Bitcoin traders can keep an eye on these levels as BTC drops into a demand zone

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Bitcoin’s market structure was bullish on the daily chart

- Risk-averse traders can wait for Bitcoin’s reaction over the next two days before formulating their trade plans

Bitcoin dipped into an area that the bulls recently flipped to support. The weekend saw low trading volume and little volatility. The anticipation around the US Fed rate announcement meant that positive news could see a minor BTC rally.

This idea could be smashed if the economic news that comes out is even slightly negative, as that can cause a wave of panic in the market.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Since 10 November, Bitcoin has traded within a range from $15.6k to $17.6k. At press time, the king of crypto hovered near the mid-range mark. Due to the risky conditions over the next couple of days, traders can look to wait and ride out the volatility.

The confluence of mid-range and bullish breaker showed Bitcoin could see a bounce toward $17.6k

The $17.4k and $16.7k levels represent the high and the low of last week’s trading, respectively. Meanwhile, the region highlighted in cyan showed a former bearish order block that was broken on 30 November.

After being beaten, it flipped to a bullish breaker and represented a region where buyers were likely to be strong. To complement this idea, the Chaikin Money Flow (CMF) had been above +0.05 in recent days. This was at a time when Bitcoin held on to the $17k mark.

However, it was clear that Bitcoin’s strong downtrend in recent months was still unbroken. To the north, stiff resistance levels lie at $17.8k and $18.6k. The $18.2k-$18.5k also represented a zone of liquidity where the bears can look to reverse any rallies.

The Relative Strength Index (RSI) was at neutral 50 recently and the price did not have noticeable momentum on the higher timeframes. That could change over the course of this week. A move back above $17.3k would herald a lower timeframe bullish bias, and a surge past $17.8k can be used to aggressively take profit. Meanwhile, a drop below $16.6k would likely be followed by another 6% drop to the range lows.

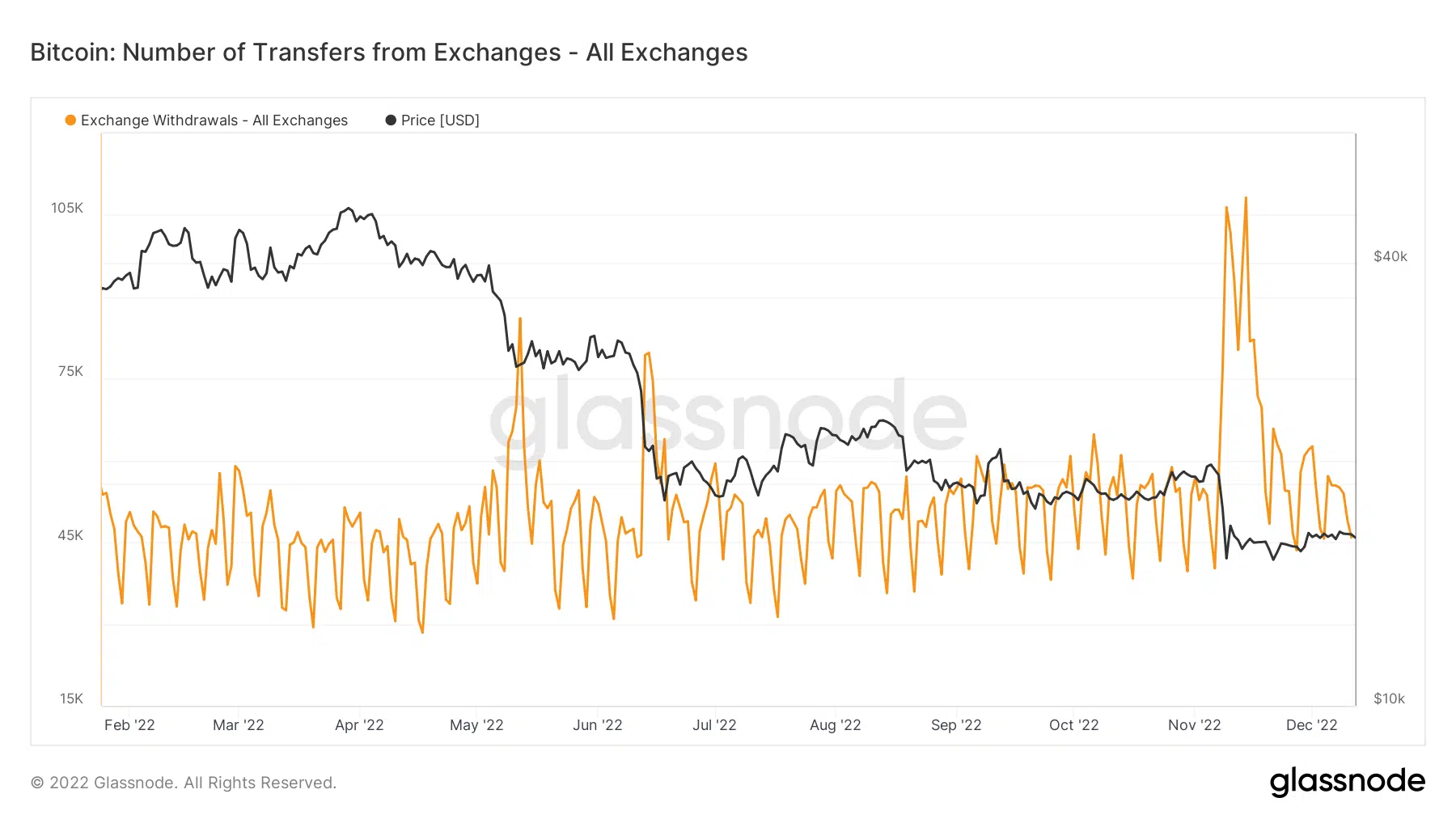

Exchange withdrawals hits yearly highs on November drop

Source: Glassnode

The total on-chain withdrawals from exchanges amounted to 106,450 BTC on 9 November. Again, on 14 November, this metric reached 108,221. Both of these values are comfortably higher than any that Bitcoin reached in 2022. Did this indicate that whales lapped up the blood on the streets following the FTX collapse?

All things considered, the bottom for Bitcoin might or might not be in. Traders and investors must still be cautious, for the higher timeframe trend was bearish. Risk management and capital preservation is extremely important, especially in the depths of a bear market.