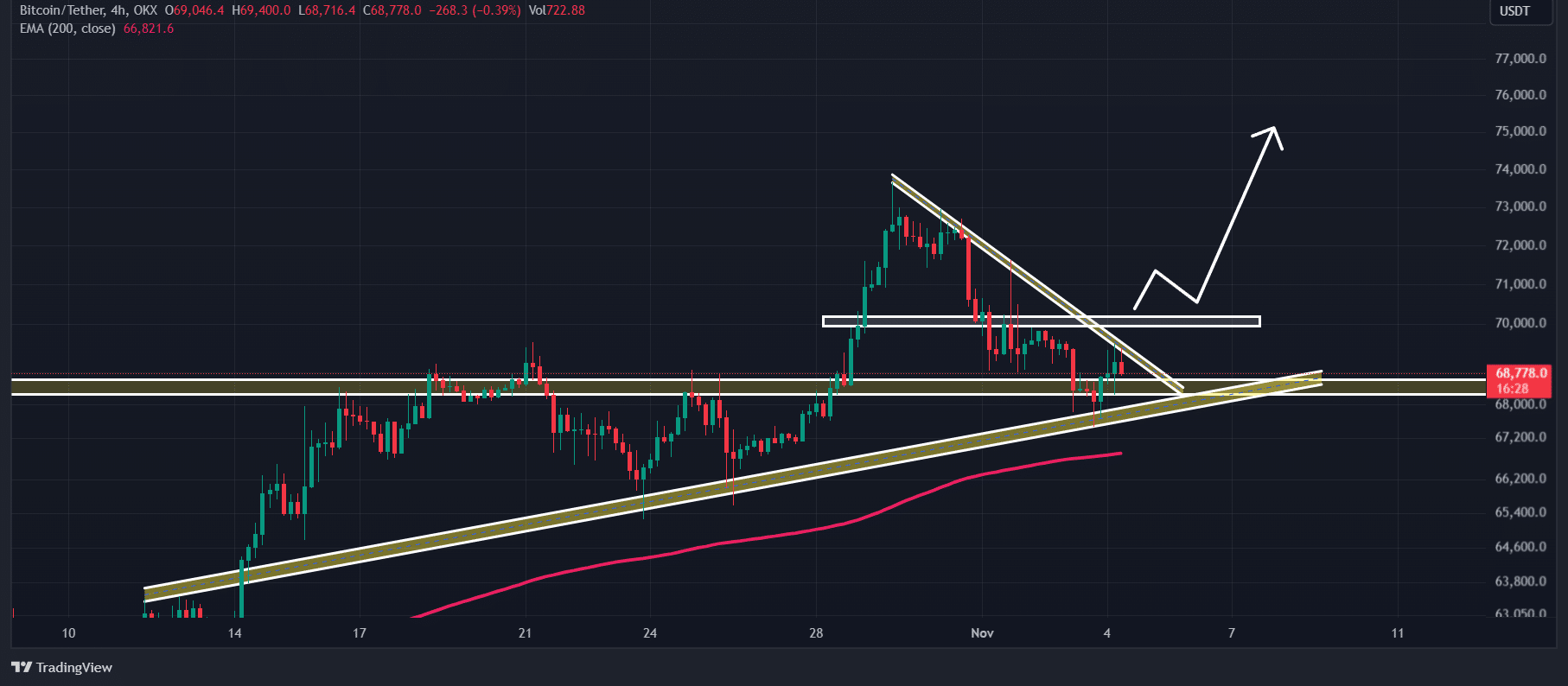

Following a breakout from the descending channel pattern on 28 October, BTC soared by more than 8%. However, the most-recent decline appears to be a price correction – A positive sign for the upcoming rally.

Bitcoin price analysis and key levels

According to AMBCrypto’s technical analysis, the cryptocurrency seemed to be facing resistance from a declining trendline on the four-hour timeframe. If Bitcoin does register an upside rally, there is a high chance that the asset could breach this aforementioned hurdle.

If BTC breaches this trendline and closes a four-hour candle above $70,000, there is a strong possibility the asset could soar significantly. Potentially to hit a new all-time high in the coming days.

However, this bullish thesis will only work if Bitcoin maintains support above the $67,500-level. Otherwise, it may fail.

At the time of writing, BTC seemed to be trading above its 200 Exponential Moving Average (EMA) on both the four-hour and daily timeframes, indicating an uptrend.

BTC’s bullish on-chain metrics

Looking at this bullish outlook, it appeared that whales and investors have increased their participation. According to the on-chain analytics firm IntoTheBlock, BTC’s large transaction volume surged by 7.85% over the past 24 hours. This could help drive the asset’s price higher.

Additionally, BTC’s Long/Short ratio had a value of 1.20, underlining strong bullish sentiment among traders. Meanwhile, its Open Interest rose by 2.9% over the last 24 hours, indicating growing interest and the formation of new positions from traders.

Based on an analysis of Coinglass data, 55% of top traders held long positions, while 45% held short positions.

Price performance

At press time, Bitcoin was valued at $69,100, after appreciating by nearly 1.1% over the last 24 hours. During the same period, its trading volume skyrocketed by 45%, indicating heightened participation from traders and investors.