Bitcoin trades at a discount on Binance.US after major announcement

- The latest blow by Binance.US triggered a BTC selling wave.

- The week’s events led to a steep decline in BTC exchange supply.

Bitcoin [BTC] traded at a slight discount on Binance.US during 9 June trading hours, following the exchange’s decision to suspend fiat trading channels beginning 13 June, according to digital assets data provider Kaiko. This was in stark contrast to the two days preceding this development when the king coin traded at a significant premium on the same exchange.

Kaiko highlighted that the BTC’s trading price on the American arm of the crypto behemoth Binance, was slightly less than what it traded on competitors like Kraken and Coinbase on 9 June.

#BTC now trades at a slight discount on https://t.co/pup2WYms9R after news broke that the exchange may halt USD withdrawals ? pic.twitter.com/ZyXKGhXTha

— Kaiko (@KaikoData) June 9, 2023

However, at the time of publication, BTC was back to trading at a premium on Binance.US with the BTC/USD pair priced at $25,836, $126 above Coinbase’s price, according to TradingView.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Roller-Coaster ride for BTC/USD pair

The U.S. Securities and Exchange Commission’s (SEC) legal action against Binance has created ripples across the broader crypto market, adversely impacting the dynamics of the highly popular BTC/USD trading pair.

After the regulator’s attempts at freezing Binance.US assets, BTC started to trade at an unusually high premium on the exchange. This was largely due to shrinking liquidity on the platform as jittery investors started to pull their assets out.

However, the latest blow by Binance.US, disallowing customers to trade using USD, had a different effect on the trading pair. After the exchange asked users to withdraw their dollars before the 13 June cutoff date, a selling wave ensued as traders rushed to cash out their BTC. This lowered the price of the BTC/USD pair for a brief period.

Infact, the above action clearly explained the low BTC withdrawals following Binance.US announcement.

12 hours after @BinanceUS suspended USD deposits and notified customers that they are preparing to pause fiat withdrawals, the exchange has seen a negative netflow of $25.4M over the past 24 hours and $1.4M in the past hour. This doesn't include Bitcoin.https://t.co/yzYBwYXTiA

— Nansen ? (@nansen_ai) June 9, 2023

Is your portfolio green? Check out the Bitcoin Profit Calculator

Exchange supply continues to decline

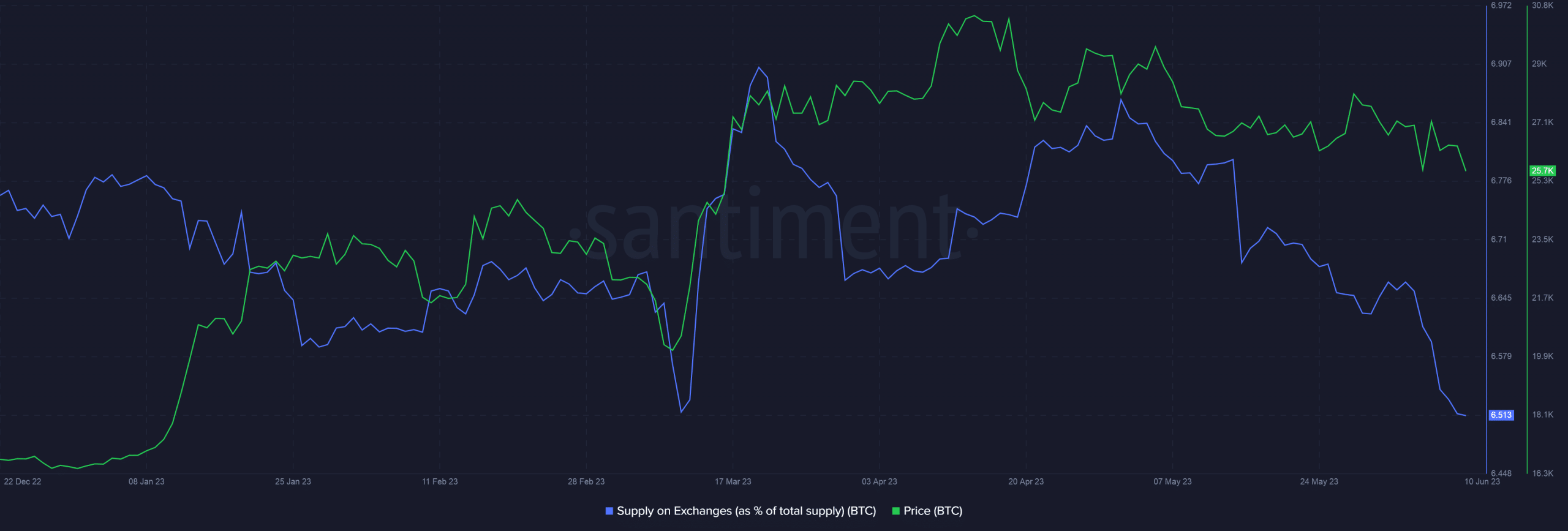

The prolonged volatility phase of May kicked off an accumulation phase that resulted in top exchanges losing a significant amount of BTC tokens. According to the Santiment graph, there has been a steady decrease in BTC supply on exchanges over the previous month, with the recent week’s events leading to a steeper decline.

At the time of publication, BTC was valued at $25,748.19, down 3.15% from the last 24 hours. Since the start of the week, it has plunged nearly 6% in value.