Bitcoin tops $87K again – Here’s what analysts are predicting from its price!

- BTC reclaimed $87k amid U.S dollar sell-offs linked to Trump’s indirect threat to Fed independence

- However, Bitcoin’s breakout was driven by low volume and may need further confirmation

Bitcoin [BTC] reclaimed $87k on the charts during an Easter rally that experts linked to a weakening U.S Dollar. This assertion was particularly highlighted by Mathew Sigel, VanEck’s Head of Digital Assets Research, in a recent note.

U.S dollar sell-off pumps BTC

Galaxy’s Head of Research, Alex Thorn, and Bitwise’s Andre Dragosch shared a similar view. In fact, Dragosch added that the US Dollar Index (DXY) hit its lowest level since 2022.

“Looks like Bitcoin is pumping on continued Dollar weakness. DXY just touched the lowest level since March 2022.”

Source: Bloomberg

According to the attached chart, Bitcoin’s price action was negatively correlated with DXY. Ergo, the DXY weakening (from $100 to $97), driven by President Donald Trump’s threat to fire Fed chair Jerome Powell, allowed the crypto to pump.

Amberdata’s Greg Madini added that Trump’s moves were a “threat to Fed independence” and Powell’s replacement would be inflationary. Magadini added that this would push gold and BTC higher.

“Next week, we have the Fed Beige Book release and multiple Fed governors speaking throughout the week. Any threats against the Fed’s independence could be a catalyst for Gold and BTC to head higher.”

Here, it’s worth pointing out that gold hit another all-time high (ATH) on Monday, marking the first positive BTC correlation after decoupling for the past few weeks.

This meant investors fled to gold and BTC as ‘safe assets’ amid tariff uncertainty. Most traders and analysts acknowledged the BTC breakout above $87k.

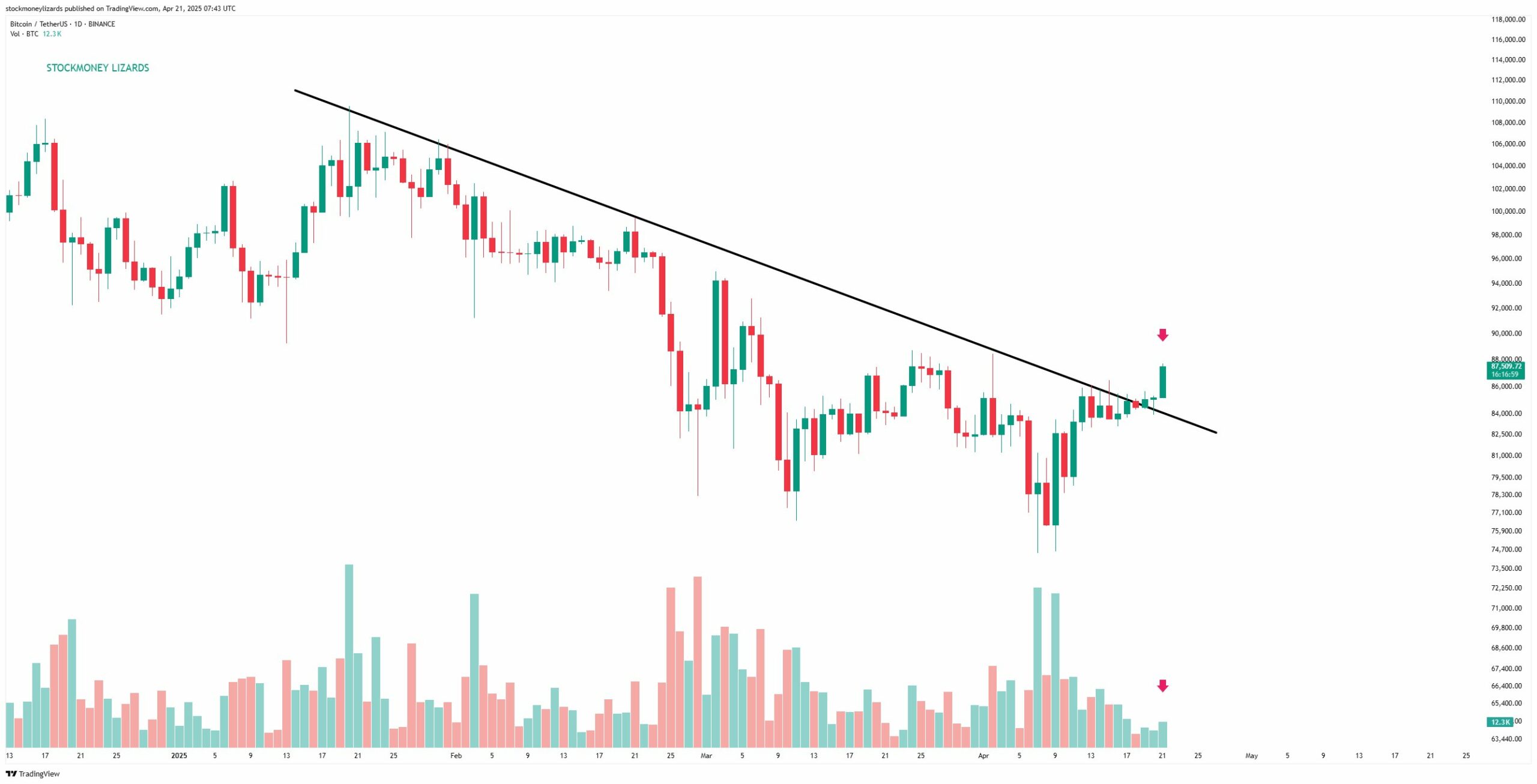

However, BTC’s pump was driven by low spot volume and it will need another confirmation during the U.S market’s opening. Pseudonymous analyst StockMoney Lizards warned,

“Nice breakout, but it’s on low volume. Will definitely need confirmation. In any case, you shouldn’t be too euphoric yet.”

For his part, analyst Matthew Hyland stated that Bitcoin’s sustained recovery will depend on clearing $89k.

“Only goal for #BTC bulls now is to break $89k, create & confirm a higher-high, and confirm an end to the downtrend.”

CryptoQuant further supported the recovery prospect, stating that prevailing price action is a normal correction, not a full bear cycle. The firm cited the On-chain Trader Realized Profit/Loss Margin metric to make this observation.