Bitcoin to stay within $55k-$75K – But for how long?

- Bitcoin is predicted to stay within the $55K-$75K range.

- Mike Novogratz of Galaxy Digital suggested developments could significantly impact Bitcoin’s price.

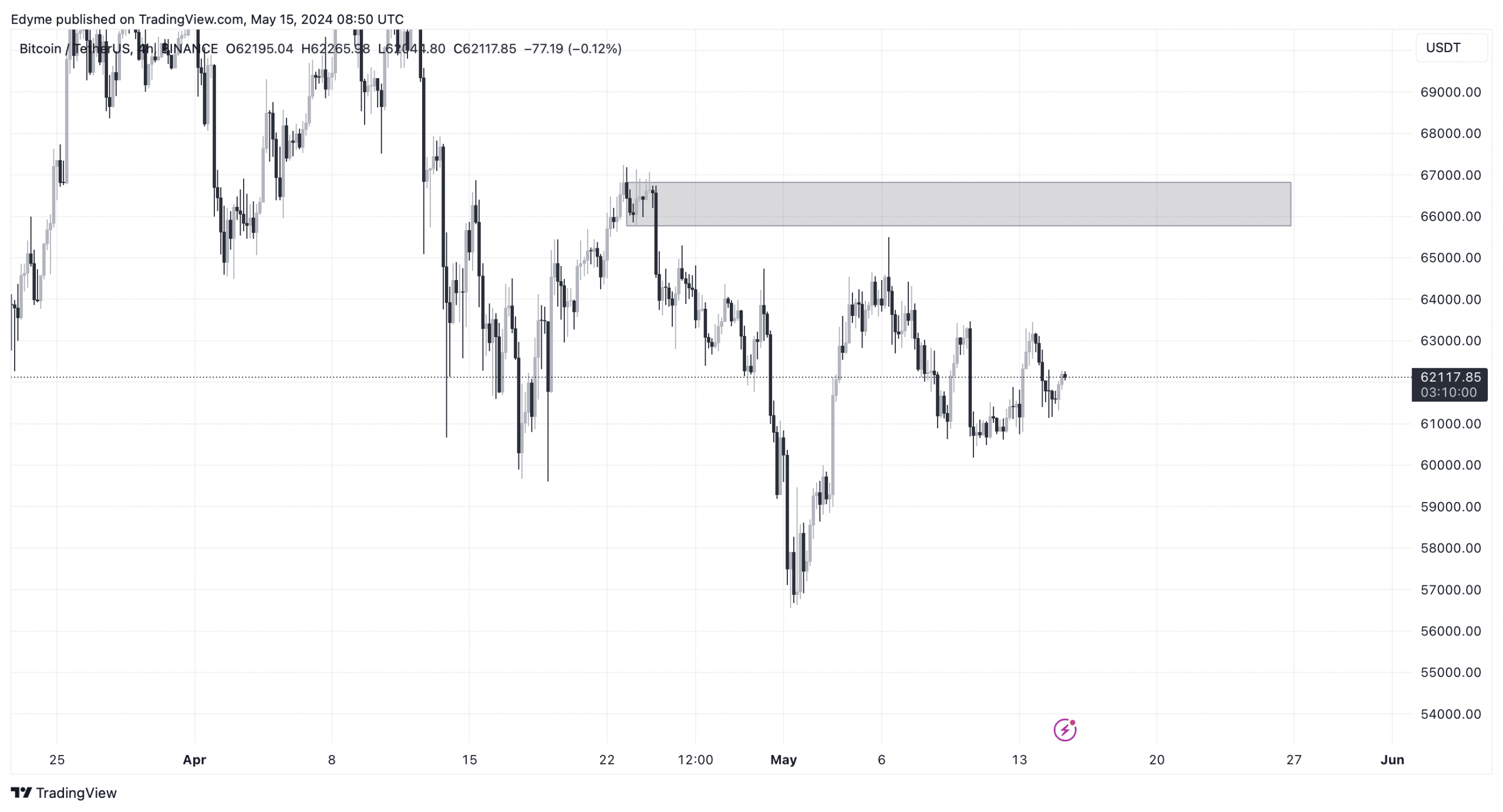

Bitcoin [BTC] has exhibited a notable steadiness, maintaining its position just above the $60,000 mark after reaching a high of over $73,000 in March.

So far, the premier digital currency has seen a slight increase of 0.4%, trading at $62,167.

This level of stability is not just a momentary phase, but a part of a broader trend that experts and analysts are closely monitoring.

Amidst a backdrop of fluctuating market conditions, Mike Novogratz, the founder and CEO of Galaxy Digital, shared his insights during the company’s Q1 earnings call.

Galaxy Digital itself has been riding high on record quarterly revenue, but it was Novogratz’s predictions about Bitcoin that caught the attention of many in the industry.

He suggested that Bitcoin is likely to continue trading within the $55,000 to $75,000 range over the next month, with potential upward movement as Q2 comes to a close.

Bitcoin: Market dynamics

During the earnings call with Bloomberg, Novogratz highlighted that the crypto markets are currently in what he termed a “consolidation phase.”

This phase indicates a period where Bitcoin, along with other major cryptocurrencies like Ethereum [ETH] and Solana [SOL], will likely see their prices stabilize within the predicted range.

Novogratz’s forecast is not just based on current market behavior, but also on historical data and the anticipation of future market events that could influence prices.

This stability comes amid varying levels of enthusiasm from institutional investors, especially regarding spot Bitcoin ETFs.

While these ETFs initially saw massive demand, generating over $13.9 billion in volume in their debut week, interest has waned amidst the broader price corrections across the crypto market.

However, Novogratz remains optimistic, noting the ongoing adoption of Bitcoin by traditional financial institutions and the gradual process of integrating digital assets into mainstream financial portfolios.

Future outlook

Technical analysts have also been closely observing Bitcoin’s price movements.

AMBCrypto’s analysis suggested that Bitcoin could surge towards the $65,000 mark before any potential reversal could occur, continuing the downtrend observed on the daily charts.

This aligns with recent reports from AMBCrypto, which noted a decrease in Bitcoin’s one-day circulation to 17,600, indicating a reduction in transactional activity.

However, Novogratz believed that several catalysts could significantly impact the crypto market in the coming months.

One major factor is the potential for the U.S. Federal Reserve to cut rates if the economy shows signs of slowing.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Another is the outcome of the upcoming U.S. presidential election, which Novogratz believes will bring much-needed clarity to the regulatory landscape for cryptocurrencies.

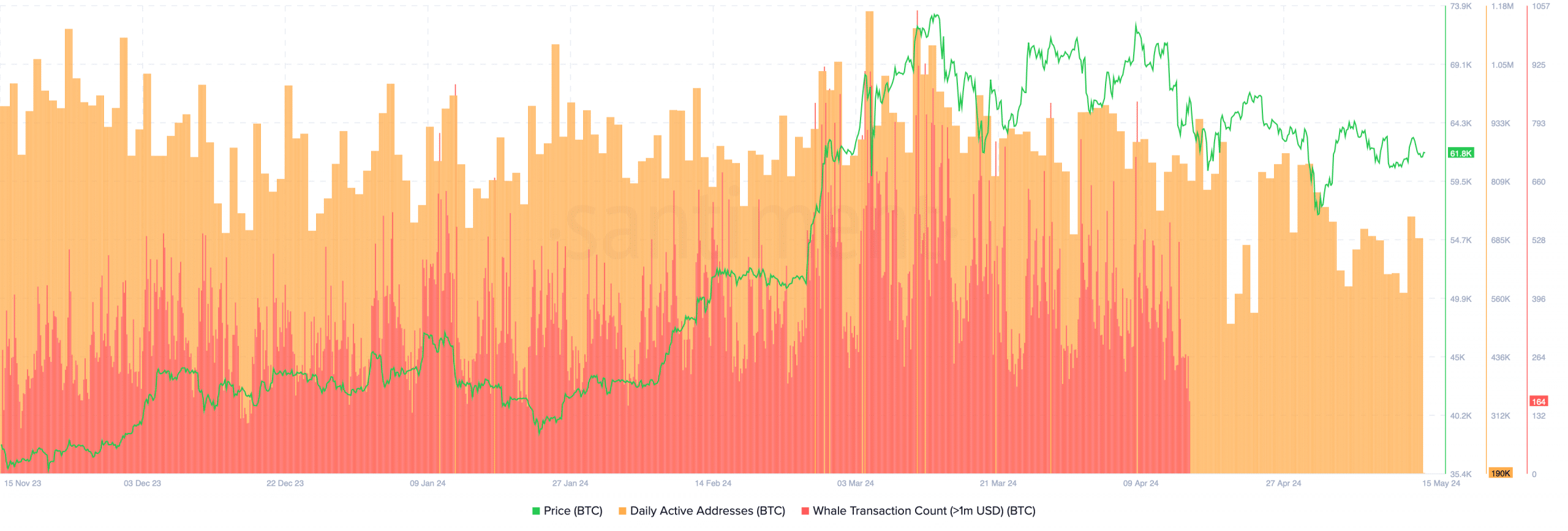

Moreover, data from Santiment indicated a decline in Bitcoin network activity, with daily active addresses and the number of large transactions both decreasing.