Bitcoin to retest $70K? Here’s what to expect before July ends

- Bitcoin neared the crucial $70,000 mark on the 29th of July, where the price previously saw rejection.

- Strong technical indicators and renewed sentiment favored additional gains ahead of July’s monthly close.

Bitcoin [BTC] is off to a good start this week after a strong performance on the 29th of July, which pushed prices towards $70K.

The flagship crypto rose past $69,000 sharply, posting a seven-week high of $69,851, per CoinMarketCap data. At press time, Bitcoin was trading only -5.76% below its March all-time high of $73,750.

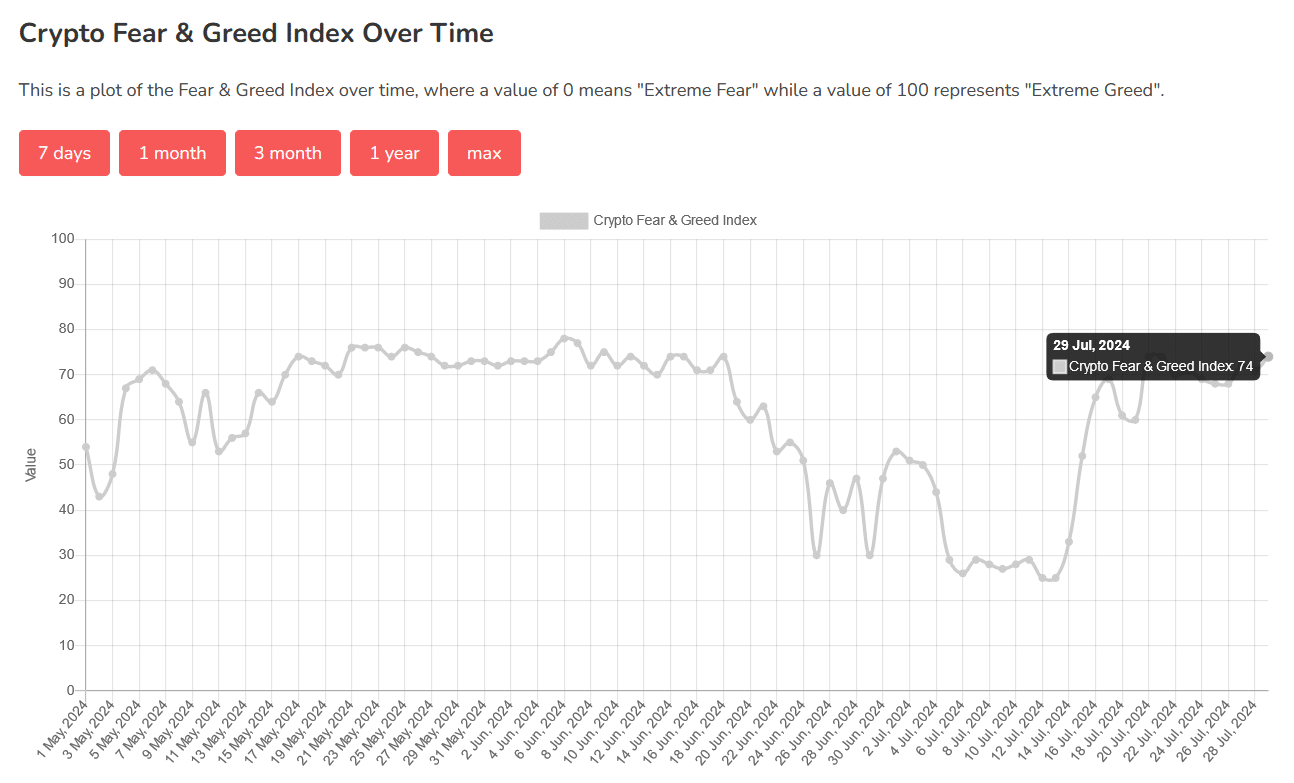

Meanwhile, the Crypto Fear & Greed Index has continued hovering in the ‘Greed’ zone, reaching 74/100 at writing — 22 points higher since the 15th of July.

Following the spirited fight, which gave bulls last-minute relief, Bitcoin managed positive, albeit meager, 0.22% returns in the concluded week.

So far this month, the leading crypto has tracked 9.2% in monthly gains per Coinglass data.

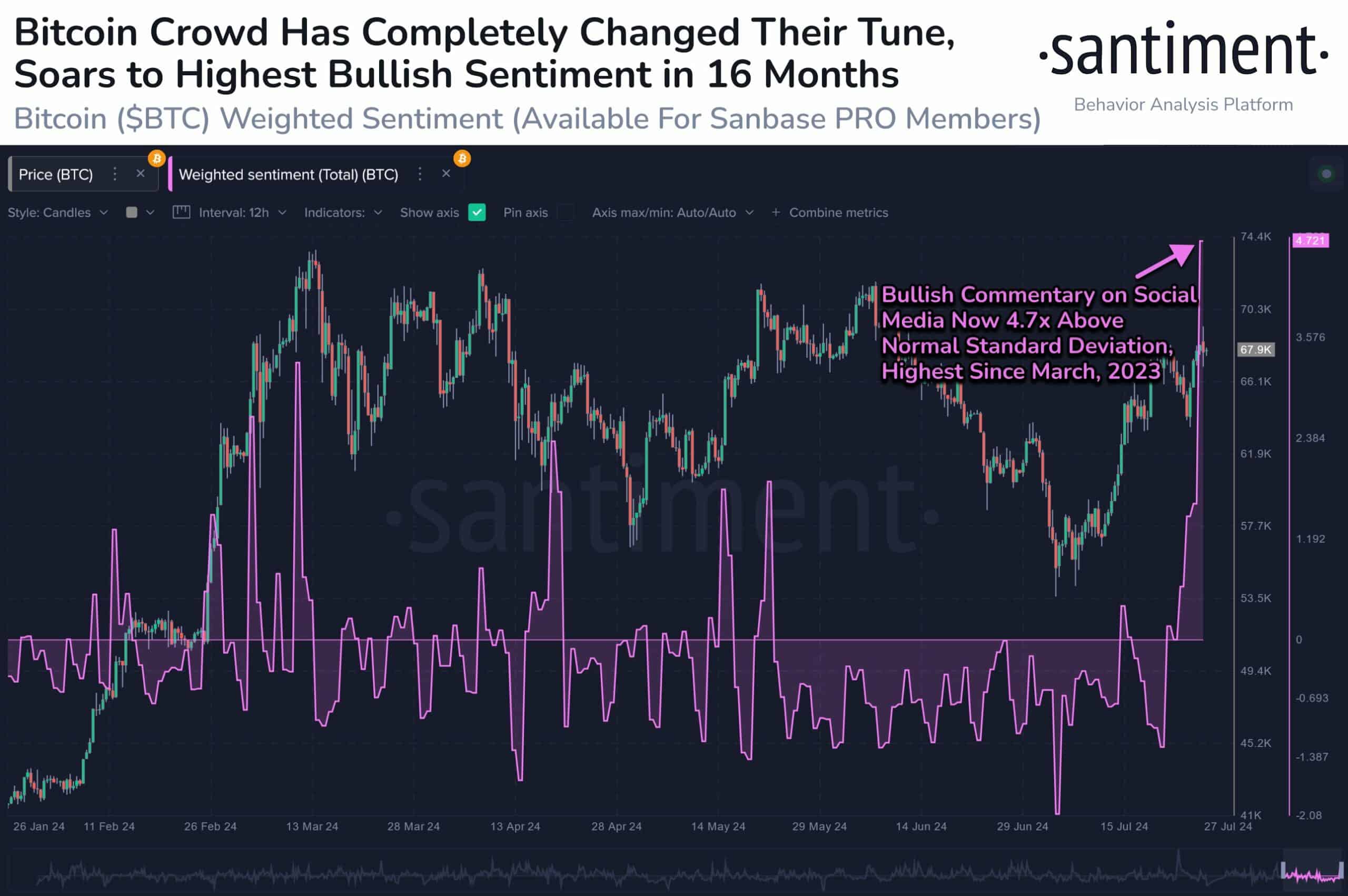

Renewed positive sentiment

Market intelligence platform Santiment observed that Bitcoin’s price rebound in the last three weeks has made speculators even more optimistic than at the start of the month.

The latest upside momentum comes on the back of the Bitcoin 2024 Conference, which concluded in Nashville on the 27th of July.

Presidential candidates Donald Trump and Robert F. Kennedy Jr. spoke highly of cryptocurrencies and both committed to establish a strategic Bitcoin reserve for the U.S.

Macro influences

The bigger macro picture favors risk assets, including cryptocurrencies, but traders need to keep an eye on macro events this week, which could spark flash volatility.

Federal policymakers are set to communicate an interest-rate decision after the anticipated Federal Open Market Committee (FOMC) meeting on the 31st of July, with expectations leaning towards the interest rates remaining unchanged.

The FOMC decision will be key in shaping the monthly close for Bitcoin, which has historically delivered positive returns in July.

10X Research wrote in a research post dated the 28th of July,

“While we expect an eventual breakout, Bitcoin will likely need ‘macro’ help in the form of projected Fed rate cuts or another dose of lower inflation […] The FOMC meeting on July 31 and the US CPI report on August 14 will be critical.”

This week also marks the end of 100 days after the fourth Bitcoin halving event, which saw block mining rewards cut to 3.125 BTC from 6.25 BTC on the 20th of April.

Halvings are considered bullish, and data from past cycles shows that prices start accelerating after around 100 days.

BTC/USDT technical analysis

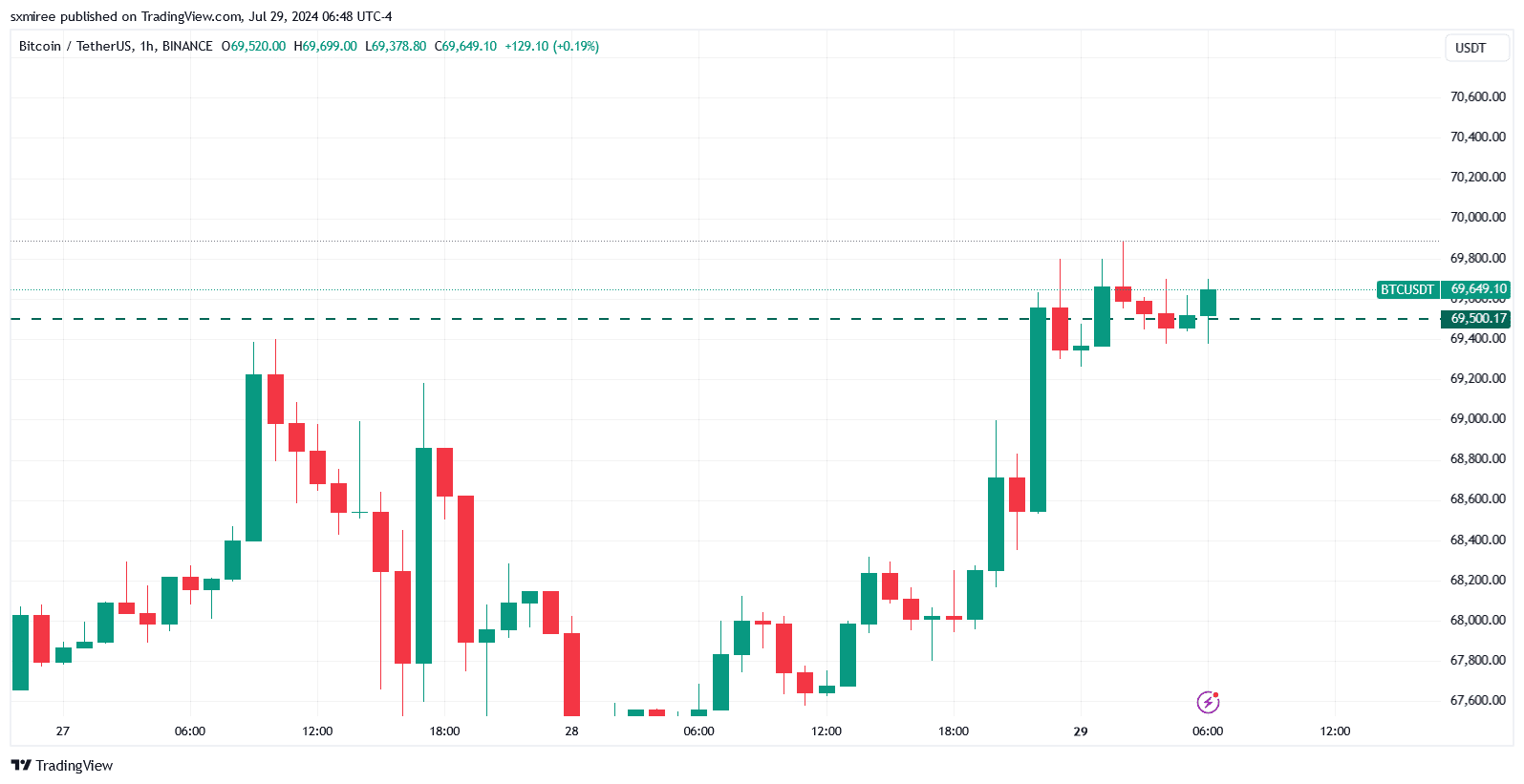

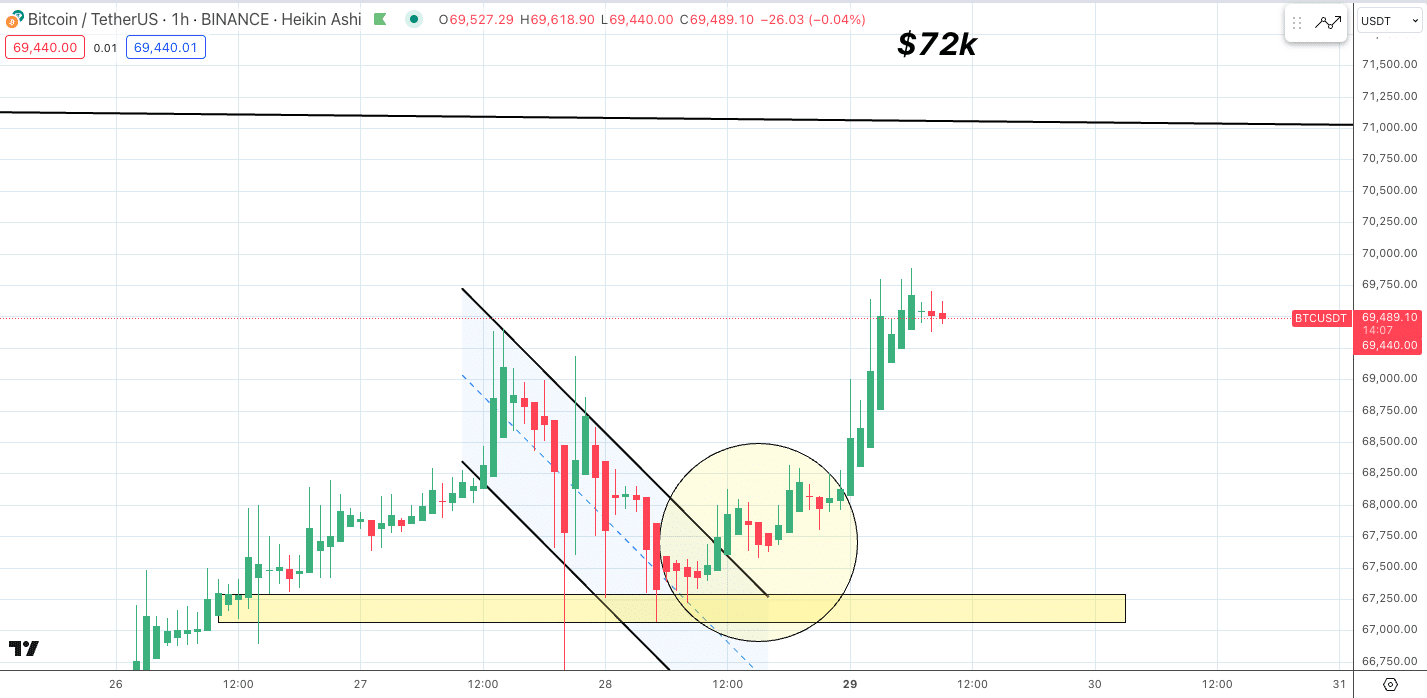

Bitcoin saw selling near its intraday high of $69,850 as indicated by the long candle wicks on the hourly chart.

Clearing the hurdle at $70,000 would bring in sight the $72,000 level, which pseudonymous futures trader Satoshi Flipper said is “programmed,” in an X (formerly Twitter) post on the 29th of July.

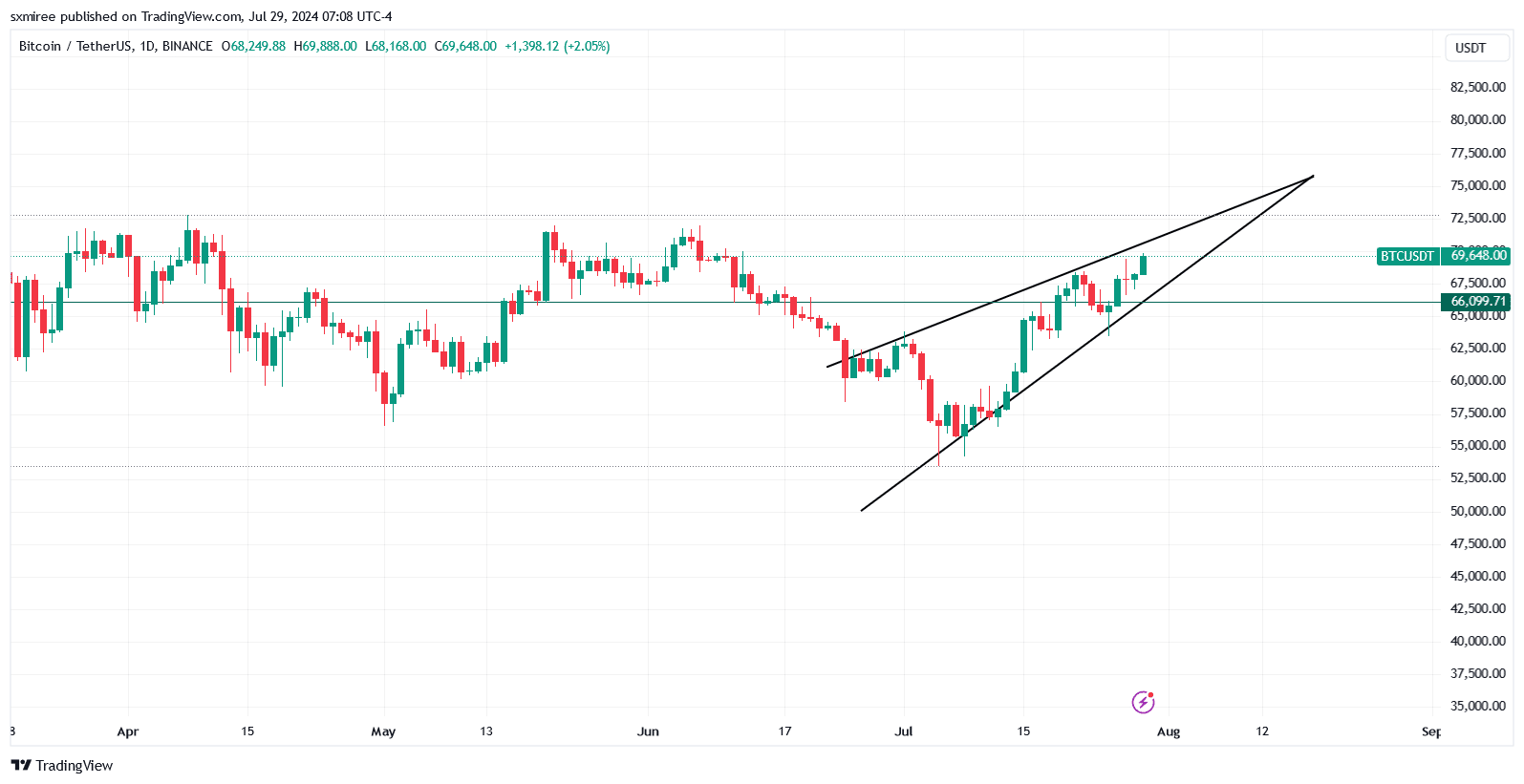

The analyst was referencing a bullish descending channel on the daily chart.

Source: X

A rising wedge on the daily chart also signals a potential rally toward $74,000, where the extrapolated pattern’s trend lines converge.

A breakdown below the wedge’s lower trendline, on the other hand, would trigger a correction toward the $66,000 range.

Read Bitcoin’s [BTC] Price Prediction 2024-25

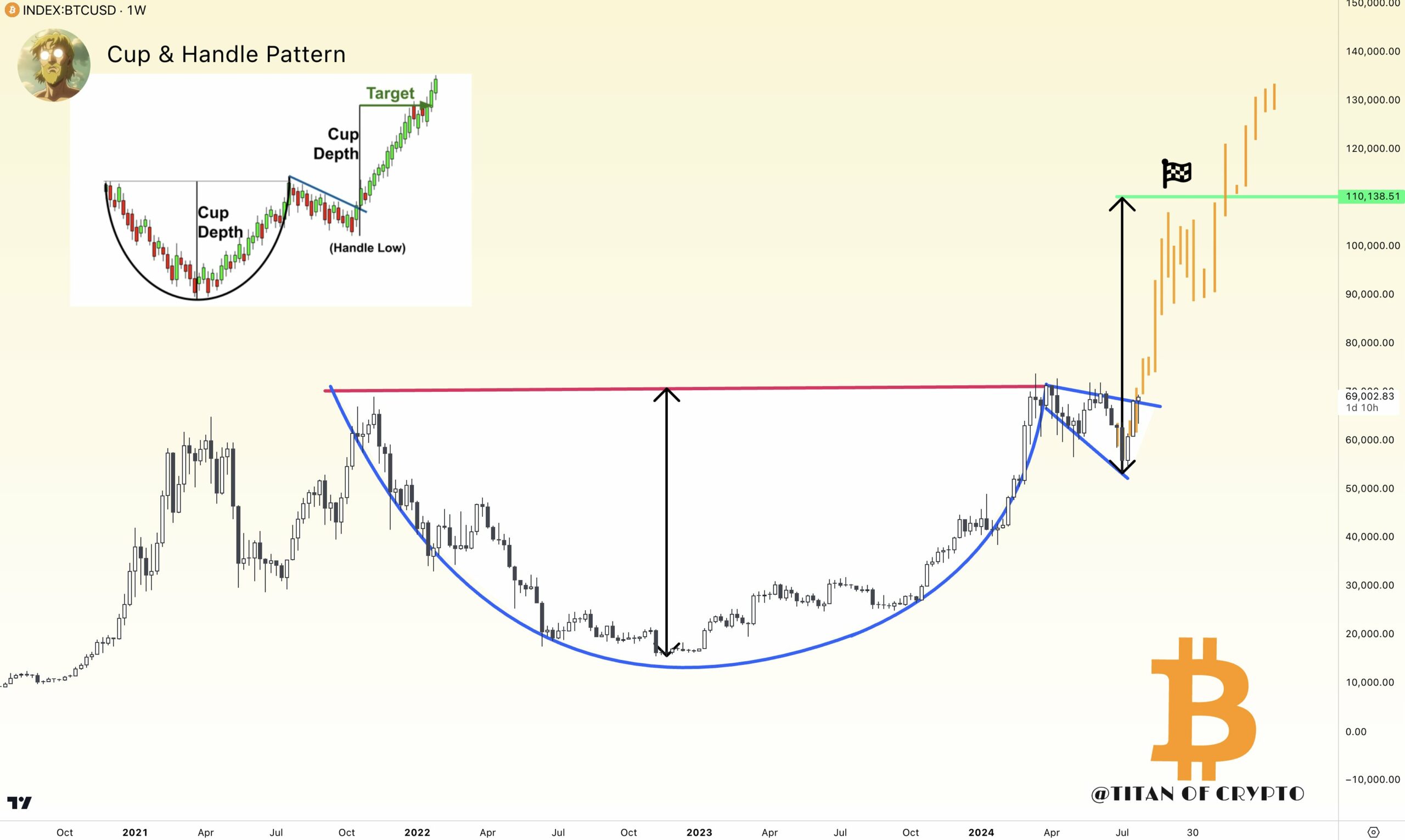

In the larger timeframe, BTC/USDT appears to be charting a new trend outside a cup and handle chart pattern.

Source: X

A successful “breaking out from the handle” would set up Bitcoin on the path to $100,000.